Investors in the cryptosphere experienced the worst crypto winter last year. This has led regulators around the globe to increase their focus towards prevention of potential financial losses possible in what the Securities and Exchange Commission deems a “Financial Wild West.” Recently, the Bank for International Settlements (BIS) issued a bulletin suggesting various solutions to tackle this highly volatile market.

The effects are contained in the cryptosphere, for now!

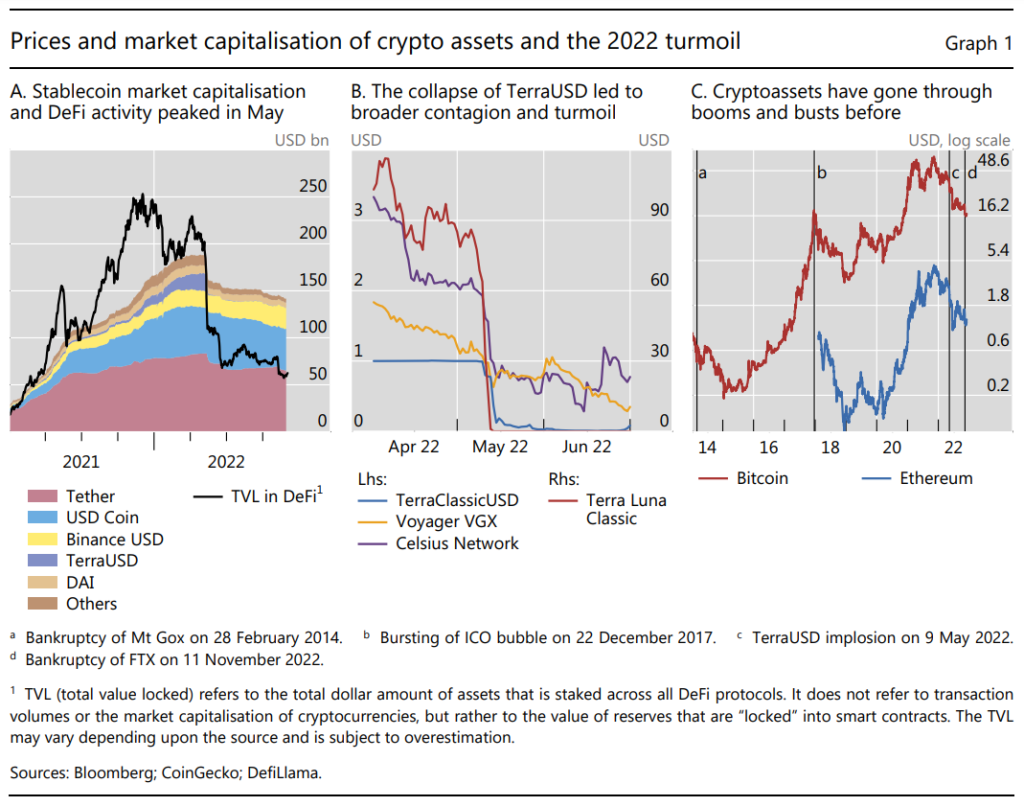

Bankruptcy filing by FTX crypto exchange last year has brewed a lot of chaos in crypto industry, raising skepticism among the investors. The BIS bulletin mentions that the “shadow financial functions” in which the virtual currencies are engaged through centralized finance (CeFi) and decentralized finance (DeFi), shares weaknesses with traditional finance (TradFi).

Majority of the crypto community believes in “ideological pursuit of a decentralized system as a TradFi alternative.” Stablecoins have become a matter of interest among the investors as they allow users to keep the market volatility at bay. However, Terra UST collapse has raised questions about it too. Moreover the document says that “There are severe deficiencies in the cryptosphere associated with the risk management.”

Malicious acts in the virtual asset sector are an increasing concern too. Since Bitcoin’s inception, bad actors have shown up to exploit investors, either using hacking skills or via fake projects. Currently, there are over 22,000 cryptocurrencies in the market and majority of them are not trustworthy according to the experts. Recently, SEC chair, Gary Gensler, said during a Twitter Space hosted by the US Army that “10,000 top 15,000 of these assets will fail.”

The bulletin addresses some options to address risks in this extremely volatile market. It suggests banning cryptocurrencies “in entirety or in a targeted manner.” The borderless nature of virtual currencies remains a barrier as the lawmakers would find it difficult to implement regulations.

Another recommendation from BIS calls for implementation of the same principles used in TradFi around the globe. This would require the lawmakers to recognize key crypto functionalities and conduct proper assessment of how regulations can affect the sector. Although, authorities may face challenges in mapping activities of digital assets appropriately.

Finally, it propounds the idea to contain crypto assets by shattering the industry ties with TradeFi. The bulletin also discusses the central bank digital currencies (CBDC) and fast payment systems like Pix in Brazil, upcoming FedNow in the US and more, as an alternative to virtual currencies.

BIS concludes that the authorities can consider a variety of policy related approaches to counter the issues associated with the cryptosphere. It says that the industry has gone through extreme volatility leading to financial blows to the investors. The regulators can act to prevent further monetary thumps considering the effects have not spilled over traditional finance.

Anurag is working as a fundamental writer for The Coin Republic since 2021. He likes to exercise his curious muscles and research deep into a topic. Though he covers various aspects of the crypto industry, he is quite passionate about the Web3, NFTs, Gaming, and Metaverse, and envisions them as the future of the (digital) economy. A reader & writer at heart, he calls himself an “average guitar player” and a fun footballer.

Home

Home News

News