- Bitcoin and Ether is a better investment than market cap crypto and DeFi index funds

- BTC’s max drawdown was 53%, and Bitwise was 50%

- The benefits of putting your money into an index versus Bitcoin are not that great

According to data from Delphi Digital, Bitcoin and Ether is a better investment and more profitable compared to weighted average market cap crypto and DeFi index funds. Furthermore, the data reveals that Bitcoin and Ethereum outperform ‘lower risk’ crypto index funds.

Index and exchange-traded funds (ETF) popularity has surged in the last two decades. They have become immensely popular with investors because they offer a passive way to gain exposure to many stocks as opposed to investing in individual stocks, which increases the risk of loss.

This trend has also extended to the cryptocurrency trade. For example, the Bitwise 10 Large Cap Crypto Index (BITX) tracks the total return of primary crypto tokens like Bitcoin (BTC), Ether (ETH), Polygon (MATIC), Stellar (XLM)of Cardano (ADA), Bitcoin Cash (BCH), Litecoin (LTC), Solana (SOL), Chainlink (LINK), and Uniswap (UNI).

Spreading out the risks is one great way to reduce losses. If an investor can access multiple projects through a weighted average market cap index it seems to be a great idea to thin out the risks and at the same time get exposure to a wide range of products. However, does the investor get a big piece of the pie cake of profits and protection against volatility compared to the top-ranking cryptocurrencies?

Let us take a closer look and find out. First, Delphi Digital analyzed the performance of the Bitwise ten and then compared it to the performance of Bitcoin following the December 2018 market bottom. The results revealed that investing in Bitcoin was a better strategy than investing in BITX, even though it was slightly less volatile than BTC.

Indices cannot outperform individual assets.

The report said that indices cannot outperform individual assets and are destined only to lower the risk portfolios compared to holding a unique asset. Hence it is not surprising that BTC exceeds BITX on a purely cost basis.

The benefits of putting your money into an index versus Bitcoin are not that big.

However, as the market plunged in May, the index did offer less downside risk to investors. However, the difference was so trivial that they could be neglected. BTC’s max drawdown was 53%, and Bitwise was 50%, a difference of only 3%. Therefore the benefits of putting your money into an index versus Bitcoin are not that great. The volatile nature of cryptocurrency and, more than large drawdowns, often significantly affect altcoins.

Delphi Digital added that crypto indices are dynamic and work-in-progress systems. For an emerging asset class, picking assets, allocations, and re-balancing thresholds are difficult. However, as the industry matures, we will see more efficient indices rise and gain traction.

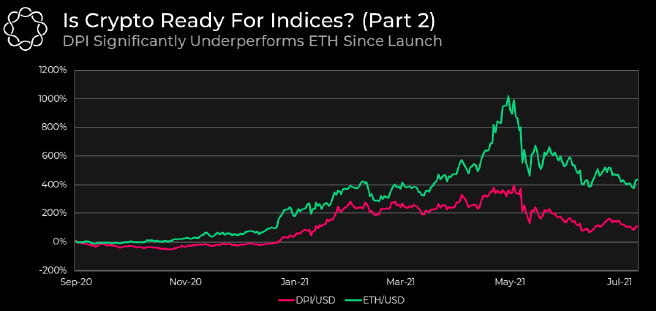

Ethereum, like Bitcoin, also outperforms DeFi baskets.

DeFi is one of the fastest-growing segments in the Cryptocurrency trade in 2021. The growth is led by decentralized exchanges like Uniswap (UNI) and SushiSwap (SUSHI) and lending platforms like AAVE and Compound (COMP). The DeFi Pulse Index (DPI) envisages to profit from this rapid growth, and the DPI token has allocations to 14 of the top DeFi tokens, including UNI, SUSHI, AAVE, COMP, Maker (MKR), Synthetic (SNX), and Yearn. Finance (YFI).

However, when comparing the figures of DPI to Ether since the inception of the index, Ether significantly outperformed profitability and volatility, as evidenced by a 57% drawdown on Ether versus 65% for DPI.

It is not precisely the proper comparison since the risk and volatility of DeFi tokens are higher than Ether’s. However, it underlines that crypto-based baskets do not equal the traditional benefits seen from indices.

Steve Anderson is an Australian crypto enthusiast. He is a specialist in management and trading for over 5 years. Steve has worked as a crypto trader, he loves learning about decentralisation, understanding the true potential of the blockchain.

Home

Home News

News