- SOFI stock gained almost 16.8% over the past four weeks.

- The analysts have raised their price target for SOFI stock.

SoFi Technologies Inc. (NASDAQ:SOFI) offers financial services and is headquartered in San Francisco, CA. The company offers multiple services such as student and auto loan refinancing, mortgages, personal loans, credit card, investing, and banking. It also develops non-lending financial products, such as money management and investment product offerings, and leverages a financial services platform to empower other businesses.

SOFI stock price analysis

SoFi stock noted an increase of 17.17% in one month. But its weekly analysis suggests that it is down by almost 2.07%. SOFI is up by 42.37% in its year-to-date price action. At present, the market cap of SOFI stock is $6.143 billion. Its next earnings report is scheduled for May 9th.

Total revenue for the last quarter stood at $555.50 million, which is 19.68% higher than the previous quarter. The net income of Q4 2022 is -$40.01 million. SoFi revenue for the same period amounts to $443.42 million despite the estimated figure of $425.62 million.

The estimated earnings for the next quarter are -$0.08, and revenue is expected to reach $442.31 million.

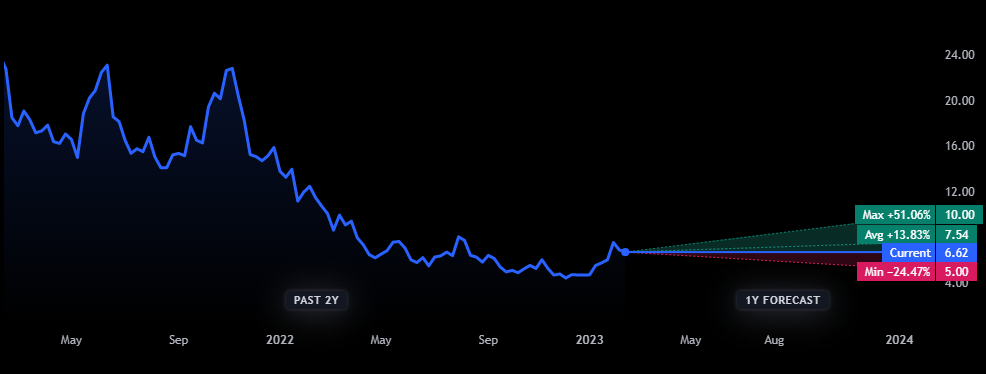

The price target of SOFI stock offered by 14 analysts in one year price forecasts has a max estimate of $10.00 and a minimum estimate of $5.00. The past three months analysis of 15 analysts showing buy for SOFI stock. Meanwhile, SOFI closed on its last trading day at $6.62.

Wall street analysts on SOFI stock

Wall Street analysts reportedly believe that SOFI stock could rally 25.68%. Most of the analysts expected that the stock would surge 96.4% to touch the $13 level. The mean estimate consists of 11 short-term price targets with a standard deviation of $2.04 and the lowest estimate of $6 that shows a 9.4% decrease from its current price level.

Analysts are confident about SoFi’s earnings prospects. They strongly agree over higher EPS estimates. It would be reasonable to expect an upsurge in SOFI stock price.

Disclaimer

The views and opinions stated by the author, or any people named in this article, are for informational ideas only, and they do not establish the financial, investment, or other advice. Investing in or trading stocks comes with a risk of financial loss.

Nancy J. Allen is a crypto enthusiast, with a major in macroeconomics and minor in business statistics. She believes that cryptocurrencies inspire people to be their own banks, and step aside from traditional monetary exchange systems. She is also intrigued by blockchain technology and its functioning. She frequently researches, and posts content on the top altcoins, their theoretical working principles and technical price predictions.

Home

Home News

News