- The market is in a bull run today, and crypto-asset lovers are on cloud nine

- ETH market is profoundly different as compared to BTC.

- Short contracts dominated liquidations.

BTC markets are steadily showing bullish sentiments

Both BTC and ETH accumulation continues in the spot market. However, the attention of investors has shifted towards the derivative market. Delving deeply, here are a few facts about the futures and options affecting the spot market.

The spot market is also inserting an effect on the Futures and options. Investors who are searching for profits in Bitcoin and Ethereum could find enticing opportunities in the derivatives market.

The market Scenario

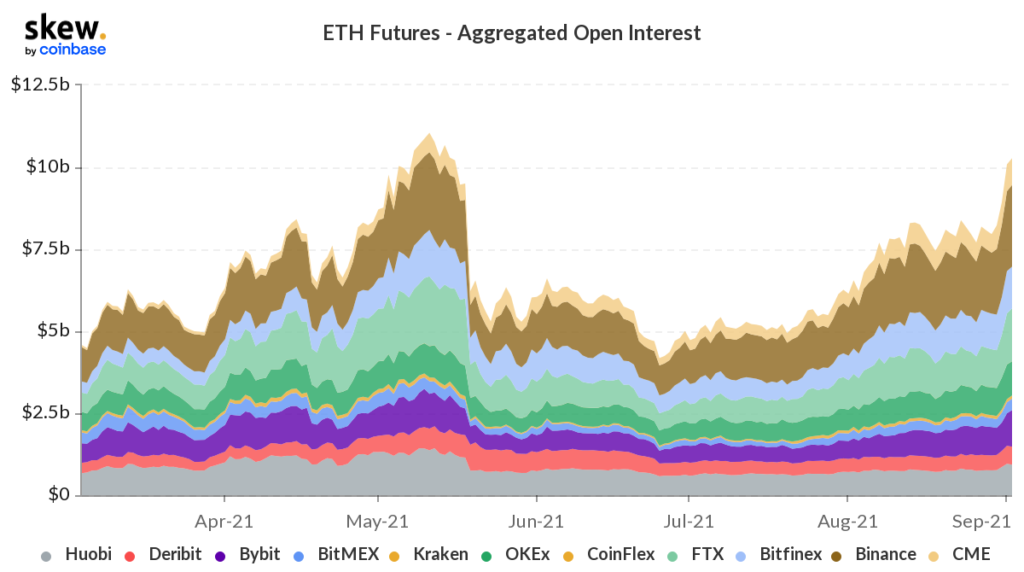

The market is in a bull run today, and crypto-asset lovers are on cloud nine. Both the Number One and Number two crypto assets are performing solidly as the Open Interest [OI] has surged to new heights. Futures OI for BTC is currently at a four-month peak and is touching $17 billion. The situation is not much different for ETH, with the OI standing at $14 billion.

However, experts are quick to add that the ETH market is profoundly different and is affected by a different set of parameters compared to BTC.

ETH market is on a bull run

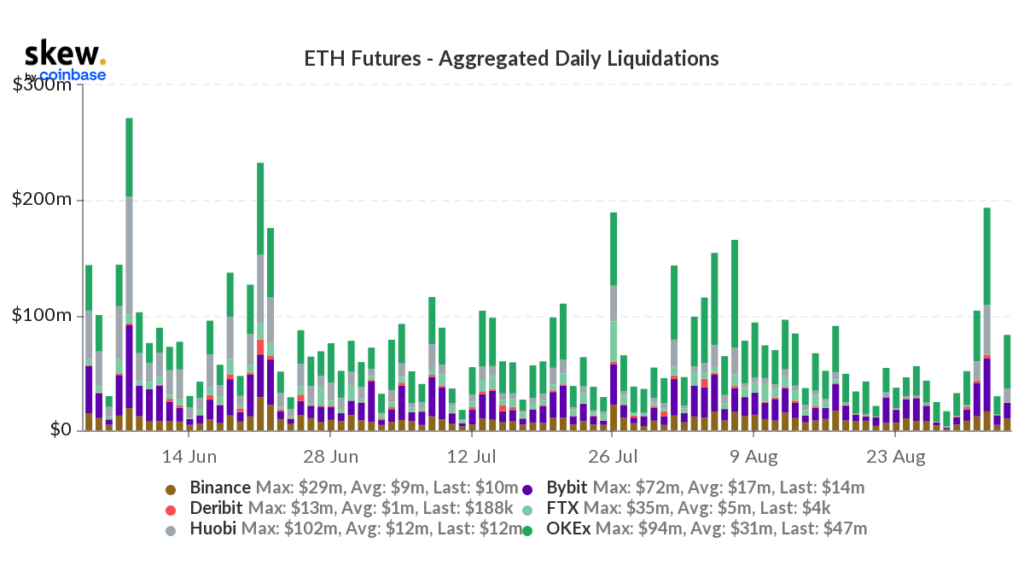

The volumes on 31 August and 1 September are close to BTC levels of $41 billion. However, these figures are alien to ETH, which usually sticks within the range of $30 billion. Over the same time frame when ETH volumes are close to BTC, daily liquidation is touching a three-month high of $194 million.

