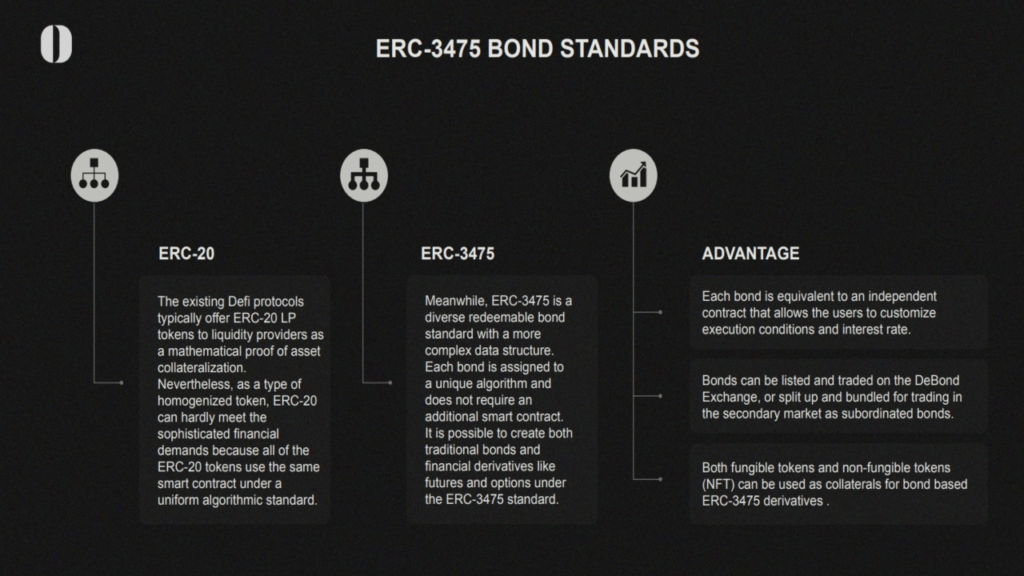

The Debond Protocol’s ERC-3475 came off as the token standard that would help bring the bonds and derivatives secondary market to the decentralized finance (DeFi) space — where it is currently non-existent. The token’s suitability for derivatives makes the EIP-3475 quite innovative. It’s also a notch above earlier versions of an ERC-20 liquidity provider (LP) token mainly serves as a mathematical proof of a loan and a fungible representation of assets transacted using smart contracts.

The timely entry of the [Debond] project is significant as the Web 3.0 era of decentralized internet gets more real and carries DeFi’s growing ecosystem with it.

Based on its late last year’s push even beyond the crypto market, some insiders expect the retail market to open up in 2022 to pave the way for new ways to participate in DeFi. Several enabling approaches are also being considered as some regulatory moves are expected in the space while cryptocurrency use increasingly becomes a part of life in any and every economy where there is a reason to question the stability of the fiat currency at hand. Or where the existing financial system is still faced with the big challenge of breaking the barriers for potential users to gain access to banking products that are meant to improve their ways of life.

Talk about the inflation in emerging markets and the instability brought by geopolitical issues like the ongoing Russia-Ukraine war and its impact on oil prices which in turn affects the global stock market amongst others, the demand for alternative financial instruments like cryptocurrency and DeFi has never been higher.

Thus, it makes sense that some venture capitalists (VCs) want to be a part of solving the problem of lack of transparency in and the non-accessibility of retail investors to the traditional derivatives markets. This is particularly interesting since derivatives don’t exist in DeFi presently because there are no token standards and infrastructure that are capable of supporting such complex data structures.

However, with the EIP-3475’s Multiple Callable Bonds Standard, and the backing of VCs — like Bixin Ventures, CSPDAO, Connectico Capital, Exnetwork, Wave Capital, Crypto Dorm Fund, F12 Capital, Collinstar Capital, etc — and more working to align their interest with Debond’s (email mailto:[email protected] for more info), LPs are about to be enabled to make contractual agreements with a derivatives issuer on repayment conditions and interest rates before being sold on a secondary market. The token standard’s smart contracts will allow LPs and borrowers to have a customizable agreement over loans/debts to manage the redemption conditions and price ranges as new financial derivatives are introduced to DeFi.

Debond Protocol is at the start of a paradigm shift journey with the ERC-3475 token standard. At a current valuation of $12.5 million and its initial DEX offering (IDO) slated for June, more is to come as the ERC-3475 token is put to real-world use.

“What we think is exciting about this project is that the update to the current yield farming system will bring more changes, possibilities and believers to the DeFi system, pushing DeFi to the next stage, where a more complex economic system can be designed using the ERC-3475 bond standard,” says Yu Liu, the Debond Protocol CEO. “We are expecting it to go beyond the boundary of our imagination: new protocols around decentralized options, derivatives and any other form of financial product, among many existing or non-existing such concepts. It has all the potential needed to substantially increase the efficiency and computational complexity of DeFi. DeBond is an open-ended platform by design. We are looking forward to seeing a series of applications and use-cases built on top of the ERC-3475 infrastructure.”

Using the ERC-3475 interface, a DeFi project can interact with smart contracts through DeBond Protocol’s Web 3.0 components. Success for Debond Protocol and token standard would mean that the intermediaries involved in the current processes of issuing and transacting derivatives would be less, the processes would be faster and less expensive.

For publishing articles on our website get in touch with us over email or one of the accounts mentioned below.

Home

Home News

News