Crypto Venture Capital funding hit $4 Billion in April and recorded two consecutive funding months above $1 Billion.

Crypto Venture Capital (VC) funding has seen a notable resurgence this year, with investors investing billions into startups. Crypto VCs injected over $4 Billion year to date, showcasing enhanced interest of investors in seed and early-stage deals.

Crypto VC Funding Hit $1 Billion For Second Consecutive Month

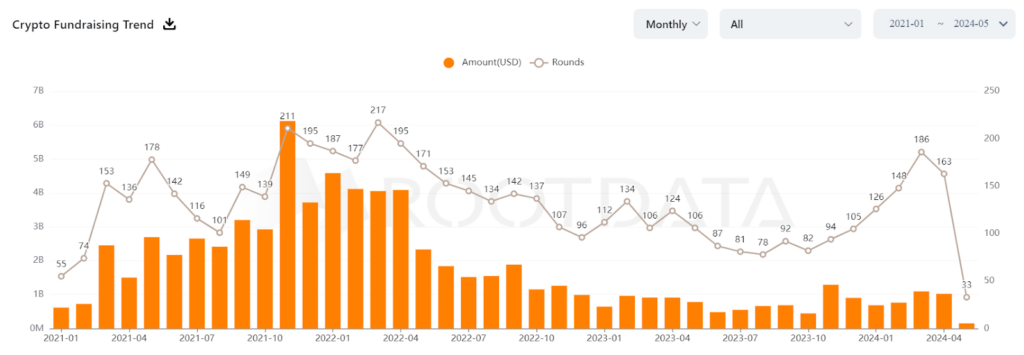

On November 1, 2021, the biggest crypto VC funding was recorded, amounting to over $7.079 Billion. As of April 2024, the Crypto VC funding crossed the $4 Billion mark YTD, showcasing enhanced interest of investors towards the crypto market.

On May 8, 2024, The Block took to X to discuss crypto VC funding’s outstanding performance.

Crypto VC funding crossed the $4B mark YTD as of April, revealing a significant increase in seed and early-stage deals. Learn more about digital asset financing and trends from our latest newsletter, The Funding. Sign up here: https://t.co/JXoIgwAdxn#thefunding #cryptofundin pic.twitter.com/GhVvUW6CSt

— The Block (@TheBlock__) May 7, 2024

It was the first time since October-November 2022 that the industry documented two consecutive funding months hitting over $1 Billion. $1.1 Billion poured in through 137 rounds in October 2022 and around $1.2 Billion was generated in 107 rounds in November 2022.

Crypto Fundraising Trend I Source: RootData

In March 2024, funding hit $1.09 Billion in 126 rounds and recorded $1.02 Billion in 163 rounds in April, taking 2024’s funding hit $4 Billion.

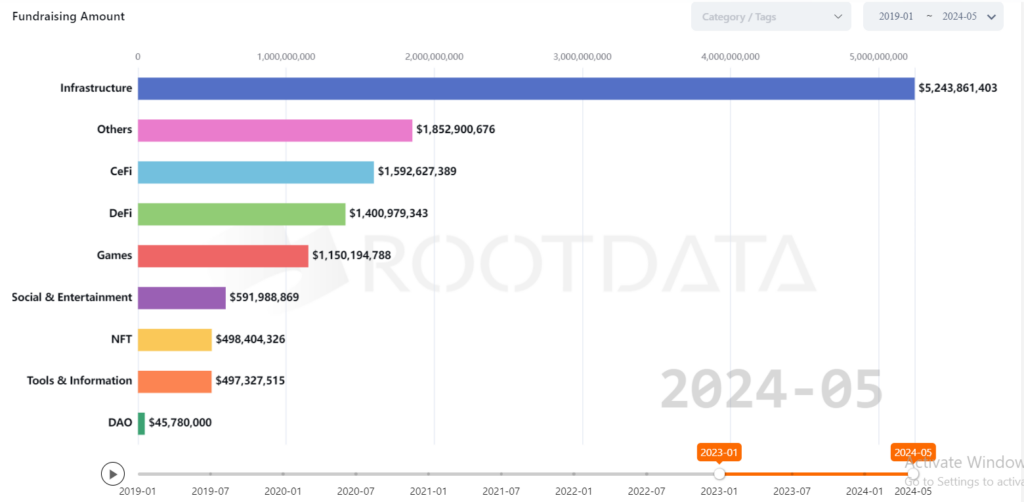

Moreover, Centralized Finance (CeFi) and infrastructure have witnessed increased investment activity, whereas Decentralized Autonomous Organization (DAO) is the least funded, according to RootData.

Is Crypto VC Funding In A Bearish Phase?

According to the DefiLlama report, the crypto VCs have raised over $100.409 Billion in 5202 funding rounds since June 2014.

After raising $7.079 Billion in November 2021, VC funding entered the bearish phase and dipped to over $283.45 Million during the bear market in August 2023. Based on the current performance, it could be said that the crypto funding is in a consolidation state.

However, the year 2024’s fundraising enhanced expectations of VCs and startups for the upcoming bullish rally.

Investor’s Interest In The Crypto Industry Booming?

As per RootData, a sudden spike has been observed in Infrastructure and CeFi investing in recent years. A formidable rivalry regarding VC funding is recorded between the Infrastructure and CeFi sectors.

Fundraising Amount I Source: RootData

The CeFi sector has raised over $20,933,663,022, whereas the blockchain infrastructure sector has raised approximately $20,402,522,864. YTD, the crypto VC, raised over $3.57 Billion in 625 rounds, indicating investors’ enhanced interest in the crypto industry.

With a background in journalism, Ritika Sharma has worked with many reputed media firms focusing on general news such as politics and crime. She joined The Coin Republic as a reporter for crypto, and found a great passion for cryptocurrency, Web3, NFTs and other digital assets. She spends a lot of time researching and delving deeper into these concepts around the clock, and is a strong advocate for women in STEM.

Home

Home News

News