- The failure of the FTX Exchange has created an atmosphere of fear in the crypto industry.

The crash of the FTX exchange has rusted the beliefs of users and investors on centralised exchanges, and many investors have even started moving their assets to non-custodial wallets like MetaMask and several others.

The failure of FTX has created pressure among the centralised exchanges to hold more liabilities than assets.

Vitalik Buterin is a Russian-born Canadian programmer known for his impactable work in developing Ethereum and is also the Chief Executive Officer of Ethereum.

Most recently, on 19 November 2022, Buterin detailed all the cryptographic methods used by exchanges so far, including the limitations of such methods.

Vitalik also advised some new strategies for centralised exchanges to achieve trustlessness, including zero-knowledge, concise non-interactive logic of knowledge, and other advanced techniques.

Buterin expressed his gratitude to Coinbase, Kraken, Balaji Srinivasan (former CTO) and major crypto exchanges for a healthy discussion on CEX and how to regain trust.

Few Impactable Work of Mt.Gox

Mt.Gox was one of the biggest crypto exchanges developed and launched in 2010 based in Tokyo, Japan. It was the only exchange to handle approximately 70 percent of Bitcoin transactions globally.

Mt.Gox was one of the first crypto exchanges to prove solvency by moving 424,242 BTC from a cold wallet to a pre-announced Mt.Gox address. Later, it was noted that the transaction needed to be more accurate since the transferred assets may have yet to be moved from a cold wallet.

These problems led to a serious argument in 2013 over how exchanges could prove the total size of users’ deposits and show that they had sufficient assets to cover those deposits.

In simple words, it is defined as when an exchange has equal or more funds than the user deposit and can return the funds at the time of withdrawal request.

One of the easiest ways to authenticate users’ total deposits is to publish their names and account balances. Nevertheless, according to users’ security, this method violates the user’s privacy on the network. However, there is an alternative: Exchanges publish a list of hashes and balances.

Buterin also noted, “In the longer-term future, this kind of ZK proof of liabilities could perhaps be used not just for customer deposits at exchanges, but for lending more broadly.”

In another context, borrowers can provide ZK certificates to lenders to ensure they have only a few open loans.

What is the Merkle tree and its mechanism?

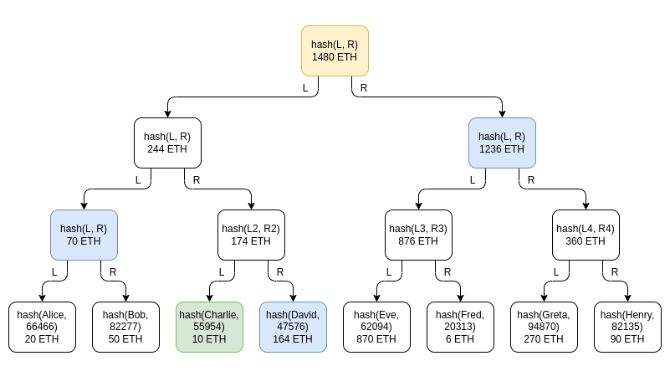

Merkle tree is a tree structure mechanism in which several transaction hashes are added to get one particular value, as shown in the picture below.

Vitalik Buterin is one of the industry’s youngest crypto enthusiasts and has made an impactable contribution to the development of Ethereum.

Recently Vitalik’s Ethereum has completed a successful and historical crypto event Ethereum Merge in which the working mechanism of Ethereum shifted from Proof-Of-Work to Proof-Of-Stake.

Ethereum Merge has been among the most popular and historical events in the crypto sector since it was developed.

With a background in journalism, Ritika Sharma has worked with many reputed media firms focusing on general news such as politics and crime. She joined The Coin Republic as a reporter for crypto, and found a great passion for cryptocurrency, Web3, NFTs and other digital assets. She spends a lot of time researching and delving deeper into these concepts around the clock, and is a strong advocate for women in STEM.

Home

Home News

News