Yuga Labs’ Bored Ape Yacht Club (BAYC) have become an apple of celebs eye in the digital asset space. It looks like these funky monkeys and other collections from the creators are going to become agents of chaos in their lives. According to Billboard, an American entertainment and music publishing magazine, the celebrity owners will face a class action lawsuit for their involvement with the virtual collection.

Buying BAYC NFT Was a Bad Decision?

The complaint was filed in Los Angeles federal court alleging several celebrities including Madonna, Justin Beiber, Jimmy Fallon, and more to promote the BAYC collection which eventually led the investors with staggering losses. According to the filing, the company’s business relies on marketing and promotional activities from highly paid A-list celebs.

Furthermore, the filed complaint says that this led to the increasing demand for the BAYC NFT collection by leading the potential investors to think that the price will take a positive leap in future. The NFT sector has plunged due to some unfortunate events in the digital asset industry.

More reports say that Guy Osheary, Sound Ventures co-founder, recruited the majority of the celebrities for the alleged activities. He reportedly hired them and offered to compensate them via MoonPay, a crypto firm. Sound Ventures was an early investor in MoonPay.

Jimmy Fallon, American comedian and television host, promoted BAYC and MoonPay on The Tonight Show. He announced his first Bored Ape NFT purchase on his show. Recently, Eminem and Snoop Dogg featured the NFT collection in their latest release “From D 2 LBC”. Moreover, they took the Apes a step ahead and showed-off their tokens during MTV Video Music Awards 2022.

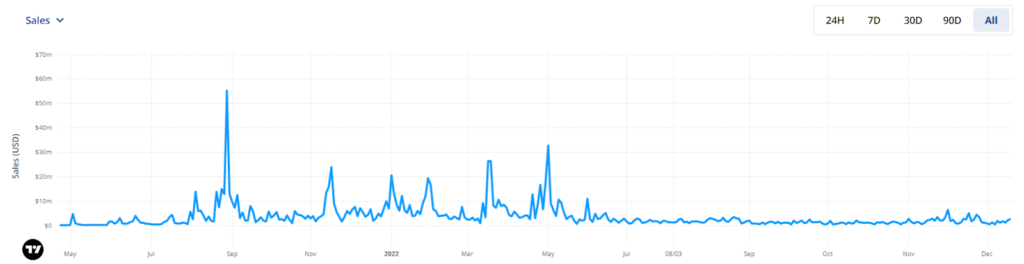

BAYC collection has lost a major value since the year’s beginning. Collection’s sales volume has plunged from $346 Million in January 2022 to $63 Million in November 2022, an over 80% decline. The digital collectibles had a trading volume of $2.5 Million and floor price of 64 ETH at the publication time. The collection peaked their floor value in February 2022 to 100 ETH.

The investors have undoubtedly received a huge blow concerning the steep decline in BAYC value. But it is possible that this is not what the people are thinking. Everybody is aware of the crypto winter and its direct influence on the NFT industry. The market downturn had taken the non-fungible token sector down as a whole, leaving other collectors in turmoil.

According to the Coin Market Cap data, the NFT sector had $13.7 Billion market capitalization at the publication time. ApeCoin, the native token in the Bored Ape ecosystem, was leading the space with a $1.4 Billion market cap, followed by FLOW and CHZ.

Cryptocurrency market had a market cap at $854.5 Billion, a 0.48% decline in a day. Bitcoin was still dominating the market with 38.6% dominance.

Anurag is working as a fundamental writer for The Coin Republic since 2021. He likes to exercise his curious muscles and research deep into a topic. Though he covers various aspects of the crypto industry, he is quite passionate about the Web3, NFTs, Gaming, and Metaverse, and envisions them as the future of the (digital) economy. A reader & writer at heart, he calls himself an “average guitar player” and a fun footballer.

Home

Home News

News