Looking closely at the liquidation, one can deduce the fact that short contracts dominated. Quick liquidation of Ethereum has reached an all-time high of $130 million. The ETH rally precipitated it over the last two days, and values went up by 18.81%. The investors are demanding stability from the Ethereum market.

BTC market has been steadily bullish

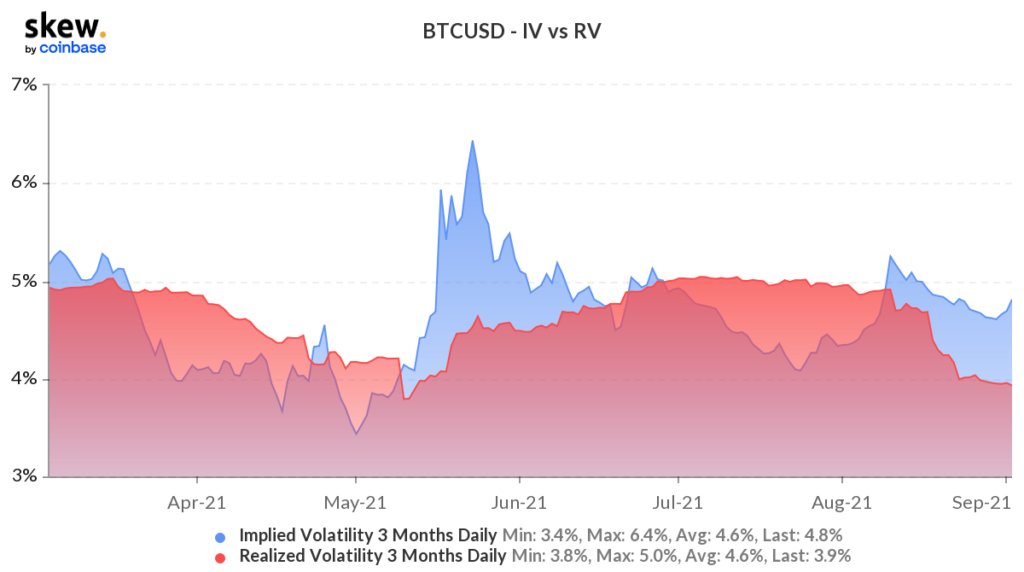

BTC markets are steadily showing bullish sentiments, and daily volumes are in the range of $100 million. Bitcoin OI in Perpetual Features contract has also reached an 18 month high of $14.157 billion. These figures augur well for a market which has remained well for over a month now. Still encouraging is the Implied Volatility to Realized Volatility spread which is at its highest level of 0.9%, a level last seen on 30 May.

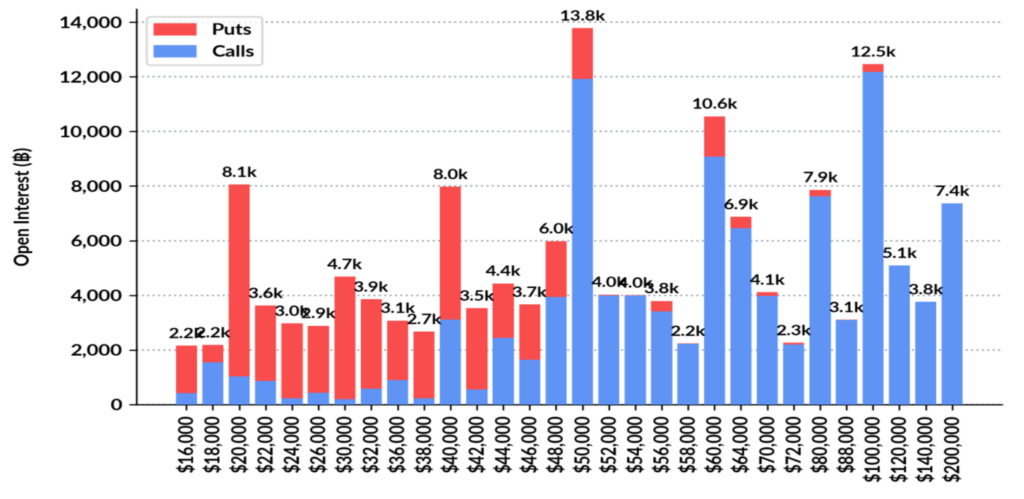

One important reason for this phenomenon is that the BTC spot price has surged at barely 4.83% in the last four days. Added to this is BTC values breaching $50K again, and the OI by Strike’s 12k Call contracts for $50k seem to be turning profitable as the 24 September expiry inches closer.

All in all, the derivatives market is in a profitable state right now.

With a background in journalism, Ritika Sharma has worked with many reputed media firms focusing on general news such as politics and crime. She joined The Coin Republic as a reporter for crypto, and found a great passion for cryptocurrency, Web3, NFTs and other digital assets. She spends a lot of time researching and delving deeper into these concepts around the clock, and is a strong advocate for women in STEM.

Home

Home News

News