- GM CEO meets key senators regarding deploying autonomous vehicles on US roads

- GM has a market share of 17% and owns brands like Buick, Chevrolet, GMC and Cadillac

General Motors CEO met two key senators regarding deploying self-driving vehicles on US roads. Can this boost the GM rally? One of the oldest and most prominent names in the automotive arena has committed to investing $35 billion in EV and autonomous vehicle technology for the next five years. Congress has been working on easing the regulation for the past six years.

General Motors (GM) Penning the New Era

On Thursday, Mary Barra, CEO of GM, met Senate Commerce Committee Chair Maria Cantwell and Senator Gary Peters, as confirmed by the company. Congress has tried to ease the regulations for deploying autonomous vehicles for over six years.

In 2022, the self-driving technology unit of GM, Cruise, filed a petition with the National Highway Traffic Safety Administration (NHTSA) asking permission to station 2,500 self-driving vehicles per year without a steering wheel, mirrors, turn signals or windshield wipers.

GM thinks the US needs to work quickly in the autonomous vehicles arena if they want to compete with countries like China and Japan.

A brief about GM

Founded more than a century ago, with HQ in Detroit, GM is the largest automaker in the US, with a market share of 17%. They own multiple brands like Chevrolet, Buick, Cadillac and GMC. GM provides a range of vehicles, from hatchbacks, sedans, SUVs, MUVs, Trucks, and EVs. The company is planning to launch 35 new E models by 2025. And has an ambitious goal of becoming carbon-neutral by 2040.

General Motors (GM) – Price Inquiry

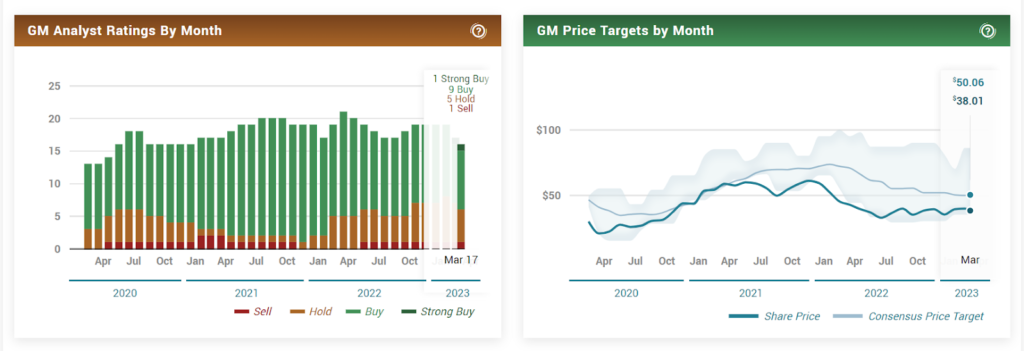

When writing, GM stock was trading at $34.61 after gaining 0.82%; previous close and open were at $34.33 and $33.85, respectively, and the 52-week-change dropped by 23.40%. Short interest seems healthy, with a 1.70% float sold short and a 2.61 analyst rating for moderate buy. Price is targetted at $50.06 with an upside of 44.6%.

Revenue hiked by 28.38% to $43.11B, and Revenue per share was $108.47, while quarterly revenue growth was 28.40%. The operating expense is $3.28B, with a hike of 58.58%, while the operating margin was 7.66%. Net income gained 14.82% at $2B, but the net profit margin dropped by 10.42% to $4.64. Earnings Per Share (EPS) was $2.12 after gaining 57.04%.

General Motors (GM) – Chart Investigation

Since September 2022, the price has been consolidating between the $30 and $43 mark, but a closer observation reveals it’s slowly moving upwards. As represented by the upward-sloping trend line. The moving average seemingly moved upward, with a slight bend at the end; MACD also shows a deviation towards the south.

The current point is on the trend line, so it might not touch the demand zone and bounce back toward the supply zone. Acting immediate resistance is at the $37.44 mark; the price is expected to consolidate below it before breaking north to the supply zone.

Disclaimer

The views and opinions stated by the author, or any people named in this article, are for informational purposes only and do not establish financial, investment, or other advice. Investing in or trading crypto assets comes with a risk of financial loss.

Nancy J. Allen is a crypto enthusiast, with a major in macroeconomics and minor in business statistics. She believes that cryptocurrencies inspire people to be their own banks, and step aside from traditional monetary exchange systems. She is also intrigued by blockchain technology and its functioning. She frequently researches, and posts content on the top altcoins, their theoretical working principles and technical price predictions.

Home

Home News

News