GBTC has finally experienced an inflow of funds for two consecutive days after the outflow streak of more than two months.

Grayscale Bitcoin Trust (GBTC) is a Bitcoin-backed spot exchange-traded fund (ETF) sponsored by Grayscale Investments, LLC. It is the largest ETF, with assets under management (AUM) of $18,466,096,997.94. It has a total holding of 292,217.6761 bitcoins as of May 6, 2024, per the data shared on its official website.

In the last two months, it has experienced significant outflows of over fifteen million, bringing it close to the second largest spot, BTC ETF, IBIT, backed by BlackRock. It has had tremendous inflows since the fund’s inception on January 5, 2024. It has an AUM of approximately $17,278,056,252 at press time.

IBIT has a net asset value (NAV) of $35.91, whereas GBTC is trading at a NAV of $56.24.

Month of May for GBTC so far

On May 1, BTC ETFs had a total outflow of $563.7 million, of which $167.4 was from GBTC. This fund experienced the second-highest outflow after the FBTC, which had an outflow of $191.1 million.

On May 2, the only BTC-backed ETF that had outflows was GBTC, as it had an outflow of $54.9 million with a net fund outflow for the day collectively for all the ETFs of $34.4 million.

May 3 marked a green day in the last five months of BTC ETF trading, as it was a day that did not have any negative flows. On May 3, BTC ETFs had a total inflow of $378 million.

On the same day, GBTC reverted the trend of outflows, as it had an inflow of $63.0 million for the first time since January 11. Eric Balchunas, an ETF analyst, highlighted the change in trends by sharing a post on X.

First time ever 1D flows all green, no red for the Bitcoin Bunch. Not going to spike the football like some did during the outflow period but will point out that over 95% of the ETF investors HOLD-ed during what was a pretty nasty and persistent downturn. Will same happen next… pic.twitter.com/3l3uwwmqGy

— Eric Balchunas (@EricBalchunas) May 6, 2024

On May 6, GBTC marked the second consecutive day to attract inflows. However, the amount was much less than the previous day, with an inflow of just $3.9 million.

| Date | IBIT (Flows) (Amount in Million) | FBTC (Flows) (Amount in Million) | GBTC (Flows) (Amount in Million) |

| 01/05/2024 | (36.9) | (191.1) | (167.4) |

| 02/05/2024 | 0.00 | 0.00 | (54.9) |

| 03/05/2024 | 12.7 | 102.6 | 63.0 |

| 05/05/2024 | 21.5 | 99.2 | 3.9 |

Source: Farside Investors

In contrast, IBIT had inflows of $12.7 million and $21.5 million, respectively. The FBTC has a maximum value of flows, either inflows or outflows.

What are the reasons for the change in trend in GBTC?

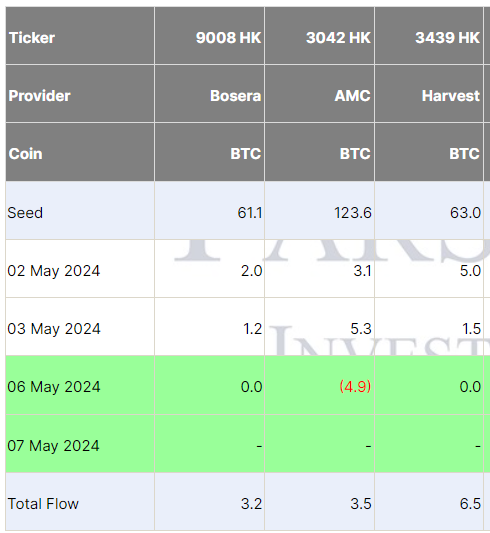

One of the most probable reasons for the growth of inflows in BTC ETFs is the establishment of BTC and ETH-backed ETFs in Hong Kong. Three funds are listed on The Hong Kong Stock Exchange, backed by BTC, with an overall total AUM of HK$ 261.40 million.

The adoption and acceptance of virtual currency-backed ETFs in multiple economies support the sector’s growth.

Source: Farside Investors

The second reason could be Bitcoin’s 200-day moving average hitting a new all-time high as it was trading over $64,200 at the time of writing, up by approximately 1.6% from the previous day.

Bitcoin's 200 day moving average just hit a new all-time high.

— Pomp 🌪 (@APompliano) May 6, 2024

GBTC saw the first day of inflows in 78 days.

Don't get lulled to sleep by bitcoin going sideways. The long-term thesis is as strong as ever.

Here is my segment on @SquawkCNBC this morning. pic.twitter.com/BG6GkzqVIi

The third and final reason that has remarkably changed the GBTC trend is that Grayscale plans to launch a mini-fund with the lowest fees and other taxation benefits. The holders of GBTC will have direct access to the mini-fund.

Bitcoin's 200 day moving average just hit a new all-time high.

— Pomp 🌪 (@APompliano) May 6, 2024

GBTC saw the first day of inflows in 78 days.

Don't get lulled to sleep by bitcoin going sideways. The long-term thesis is as strong as ever.

Here is my segment on @SquawkCNBC this morning. pic.twitter.com/BG6GkzqVIi

Andrew is a blockchain developer who developed his interest in cryptocurrencies while pursuing his post-graduation major in blockchain development. He is a keen observer of details and shares his passion for writing, along with coding. His backend knowledge about blockchain helps him give a unique perspective to his writing skills, and a reliable craft at explaining the concepts such as blockchain programming, languages and token minting. He also frequently shares technical details and performance indicators of ICOs and IDOs.

Home

Home News

News