Bitcoin and Ethereum prices fell in the beginning of Asian business week amid mixed bullish and bearish market signals.

The crypto market forces are trying to balance the threat of stagflation against a potential liquidity increase, getting support from the Treasury General Account (TGA), and the launch of spot Bitcoin exchange traded funds in Hong Kong.

Ongoing Market Trends In BTC And ETH

The major crypto markets are experiencing red candles amid the renewed fear surrounding U.S. stagflation, which is a possible worst-case scenario for risky asset classes, including digital assets.

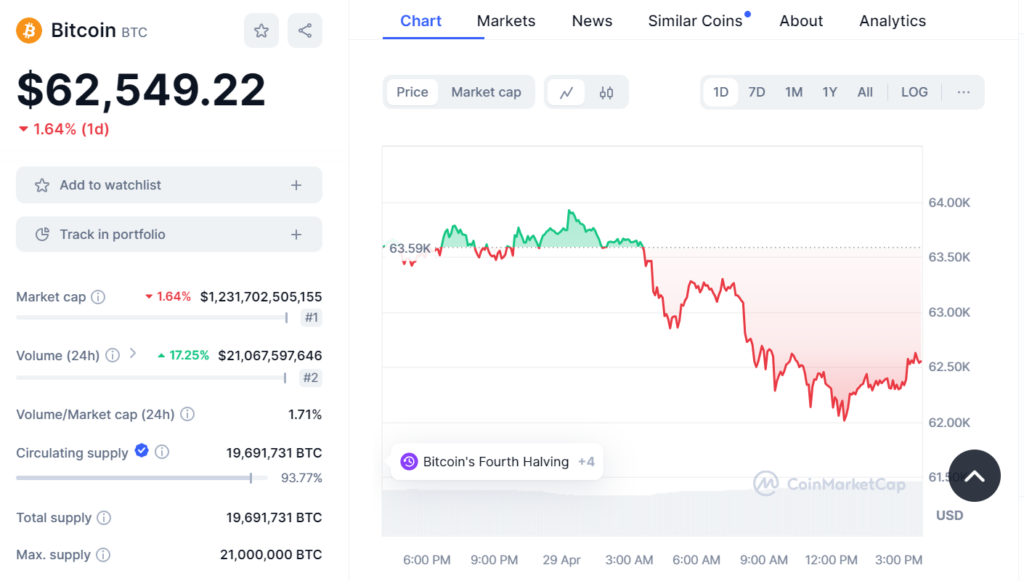

Bitcoin (BTC), the most popular and leading cryptocurrency in terms of market value, is currently trading at a price of $62,549.22 (at the time of writing), which is approximately 1.64% less than the previous trading session, as per the data taken from Coinmarketcap.

During the same time, Ethereum (ETH) was trading 3.56% lower than the previous trading day at $3,186.12.

At the same time, a popular crypto index, Coindesk 20 (CD20) stood at 2,176.55, post a 3% decrease in the last 24 hours.

The market is in a bearish phase and the direction for the near future is unclear. This weekend, QCP Capital wrote a note, “the threat of stagflation- a period of high inflation and low growth- is very real.”

It mentioned, “The weaker than expected [U.S.] GDP print points to a more sluggish economy while the higher Core PCE warns of an inflation problem that continues to be a thorn in the Fed’s side.”

Stagflationary Results

The U.S. GDP report that was released last week showed that the world’s largest economy grew at an annualized rate of 1.6% in the first quarter of this year, following the preceding quarter’s 3.4% growth. The personal consumption expenditures price (PCE) index, the Fed’s preferred inflation metric, experienced a price rise to 3.4% annualized rate in the first three months of the year from 1.8% in the final quarter of 2023.

A combination of slower growth rates and sticky inflation facilitated stagflation, further reducing the probability of Fed rate cuts. Most traders on the prediction market platform, Polymarket, do not expect any rate cuts, as there is a 35% chance of a rate cut. However, the probability of a rate cut is increasing on a weekly basis. In the beginning of this month, the probability was 14%, which was up to 26% a week ago and is now 29%.

It further wrote that Janet Yellen’s fiscal strategy is leveraging the Treasury General Account (TGA), which currently holds approximately $ 1 Trillion in assets. The Reverse Repurchase Program (RRP) with $400 Billion could add up to $1.4 Trillion in liquidity for the financial system, pushing up prices for all the risky assets.

Another key factor to consider is the $750 Billion in TGA, as it serves as a considerable signal to financial markets about the U.S. government’s fiscal intentions that can substantially impact economic stability and growth.

On April 30, the spot BTC ETF will be launched in Hong Kong, which is also catching the eye of crypto investors and traders. The news that mainland Chinese investors will not be allowed to trade ETFs product has led to decrease in the pertained bullishness in the market.

Steefan George is a crypto and blockchain enthusiast, with a remarkable grasp on market and technology. Having a graduate degree in computer science and an MBA in BFSI, he is an excellent technology writer at The Coin Republic. He is passionate about getting a billion of the human population onto Web3. His principle is to write like “explaining to a 6-year old”, so that a layman can learn the potential of, and get benefitted from this revolutionary technology.

Home

Home News

News