Thorchain has observed a strong decline in overall transactions while the RUNE price is down by 29% in the last one month.

Thorchain is a decentralized liquidity protocol which allows users to swap digital assets without losing custody in the process. With its innovative crosschain capabilities, Thorchain allows users to have a seamless experience while ensuring security and reliability. RUNE is the official token for the Thorchain blockchain and is used to incentivize liquidity providers and validators. The blockchain is designed to minimize trust and become more scalable. Various exchanges use the Thorchain platform to process swaps.

Thorchain’s robust infrastructure and community-driven governance make it a promising platform in the ever-expanding DeFi landscape, offering users unparalleled freedom and control over their assets. Here are the onchain factors of the blockchain.

Is Thorchain Blockchain Losing The Battle?

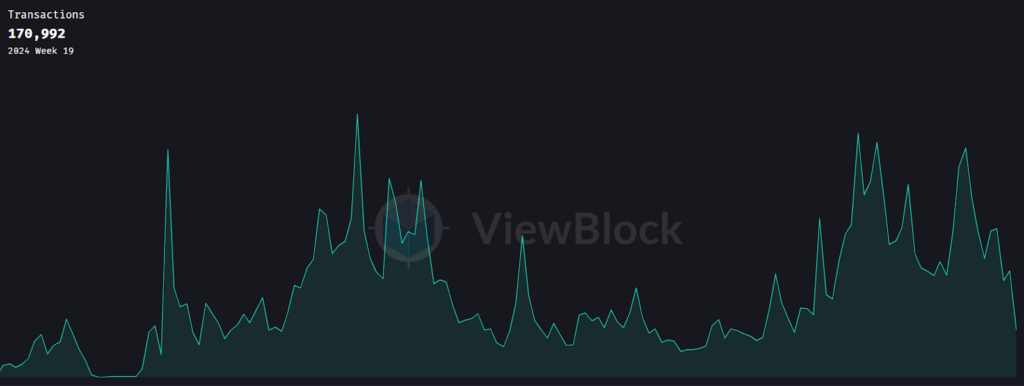

Source: Transactions Of Rune By Viewblock

Thorchain blockchain is one of the biggest liquidity protocols for swaps currently present in the market.The platform has observed a lifetime volume of $58.8 Billion with a total pool earnings of $131 Million. The blockchain has 30.49 Million swap count with 105.5k swappers which has swapped their assets through the platform. It has a total of 98 active validators with a $530.1 Million validator bond.

Source: Affiliate Fee Volume by Viewblock

The blockchain has been observing a decline in the overall transactions and has reached to 25672 from the highs of 140k. Meanwhile, looking at the total volume of swaps it has declined from the highs of $200 Million to $69 Million within a few weeks.If we look at the affiliate volume then it has also been declining and has reached to $14.67k. Meanwhile, the pool liquidity of the protocol has plunged to a low of $322 Million. If we see the Open Interest change of RUNE then it has declined by 2.3% in the intraday session. The swap volume is largely contributed by Bitcoin and Ethereum while other altcoins are less compared to others.

Is RUNE Price Looking To Head For $10?

Is RUNE Price Looking To Head For $10? by Ritika_TCR on TradingView.com

THORChain has a market cap of $1.85 Billion and is ranked 53rd in the CMC. RUNE has a total supply of 414,236,892 in which 100% of it is circulating in the market. Meanwhile,the overall volume of the RUNE coin has seen a surge of 10% in the intraday session. RUNE token price is currently trading near the volume of $5.54 with a gain 1.19% in the intraday session.

RUNE token price is currently trading below the 50 and just above the 200 EMA in the daily chart. If the asset price breaks above the 50 EMA then a strong upside trend can be seen in the future. The upside trend of RUNE can see a halt near the value of $6.5. Meanwhile,the support of the asset price can be observed near $4.5.

The RSI for RUNE is at 49 with a small positive slope in it hinting its presence in the neutral zone. The overall sentiment of RSI and MACD are bullish in nature.

Conclusion

Thorchain is one of the biggest protocol for swaps currently in the market. Despite being the biggest it has been continuously seeing a decline in the pool liquidity and swap volume from the past few months. RUNE token is currently observing a weak bullish momentum but can see a new high in the future as per analysts.

Disclaimer

The views and opinions stated by the author or any other person named in this article are for informational purposes only and do not constitute financial, investment, or other advice.

Andrew is a blockchain developer who developed his interest in cryptocurrencies while pursuing his post-graduation major in blockchain development. He is a keen observer of details and shares his passion for writing, along with coding. His backend knowledge about blockchain helps him give a unique perspective to his writing skills, and a reliable craft at explaining the concepts such as blockchain programming, languages and token minting. He also frequently shares technical details and performance indicators of ICOs and IDOs.

Home

Home News

News