- 1 PLTR shares rallied 130% YTD, citing the recent boom in AI stocks.

- 2 Earnings were announced on May 8, 2023.

Palantir Technologies (PLTR Stock) is riding the AI frenzy, gaining 87.17% post-earnings and 130% YTD. Can it continue the trajectory? The recent boom in the Artificial Intelligence market has been beneficial for many; in May 2023, Nvidia (NASDAQ: NVDA) gained 42%, C3.ai (NYSE: AI) acquired 158%, and Alphabet Inc (NASDAQ: GOOGL) was up by 18%, among others.

Palantir Technologies (PLTR Stock) – Financial Analysis

Every company related to AI is drafting behind the boom, with the pole position grabbed by C3.ai with a 158% gain in May 2023. PLTR share price hiked by around 87% in the same time-lapse. These are the best numbers since November 2020, when the surge was about 167%.

The latest earnings were announced on May 8, 2023, with reported revenue of $525.186 Million, which was previously estimated to be $502.824 Million. Also, the surprise was $19.362 Million, with a jump of 3.83%.

The Q1 2023 revenue jumped by 17.66% to $525.19 Million, while the trailing twelve months (ttm) revenue is $1.98 Billion. The Denver, Colorado-based company reported quarterly earnings per share (EPS) of $0.05 with a 150% increase, while the essential EPS is minus $0.12.

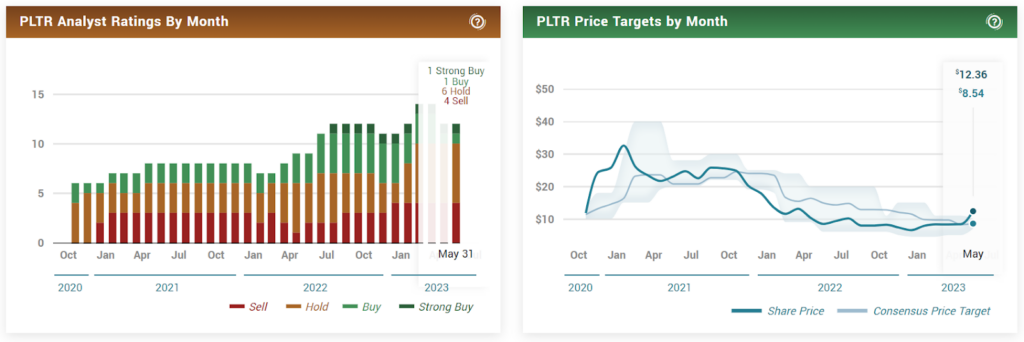

At press time, PLTR stock is trading at $14.71, with a gain of 7.77% in the last 24 hours. Previous close and open were at $13.65 and $14.44, respectively. The 52-week change is a gain of 73.88%. With an average volume of 49.13 Million shares, the market cap is $31.162 Billion. Analysts placed a price target at $8.54 with a 42% downside.

The quarterly revenue growth is 17.70%. Also, the United States’ revenue jumped by 23% YoY. Commercial revenue increased by 15%, while government revenue hiked by 20%. Their overall customer count swells by 41% YoY, and the U.S. customer base is now more substantial by 50%.

Operating expenses are up by 5.63% to $413.43 Million, the operating margin is down by 5.93%, and the profit margin is down by 12.87%. The gross profit is $1.58 Billion. Cash flow from its operations is valued at $187 Million with margins of 36%. Total cash in hand at the end of the quarter is $2.9 Billion, with a debt of $259.49 Million.

Palantir Technologies (PLTR Stock) – Candle Exploration

PLTR share price skyrocketed post earrings after a slight correction near the EMA. The RSI of 75.36 indicates an overbought range, and the slightly upward-moving trajectory of EMA also shows positivity. However, in such cases, price actions usually consolidate for some time after reaching a high.

If the price drops, it should return from the immediate support at $10.54. The possibility of breakdown and entering the demand zone is rare, citing the current AI frenzy. However, the debt ceiling scenario could play a considerable role and affect the price action.

Disclaimer:

The views and opinions stated by the author, or any people named in this article, are for informational purposes only and do not establish financial, investment, or other advice. Investing in or trading crypto assets comes with a risk of financial loss.

Andrew is a blockchain developer who developed his interest in cryptocurrencies while pursuing his post-graduation major in blockchain development. He is a keen observer of details and shares his passion for writing, along with coding. His backend knowledge about blockchain helps him give a unique perspective to his writing skills, and a reliable craft at explaining the concepts such as blockchain programming, languages and token minting. He also frequently shares technical details and performance indicators of ICOs and IDOs.

Home

Home News

News