- Bitcoin and Ethereum were observed in a consolidation phase, on February 10, 2021

- While numerous smart contract coins managed to project a bull rally

- The investors may shift their interests towards other smart contract-based altcoins

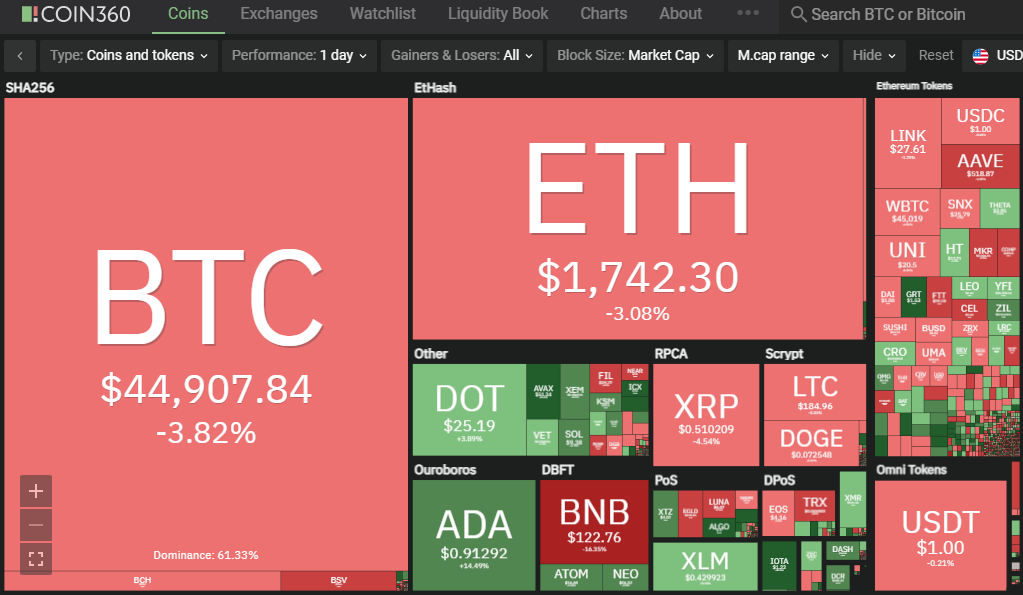

Bitcoin (BTC) and Ethereum (ETH) are the two largest cryptocurrencies by market capitalization. At present, the Bitcoin market cap exceeds $700 Billion. Whereas, Ether market cap exceeds from $180 Billion. The two assets continued in a consolidation phase until February 10, 2021 night. But, the world observed various smart contract coins on a bull run.

What Happened?

On February 11, 2021, the BTC prices traded 3.16% lower at $44,977. Whereas, ETH price was down by 3.84% trading at $1,741. The Ethereum killer coins projected a bullish trend and soared higher at the same time.

Cardano (ADA) stands as the fourth-largest cryptocurrency with a market capitalization of $28 Billion. On February 11, 2021, the asset price soared 18.73%, hitting $0.92.

Polkadot (DOT) is the sixth-largest cryptocurrency with a market capitalization of $22 Billion. On February 11, 2021, the asset price soared 5.61%, hitting $25.06.

Solana (SOL) surged 7.8% at $9 with a market capitalization of $2 Billion. The asset attained an all-time high of $9.23 on Wednesday evening, February 10, 2021.

Other striking gainers on February 11, 2021, were Aave (AAVE), Stellar (XLM) and Avalanche (AVAX). AAVE soared up 3.44%, hitting $518. XLM was up 4.03% operating at $0.43. And, AVAX traded 30% higher, attaining the price of $54.66.

Drastic Interest Change of Investors

Bitcoin and Ethereum have attracted several institutional investors in the past few months. Moreover, Bitcoin market capitalization has sailed above $700 billion, contemplating investors’ buy in the asset. Similar is the case with Ether (ETH). ETH has a market capitalization exceeding $180 billion. Thus the asset cannot be ignored by the investors either.

The reason for interest shift from Ethereum is nothing else but its gas fees, which has significantly surged as years have passed.

When you found a new hot Ethereum DeFi project but too poor to pay gas fees. pic.twitter.com/dxGcsmMXZX

— TrevonJames.eth 🟢 (@TrVon) February 3, 2021

However, the notable point is that the Ethereum killer coins are surging up significantly. Such a situation may cause a drastic interest shift of pro investors towards these smart contract coins soon.

With a background in journalism, Ritika Sharma has worked with many reputed media firms focusing on general news such as politics and crime. She joined The Coin Republic as a reporter for crypto, and found a great passion for cryptocurrency, Web3, NFTs and other digital assets. She spends a lot of time researching and delving deeper into these concepts around the clock, and is a strong advocate for women in STEM.

Home

Home News

News