- The brutal negative performance of the overall crypto market has brought concern around the globe.

- Bitcoin touched its lowest level for the year which is $3600. However, after the sudden downfall, BTC is making price recovery currently. The current price is at the level of $5600.

- ETH is also at a vulnerable level with breaking the support level of $140 with a current level of $130. It is facing an overall loss of -8.84%

- The only good symptom looking for the cryptomarket is the price recovery of BTC from the lowest level of $3600 to the current level of $5600.

Index and Indicators Reflects On the Bearish Move

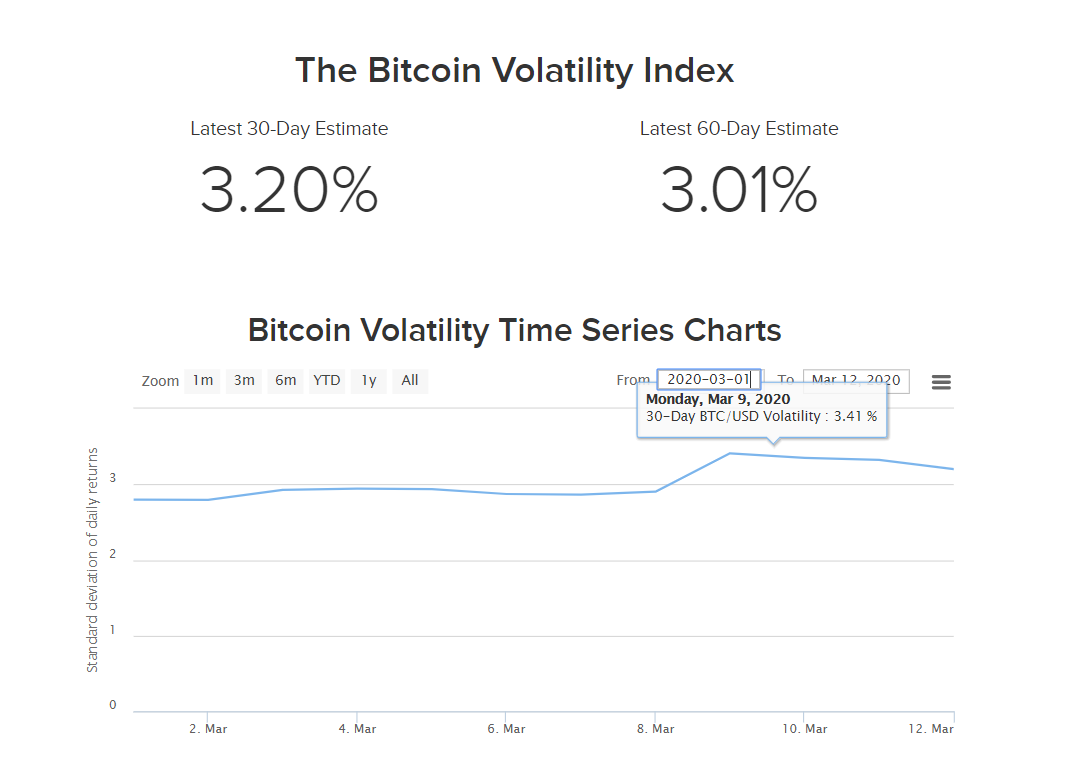

- Volatility Index: Increase in volatility index by 1% justifies the ongoing downfall for BTC. From the starting of the year, the volatility index was moving between the range of 2% to 2.50%. The sudden rise in the volatility index meant that BTC will show some unpredictable move in the market. During the starting of the downfall, BTC was expected to stop the downtrend at the price level of $6k by most of the leading investors and trading analysts. But BTC bears got something else to offer and plunged the price level to the lowest of $3600.

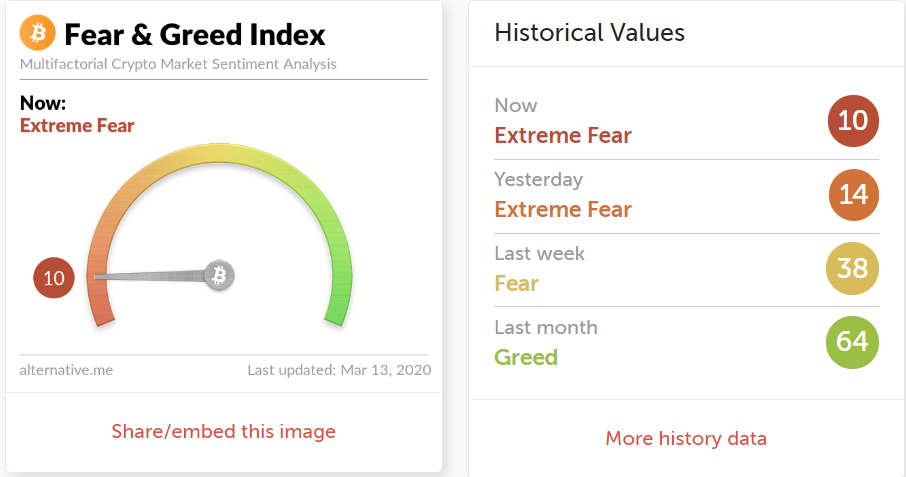

Fear and Greed Index: Fear and Greed Index indicates the overall nature of investors in the market for a specified period. As of now, there is the condition of extreme fear among the crypto investors which means that overall selling volume will be much higher buying volume. The case can be justified looking at the overall downfall of the majority of coins like Tezos, Tron, ICON, IOTA, etc.

Global Market Concerns Affecting Cryptomarket

The crash in the global stock market is so significant that Dow Jones Industrial suffered its largest one-day point loss in history and dropping almost 2353 points and closing at 21,200. The S&P 500 index also a significant downfall of 20% with FTSE facing a loss of nearly 11%.

- Coronavirus: A pandemic

The World Health Organisation declared the new coronavirus outbreak a pandemic, the global market faced sudden downfall activities bringing one of the worst crash scenes in the history of the global stock market. The cryptomarket is seemed to be affected by the same which vanished the hope of bitcoin reaching $10k.

- Travel Bans

The travel ban imposed declared by the United States and European Countries due to the coronavirus outbreak have affected the crypto market as it is providing resistance to potential collaborations, partnerships, meetings among the community of the cryptocurrencies.

- Investors in thirst of liquidity

Due to the continuous and significant downfall occurring in the cryptomarket, Investors want for liquidity also increases. The global market faced a liquidation of almost 11.5 Lakh Crore (INR). The cryptomarket also faced the same phenomenon where crypto assets like Bitcoin, Ethereum and Ripple faced heavy selling volume.

- The drop in market cap of BTC

There has been a significant decline in the market capitalization of BTC. When compared to the market cap of BTC in the previous month which was around $180 billion and now is at $100 billion. The significant decline in the market cap of BTC results in a decrease in the valuation of BTC in the crypto market which is turning the cryptoasset from “hedging asset” into “harmful asset”.

- Plustoken Scam

The scam reported a huge movement of coins from wallets known to be connected to the Pus Token. There was said to be dumping of 13,000 Bitcoin by Plus token scammers which resulted in the spark of initial selling activities in the crypto market.

Mr. Pratik chadhokar is an Indian Forex, Cryptocurrencies and Financial Market Advisor and analyst with a background in IT and Financial market Strategist. He specialises in market strategies and technical analysis and has spent over a year as a financial markets contributor and observer. He possesses strong technical analytical skills and is well known for his entertaining and informative analysis of the Financial markets.

Home

Home News

News