- Lido DAO surged on Coinbase CEO’s comments about the SEC.

- The CEO of Coinbase said the SEC might ban staking for retail customers.

Lido DAO governance token noted an increase in rumors boosted by Coinbase CEO Brian Armstrong. He said the Securities and Exchange Commision (SEC) might ban staking for retail customers. While the SEC has declined to make any further comment on this rumor, it intends to classify tokens that allow staking as securities.

Lido is a liquid staking solution for Ethereum that allows users to stake their ETH whilst participating in on-chain activities. LDO, the native utility token, is used for granting governance rights in the Lidp DAO, manages fee parameters and distribution, and governs the addition and removal of Lido node operators.

At press time, 0.9% of the total LDO supply is in circulation. While founding members of the Lido DAO possess 64% of LDO tokens. On-chain data shows that Lido has a market cap of 25% of the staking pool market, while Coinbase has 11.5% and Kraken has 7%.

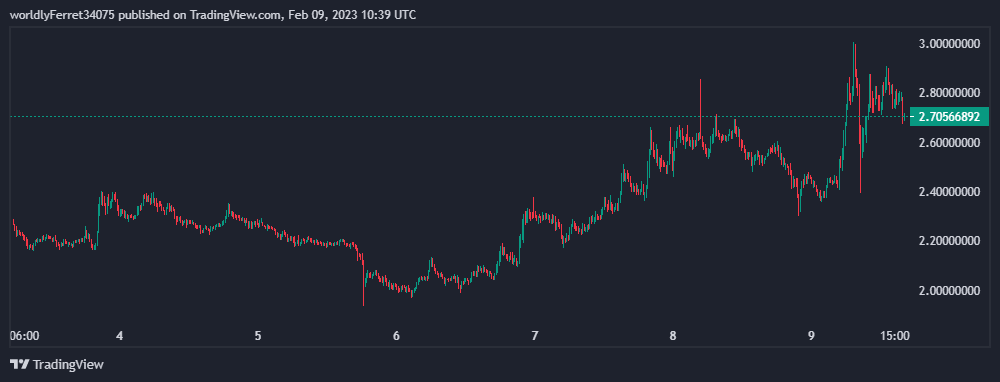

Lido DAO Price Analysis

According to Tradingview, Lido DAO is currently trading at a price of $2.70 with a 24-hour trading volume of $641.574 Million. The token is almost up by 5.76% in the last 24-hours, while in one week it is up by more than 16%. It has a market cap of $2.271 Billion.

In one month Lido DAO noted an increase of 38.83% while its year-to-date surge is more than 180%. The technical analysis summary for LDO is suggesting a strong buy, as per the data sourced by Tradingview.

Coinbase CEO’s Saying

Brian Armstrong is the CEO of Coinbase, a crypto exchange. In recent hours in a long twitter thread he wrote as “we are hearing rumors that the SEC would like to get rid of crypto staking in the U.S. for retail customers.” He hopes that this is not the case as he believes it would be a terrible path for the U.S. if that was allowed to happen.

1/ We're hearing rumors that the SEC would like to get rid of crypto staking in the U.S. for retail customers. I hope that's not the case as I believe it would be a terrible path for the U.S. if that was allowed to happen.

— Brian Armstrong (@brian_armstrong) February 8, 2023

Armstrong shared his thoughts and said that “staking is a really important innovation in crypto. It allows users to participate directly in running open crypto networks. Staking brings many positive improvements to the space, including scalability, increased security, and reduced carbon footprints.”

Coinbase CEO clarified that “staking is not a security.” He further added “we need to make sure that new technologies are encouraged to grow in the U.S., and not stifled by lack of clear rules.”

“When it comes to financial services and web3, it is a matter of national security that these capabilities be built out in the U.S. Regulation by enforcement does not work. It encourages companies to operate offshore, which is what happened with FTX,” as Armstrong said.

1/ We're hearing rumors that the SEC would like to get rid of crypto staking in the U.S. for retail customers. I hope that's not the case as I believe it would be a terrible path for the U.S. if that was allowed to happen.

— Brian Armstrong (@brian_armstrong) February 8, 2023

Disclaimer

The views and opinions stated by the author, or any people named in this article, are for informational ideas only, and they do not establish financial, investment, or other advice. Investing in or trading crypto assets comes with a risk of financial loss.

Nancy J. Allen is a crypto enthusiast, with a major in macroeconomics and minor in business statistics. She believes that cryptocurrencies inspire people to be their own banks, and step aside from traditional monetary exchange systems. She is also intrigued by blockchain technology and its functioning. She frequently researches, and posts content on the top altcoins, their theoretical working principles and technical price predictions.

Home

Home News

News