Aave recently shared its roadmap for the next five years and also announced the outline for V4, an upgrade and evolution of its protocol.

Aave is a decentralized and permissionless DeFi platform that allows users to instantly lend and borrow cryptocurrencies. On May 1, Aave outlined a governance proposal to get community feedback on upgrading the protocol to its next-generation which is version 4.

Among the proposed changes are major upgrades and expansions to the Aave Network, which includes a cross-chain liquidity layer and non-Ethereum Virtual Machine (EVM) layer-1 deployments. Additionally, the proposal highlights the introduction of a new visual identity for the platform.

Development Of The Aave V4

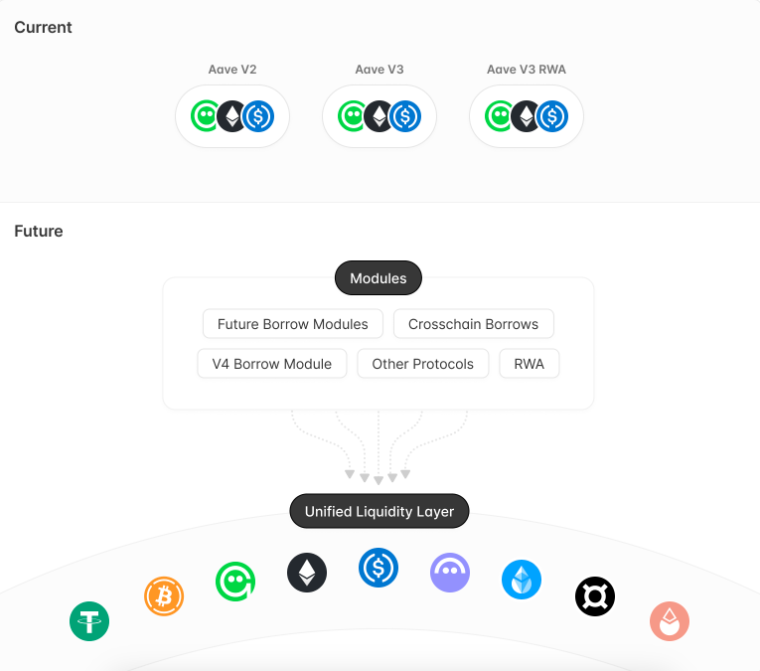

Aave V4 is poised to be built on an entirely new architecture, featuring a unified liquidity layer. This layer aims to enhance integration capabilities for features like isolation pools, risk modules, and the platform’s native stablecoin, GHO.

The above represents the changes in the newer version.

One of the notable features proposed for Aave V4 is the implementation of interest rates that can dynamically adjust based on market conditions, leveraging Chainlink data oracles.

Furthermore, the proposal suggests the introduction of liquidity premiums to tailor borrowing costs according to collateral risk profiles. Additionally, the concept of vaults and smart accounts was proposed to streamline user management of positions within the platform.

Launch & Growth Of GHO

Particular attention was given to Aave’s algorithmic stablecoin, GHO, which was launched in July 2023 but currently lags behind competitors such as Tether (USDT) and USD Coin (USDC) with a market capitalization of $49 Million. Suggestions for GHO improvements include enhancements to the liquidation engine, such as variable liquidation bonuses and “soft” liquidations.

Moreover, there was a focus on better integration of GHO, offering users options to earn interest and introducing an emergency redemption mechanism for scenarios where GHO depegging occurs.

The proposal is currently in the “temperature check” phase, where community sentiment is gauged before moving towards an on-chain vote. The outlined development timeline spans from research completion in Q2 2024 to a full V4 release by mid-2025.

Execution Of The Plan

For the execution of the first year of the three-year plan, Aave Labs is seeking a grant with a budget of 15 million GHO and 25,000 stkAAVE, amounting to approximately $17 Million combined. Aave stands as the third largest DeFi protocol, boasting a total locked value of around $10 Billion, according to DefiLlama.

At the time of writing, AAVE was trading at $84.53, 4.31% up from the previous day. However, it has experienced a decline of 5.83% in a week and a decline of 26.53% in a month. It has declined by over 85% from its all-time high of $660 in 2021.

Aave’s governance proposal for upgrading to V4 outlines significant enhancements and expansions to the platform, including a revamped architecture, improved liquidity features, and advancements to its algorithmic stablecoin, GHO.

With community feedback sought and a detailed development timeline in place, Aave is poised for further innovation and growth in the DeFi ecosystem.

Steefan George is a crypto and blockchain enthusiast, with a remarkable grasp on market and technology. Having a graduate degree in computer science and an MBA in BFSI, he is an excellent technology writer at The Coin Republic. He is passionate about getting a billion of the human population onto Web3. His principle is to write like “explaining to a 6-year old”, so that a layman can learn the potential of, and get benefitted from this revolutionary technology.

Home

Home News

News