- Electronic Arts is among the biggest gaming companies operational today.

- The company is bullish on their future.

- Their stock price has suffered a lot in a day.

Electronic Arts’ (NASDAQ: EA) has recently made announcements that some fans may find satisfactory. Quarter 3 financial report proved to be a moderate monetary blow, resulting in the company stock to go down by over 9% yesterday. Still, they are among the biggest organizations in the gaming sector and offering additional content to their users in near future may improve their position in the market.

The ‘Battlefield’ Effect

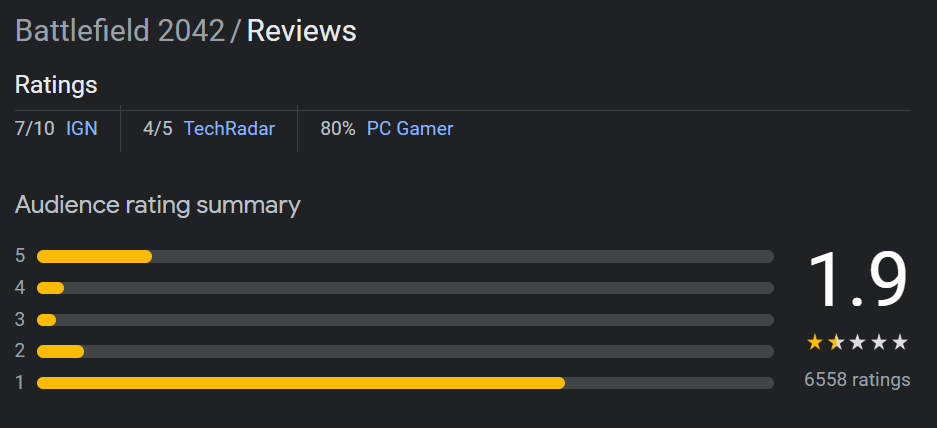

Company recently announced that they will shut down the mobile version of Apex Legends in May 2023. Users will be able to enjoy the game for a few more months. Not just this, Battlefield Mobile too is going down soon. One of the reasons for this remains the massive failure associated with Battlefield 2042 which currently holds an audience rating of 1.9 on Google.

We have made the decision to sunset Apex Legends Mobile.

— Respawn (@Respawn) January 31, 2023

We're sure you have a lot of questions. For more information on where things are at currently, including an FAQ, please read the blog below.https://t.co/Yjr4EOJnTq pic.twitter.com/4k3dGzOL12

They said that the content pipeline started to fall short for the Apex Legends Mobile. Coincidently, Call of Duty: Warzone Mobile by Activision Publishing will possibly arrive in the same month they decided to wind up the operations. Activision are testing the game in selected regions before the global launch in 2023. Bloomberg reported that the company also canceled a crossover game based on Titanfall and Apex Legends, codenamed Titanfall Legends.

As a gaming organization, the metaverse sector may impact the company’s health in future. According to an Electronic Arts’ General Manager appearing in an interview with Digiday, a New York-based online trade magazine, The Sims, a life simulation game, will be a huge asset for them in this context. It is among the company’s most popular and oldest franchises today. Currently, they are working on the next game in the series and believe it can grow as big as Roblox or Fortnite in future.

EA Stock Price Analysis

EA Stock received a huge blow upon releasing the earnings call. If we take last day’s close out of the picture, we can see a regression channel showing the price advancing in the sellers’ zone where a potential fall was expected. Fib retracement highlights a potential resistance at $122.

MACD depicts buyer dominance during January 2023, but lost it after the Q3 financial report. Though it may reconstruct the scenario as Electronic Arts’ CFO, Chris Suh, believes fiscal year 2024 will be better. Moreover, CEO Andrew Wilson said that the company’s net bookings were down by $2.3 Billion, a Battlefield 2042 and Apex Mobile Legends effect probably.

However, the loss was partially set off by their evergreen FIFA ecosystem and Need For Speed: Unbound. They revealed during the earnings call that FIFA Mobile gained triple digits, unit sales in North America were up by around 50% and FIFA Online saw the highest monthly active users (MAU) in years. Furthermore, their rebranded EA Sports FC franchise may bring more prosperity to the company.

Disclaimer

All the views given in this article belong solely to the writer and should not be taken as investment advice.

Anurag is working as a fundamental writer for The Coin Republic since 2021. He likes to exercise his curious muscles and research deep into a topic. Though he covers various aspects of the crypto industry, he is quite passionate about the Web3, NFTs, Gaming, and Metaverse, and envisions them as the future of the (digital) economy. A reader & writer at heart, he calls himself an “average guitar player” and a fun footballer.

Home

Home News

News