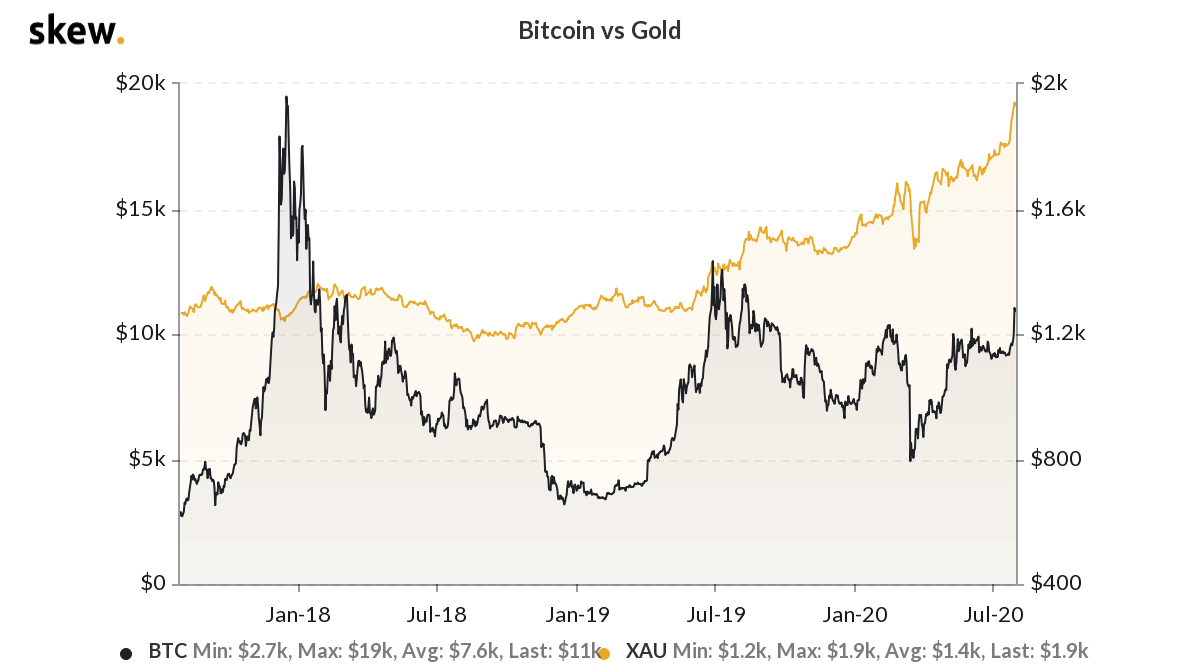

- The price of bitcoin surged by more than 10 percent in recent days, finally breaking the psychological barrier $10,000 after months of stagnation.

- Bitcoin’s price rally arrives amid a similar upswing for gold prices, indicating Bitcoin-gold correlation.

- Cryptocurrency pointed towards the second paradigm shift, bitcoin’s transformation as digital Gold.

Cryptocurrency analyst, Alex Cruger, recently opined that Bitcoin is undergoing its second paradigm shift as Bitcoin is evolving as digital Gold. The recent weakness of the US dollar has spotted safe heaven assets post impressive gains, Gold peaked to its ATH, and the same suit followed by Bitcoin.

The first paradigm shift was when BTC was recognised as a risk asset due to high volatility in its prices, according to Alex. For much of its existence, bitcoin’s price showed a negative correlation with stocks. But since the massive march crash, that correlation has weakened, bitcoin’s ability to offer security in the times of trouble has come into question.

Bitcoin is undergoing its second paradigm change.

The first was becoming a risk asset, following stocks and risk sentiment, after being uncorrelated for a full decade.

The second is evolving into true digital gold. The dollar gets dumped, and $BTC benefits.

— Alex Krüger (@krugermacro) July 27, 2020

BTC Created A Paradigm Shift In The World Of Transactions

A paradigm shift generally referred to as a particular event or set of circumstances that change the underlying principles and concepts that are associated with a specific thing. The most popular example being the revolutionary internet, which created a paradigm shift in the industrial world and how businesses were conducted. Similarly, Bitcoin created a paradigm shift in the world of transactions.

If we look back to the year when Bitcoin was launched, it was not even worth a cent. People could only buy pizza or a bottle of coke with thousands of BTC. When BTC reached, the one dollar mark, people started treating it as a currency for transactional purposes.

Owing to the growth of BTC over the last decade, people started considering it as a viable option for wealth storage. However, in the last few years, we have seen a fair amount of BTC used for transactions which imply two important things. Firstly, the wider adoption of the cryptocurrency and secondly, the denial of the stereotypical notion of accumulating BTC.

CEO Of Abra Points to BTC’s Correlation With Gold

However, now the tables have turned and the much anticipated BTC rally has started. As of now, when the article was written BTC traded at $10,865.27 and was down by 4.27% in the last 24 hours. Today itself it crossed the $11000 barrier and reached a daily high of $11,394.85. On the other hand, Gold recorded a new all-time intraday high of $1,942 on July 27th, 2020.

The previous all-time high was approximately 9 years ago when it reached a high of $1,924 in September 2011. And simultaneously, the value of the so dubbed digital Gold also soared above the $11000 mark to keep in pace with Gold. The CEO of the crypto platform Abra, Bill Barhydt says that the correlation of Bitcoin with the traditional Gold is so far the best analogy that he has seen.

Home

Home News

News