Grayscale, the prominent asset manager, just withdrew its 19b-4 filing for Ethereum Futures ETF just before the SEC was set to rule on several spot ETH ETFs.

The tug of war between the exchange-traded funds (ETF) isn’t resting as the Securities and Exchange Commission (SEC) delayed spot ETFs. Recently, Grayscale pulled its hands out from the Ethereum Futures ETF and withdrew its 19b-4 filing.

Why Did Grayscale Withdraw From The Race?

The Securities and Exchange Commission’s (SEC) delayed decision on Spot Ethereum ETF, stirred the crypto space. Grayscale, the world’s largest asset manager withdrew its application for Ethereum Futures ETF.

At press time, Ethereum (ETH) was trading at $3,000.63, after an intraday drop of 2.47% with a market cap of $360,168,457,111 and $11,313,680,314 in trading volume.

James Seyffart, an ETF analyst, shared the Grayscale’s ETF withdrawal news to his 137K followers on X.

UPDATE This is interesting. @Grayscale just withdrew their 19b-4 filing for an #Ethereum futures ETF. This was essentially a trojan horse filing in my view, in order to create the same circumstances that allowed Grayscale to win the $GBTC lawsuit (approve futures deny spot) pic.twitter.com/Kihj2dlQx1

— James Seyffart (@JSeyff) May 7, 2024

He connected the recent filing to a strategic “Trojan horse” tactic, showcasing the approach that led to Grayscale’s victory in the GBTC case. The ETF expert also suspected that Grayscale’s withdrawal could stem from discussions with the SEC.

Other Analysts’s Views On Grayscale’s Action

Nete Geraci, on the other hand, believes Grayscale might challenge the SEC in court if their Ethereum ETF is rejected. Furthermore, Bloomberg’s Eric Balchunas decrypts Grayscale’s recent actions as an indication that they may not file another lawsuit against the regulator.

Grayscale Investments filed the Ethereum Future ETFs application in September 2023 with a plan to track on the Chicago Mercantile Exchange (CME). The sudden withdrawal of the company has left analysts scrambling to figure it out.

Moreover, Grayscale Investment’s experience with spot Bitcoin ETFs wasn’t up to the market.

What About Grayscale’s Bitcoin ETF Performance?

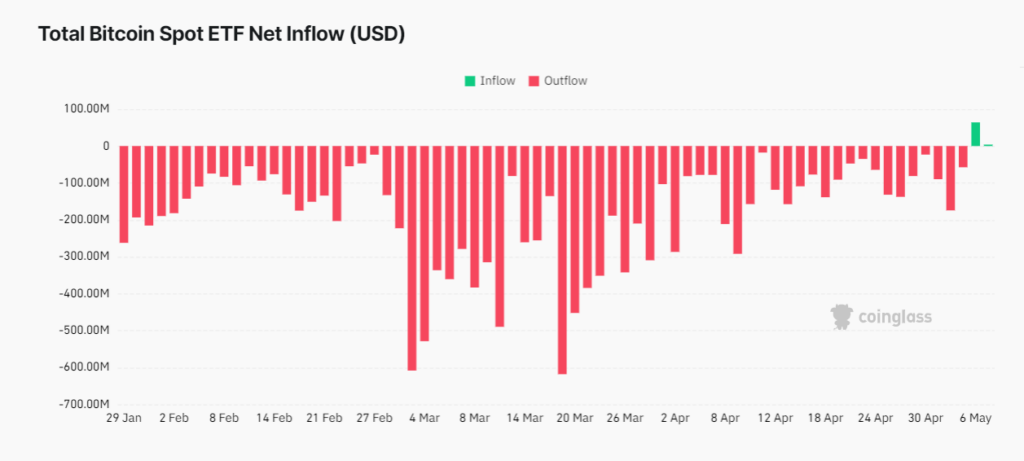

According to Coinglass data, Grayscale Investments’s Grayscale Bitcoin Trust (GBTC) experienced a downturn.

At the time of writing, GBTC was trading at $56.11, after a 50.59% change year to date (YTD), and shares outstanding of 328,400,100.

Total Bitcoin Spot ETF Net Flow (USD) I Source: Coinglass

Since the spot Bitcoin ETF launch, GBTC experienced a downturn and recorded outflows in a line, hitting an all-time high of $618.16 Million on March 19, 2024. However, minor investment activity was observed on May 6, leading the Inflow to over $64.11 Million.

Adarsh Singh is a true connoisseur of Defi and Blockchain technologies, who left his job at a “Big 4” multinational finance firm to pursue crypto and NFT trading full-time. He has a strong background in finance, with MBA from a prestigious B-school. He delves deep into these innovative fields, unraveling their intricacies. Uncovering hidden gems, be it coins, tokens or NFTs, is his expertise. NFTs drive deep interest for him, and his creative analysis of NFTs opens up engaging narratives. He strives to bring decentralized digital assets accessible to the masses.

Home

Home News

News