- Any fiat currency does not back AMPL; instead, it has incorporated an automatic rebasing system.

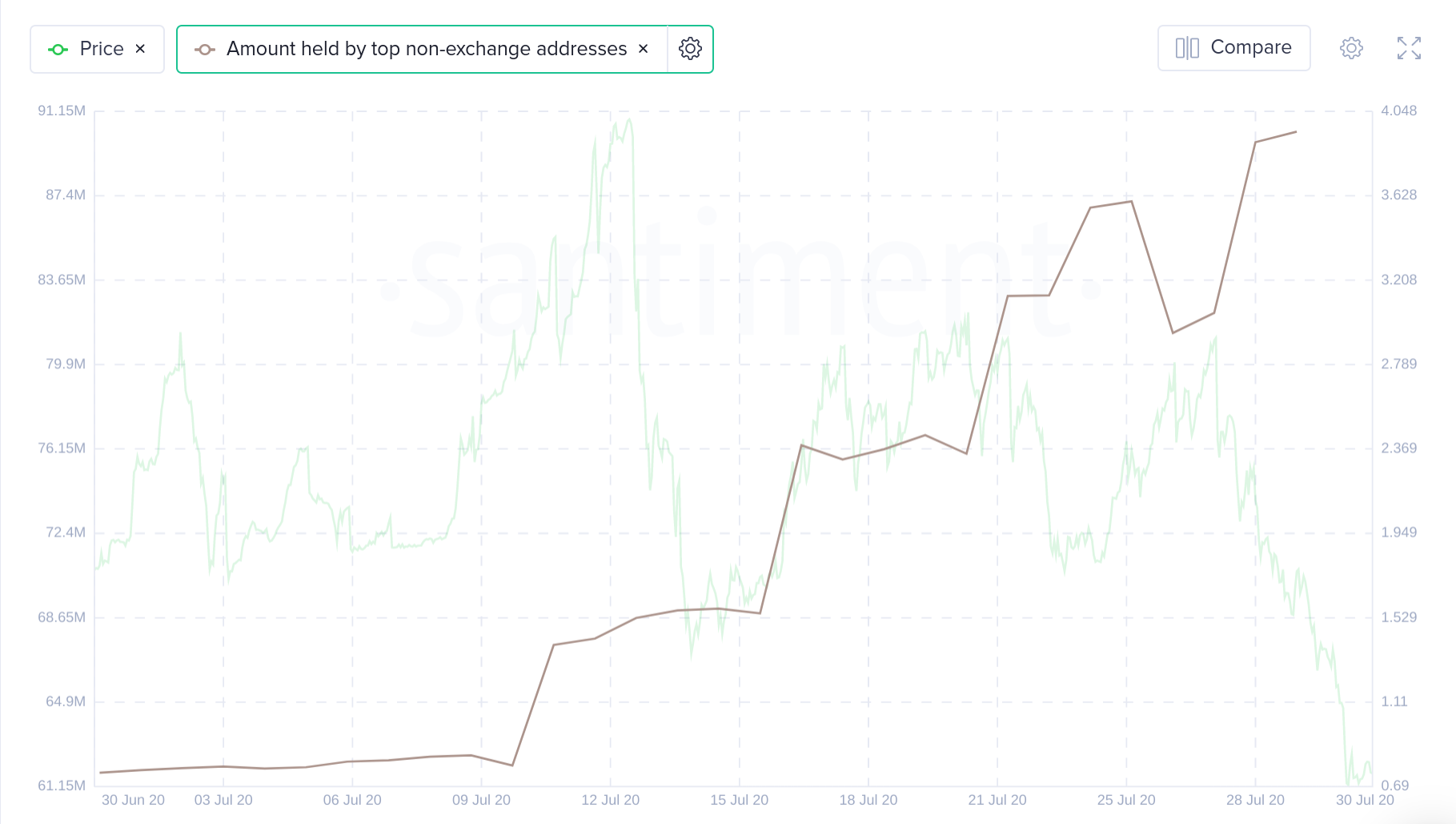

- The top non-exchange addresses holding AMPL tokens seem to be accumulating the asset. This indicates some optimism in the investors’ confidence.

Recently, Santiments released a blog post on a potential stablecoin. This new category of asset called ‘Ampleforth (AMPL)’ is a stablecoin protocol based on the Ethereum platform.

AMPL Not Pegged by Any Fiat Currency

Unlike USD coin, AMPL not backed by any fiat currency; instead, it has incorporated a reflexive rebasing system. This system tries to balance the value of the asset to around a dollar. Every day at 7 PM Pacific Standard Time, AMPL users tend to see a change in the assets either up or down, as the system attempts to stabilize the price of the token.

Changes in the holdings happen in this manner: if the price of AMPL is above $1, the supply expands, and similarly, if AMPL is above $1, the token supply lessens. AMPL is bound to trade in the vicinity of $1. However, Ampleforth doesn’t like to be termed as stablecoin.

Positive Aspects That Indicate Growth of Stablecoin

The increase in social volumes is rare, considering the token’s ever-changing price performances. Furthermore, the top non-exchange addresses holding AMPL tokens seem to be accumulating the asset. This indicates some optimism in the investors’ confidence.

According to the data provided by Santiments, the top four addresses holding AMPL are dumping. And the fifth address is a smart contract, and the sixth address is a whale, which has approximately 3.5% of total AMPL supply stored.

The Daily Active Addresses are considerably increasing, hinting towards a strong engagement with the network. The high transaction volumes recorded during the dump indicate extreme activity among the investors.

AMPL Capital Plummets By 60% in The Last Few Days

But, the AMPL market capital has plummeted down by 60% in the last few days. The market capital fell from $719 million on Monday to $216 million on Thursday. It has slightly recovered to $316 million. The main reason for this may be the elasticity of its price. As its supply tends to change, it affects the market capital. Currently, it is trading at $0.871503 and is up by 18.3% in the last 24 hours. Consequently, the supply of the token has deflated. However, these swings are not a surprise considering the reflexive model of this stablecoin.

Some crypto experts see the token as more of a risky asset. This is because investors can lose both the value of the tokens as well as the token itself owing to the design of the protocol. Ampleforth is supported by Investment firms like Pantera Capital, Arrington XRP Capital, and Slow Ventures.

Home

Home News

News