- Bitcoin’s (BTC)’s market capitalization has soared to $43 billion and sits at $115 billion

- While long-term bias remains compelling, declines prevail in the short-term

- The day traders are enjoying an aggregate profit of nearly 65%.

In cricket, there is a popular term ‘records are meant to be broken’ and it isn’t much of a difference when it comes to the crypto world as well.

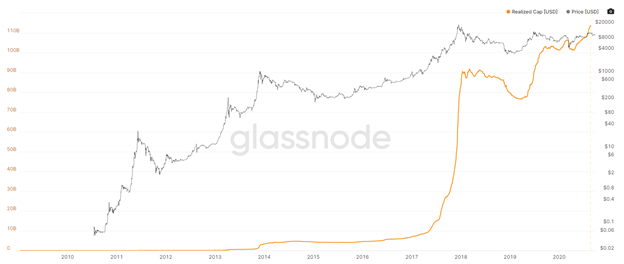

According to a recent study from data aggregator Glassnode, the Bitcoin’s (BTC)’s market capitalization has soared to $43 billion and sits at $115 billion which is 50% since tagging its all-time high of $72 billion at the end of 2017. With this substantial increase, the BTC holders too are reaping the benefits of it, with an aggregate profit of 65%.

Metrics

As the metrics, of Glassnode Studio, shows that the BTC’s realised capital is lingering after the early months of 2018, but decreased in 2019 before continuing its impulses this year.

Bitcoin’s current trading value is around $10,293 after closing at $10,233 on Wednesday. While long-term bias remains compelling, declines prevail in the short-term, especially after Bitcoin failed to continue the price above $12,000 and $11,000. On 3rd of September, Bitcoin finally imparts from $11,000 to drop to $10,160, its lowest in more than 30 days by then. Bitcoin made a slight recovery but the price reacted recklessly after failing to break past $11,000 on 21st of September.

‘Black Thursday’ flipped

In 2020, the low just hit around $5000 with the market crash in March (‘Black Thursday’). After this upward movement in the realised capital, reversed 2020’s ‘Black Thursday’ to 2020’s gain. Since May 2020 Bitcoin’s realized capital is influencing upwards.

According to some crypto data researcher’s, more than 72% of crypto addresses are cost-effective. Unlike other currencies, those are suffering to reclaim its past highs. The day traders are enjoying an aggregate profit of nearly 65%.

Coins on the centralized exchanges

Cointelegraph said BTC’s realized capital is the measure of the value of every Bitcoin when it last moved, a metric that can be used to estimate the aggregate cost of Bitcoin to market participants. The coins which don’t have other competitors in the market are not available on the metrics which is a good mark for the data, which seems to be more accurate in terms of the cost-basis for day traders rather than intra-day traders.

Ethereum’s struggle

Where BTC is showing steady improvement in the market, ETC is suffering to restore it’s previous high even before the Bitcoin started to shake. The main factor which is affecting it is the hype around Decentralized Finance (DeFi), has died since and Ethereum naturally gets affected since the majority of the DeFi brands are built on it. As per Ethereum’s metric’s of realised capital from Glassnode, ETC is currently sitting at 25% lower than it’s 2018’s record. Though some crypto researchers are assuming that 62% of ether addresses are currently in profit.

With a background in journalism, Ritika Sharma has worked with many reputed media firms focusing on general news such as politics and crime. She joined The Coin Republic as a reporter for crypto, and found a great passion for cryptocurrency, Web3, NFTs and other digital assets. She spends a lot of time researching and delving deeper into these concepts around the clock, and is a strong advocate for women in STEM.

Home

Home News

News