Microstrategy, a business intelligence, and software service provider introduced ‘MicroStrategy Orange’, a Bitcoin-based Decentralized Identity platform.

In a world full of scams and frauds, it becomes essential to prioritize security and efficiency and this is why MicroStrategy Orange was introduced. On May 1, Microstrategy announced the launching of its new product at the annual Microstrategy World event in Las Vegas.

The Bitcoin-based decentralized ID platform uses the Segregated Witness (SegWit) feature of Bitcoin (BTC) and aims to improve security measures.

Need For The Bitcoin-Based Decentralized ID Platform?

On May 1, 2024, Microstrategy announced the launching of its new product, ‘Microstrategy Orange’ which integrates digital signatures for identity verification purposes. The Bitcoin-based decentralized identity platform uses Ordinal-based inscriptions for information storage and retrieval.

Michael Saylor, the company’s executive chairman unveiled the product during the company’s Bitcoin for Corporations conference. Bitcoin Magazine, the most trusted magazine publisher covering Bitcoin and digital currencies announced the same on X.

JUST IN: MicroStrategy launches an enterprise platform for building decentralized identity applications on #Bitcoin — MicroStrategy Orange 👀 pic.twitter.com/P5PXz80kSD

— Bitcoin Magazine (@BitcoinMagazine) May 1, 2024

The open-source platform doesn’t require any sidechains and can process over 10,000 decentralized identifiers in a single BTC transaction. It also permits the issuance of DIDs to the personnel and deploys applications, followed by several customization tools to integrate particular services.

Orange For Outlook is MicroStrategy’s already built application which made it easy for the users to verify the identity of the email sender. The process includes acceptance of the invitation email signed by MicroStrategy’s DID to generate unique DID and keys for the user.

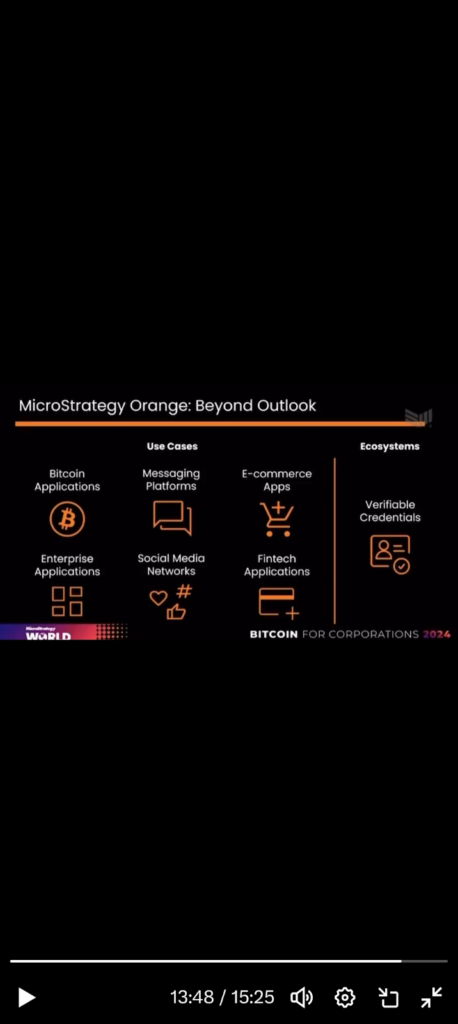

In the same way, MicroStrategy Orange will be used for BTC applications, E-Commerce Apps, Social Media Networks, Fintech Apps, and enterprise apps under a verifiable credentials ecosystem.

MicroStrategy’s Bitcoin Journey

MicroStrategy is considered a BTC development company and continuously supports the BTC ecosystem.

In August 2020, MicroStrategy made its first even BTC purchase, buying over 21,454 bitcoin for $250 million. Michael Saylor sold publicly traded company bonds and equity worth $750 Million to invest in BTC.

As of April 30, 2024, the company holds 214,400 BTC worth $7.57 Billion. As MicroStrategy is a big supporter of BTC, the influence of new product launches was experienced on BTC’s price.

BTC’s price spiked from $57,405.63 on May 1, to $59,071.36 on May 2. At the press time, BTC was trading at $58,575.18, after a surge of 1.41% in one day and a market cap of $1,154,877,274,338.

What Microstrategy’s Earning Report Is Showing

MicroStrategy (MSTR) is a business intelligence and software provider company introduced in November 1989. Co-founded by Michael J. Saylor, the company offers a wide range of products including HyperIntelligence, Embedded Intelligence, Cloud, Consulting, Education, and BI and Analytics tools.

Recently, the company announced its Q1 2024 earnings report on 29 April 2024. However, the report hasn’t performed as per expectations, showcasing a drop of 466.97% in earnings per share (EPS).

Also, the EPS was recorded at $3.09 in negative whereas the revenue was documented at $121.725 Million, a drop of 5.57%. Additionally, MSTR is currently trading at 1028.27, indicating a drop of 3.45% in a day.

Anurag is working as a fundamental writer for The Coin Republic since 2021. He likes to exercise his curious muscles and research deep into a topic. Though he covers various aspects of the crypto industry, he is quite passionate about the Web3, NFTs, Gaming, and Metaverse, and envisions them as the future of the (digital) economy. A reader & writer at heart, he calls himself an “average guitar player” and a fun footballer.

Home

Home News

News