- Bitcoin supply changes trigger a price movement.

- Indication of a bull market and it is leading the charge in Holding sentiments.

- Trends in play indicate squeeze would mainly hit the market somewhere in mid-September.

The last couple of months have been trying for the cryptocurrency segment, particularly Bitcoin, which saw almost half its worth erosion. However, people have not lost faith, and the community believes that the coming months will see much of the damage undone.

Bitcoin has been experiencing all kinds of pressures. First, the volatility squeezes and was followed by the short squeeze, and now the supply squeeze. To answer these burning questions, let us analyze the dynamics of the supply first.

Squeezing Supply

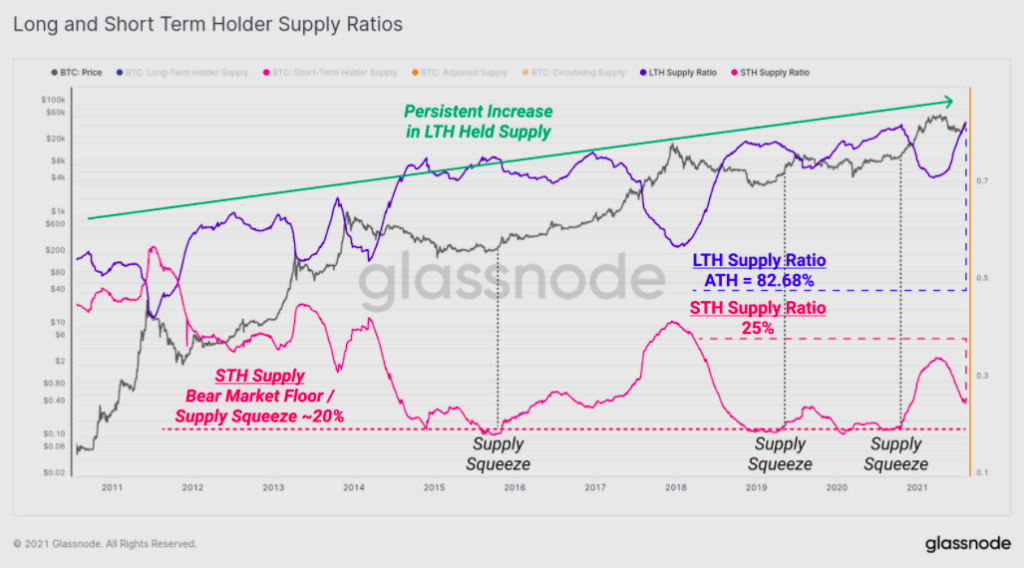

A supply choke or supply shock is possible where the actively traded Bitcoin supply changes and consequently triggers a price movement. Supply shock incidents happen during the halving phase, and past instances reveal that prominent supply shocks have generally aided the king coin’s price surge. The next halving will happen in 2024, and BTC will witness a squeeze at that time. But can we expect a squeeze in the coming months? According to the current supply spread out, there is a fair chance that this is possible.

The total supply of bitcoins by the long-term HODLers was close to 12.48 million BTC, as is evident from the chart attached that this number is dependent on the volume of coins held by LTHs in October 2020, just before the start of the bullish phase. Therefore it can be safely said that the volume of coins that were accumulated in the first quarter this year remain firmly held. Therefore, in a larger perspective, it represents a bullish picture for the aggregate market conviction.

If the adjusted supply was also taken into consideration along with the circulating supply, it could be seen that the LTH-owned supply has reached an all-time high of 82.68%. Thus, the crypto assets held by these investors are witnessing an upward trend for quite some time now.

The STH-owned supply has been tanking continuously and is at 25%. The major squeeze happened when the STH supply ratio had reached the 20% level. Therefore only a maturation of only 5% is required at the moment for the market to get back into its squeeze condition. When that happens, the freely circulating supply would feel the pinch.

Another interesting fact is middle to old age coins (Coins between 3 months to two years) have shown a drastic rise in recent times. These are an indication of a bull market, and it is leading the charge in Holding sentiments.

In a nutshell, it implies that coin maturation is playing its part, and a host of bull market buyers have stuck around and have become strong HODLers. The supply squeeze has not breached 20% levels. The trends mentioned above in play indicate that it [the squeeze] would mainly hit the market somewhere in mid-September.

Bull markets are the product of a supply squeeze that is formed in bear markets. The cryptocurrency trade has been in the red and bearish since May. The above analysis augurs well the fact that the actual Bull Run is yet to commence, and the recent surge is just a glimpse of what will happen in the coming weeks.

Steve Anderson is an Australian crypto enthusiast. He is a specialist in management and trading for over 5 years. Steve has worked as a crypto trader, he loves learning about decentralisation, understanding the true potential of the blockchain.

Home

Home News

News