- 1 Home-price growth rate is low which could be bad news for Zillow Group.

- 2 With falling liabilities and supposedly increasing earnings, ZG stock might rally.

A recent drop in the growth rate of home prices may not be good news for Zillow Group (ZG). Home prices are tracked by S&P CoreLogic Case-Shiller Home Price Indices, which says that the index fell considerably and adjusted to 0.2% from December 2022. This point is close to zero and is bad news for industries associated with real estate.

Zillow Group (ZG) – Financial Health Analysis

Debt can never be good for a company, and studies show that Zillow Group had a debt of around $1.70 billion in December 2022. This amount is up from $1.43 billion last year. Per their balance sheets, they have $270.0 million in liabilities within a year and $1.81 billion due after that. While the receivable amount of 3.36 billion and $72 million in a year.

Essentially, Zillow Group has $1.35 billion more liquid assets than liabilities. Short-term liquidity indicates that the liabilities can be paid soon.

Zillow Group – A briefer

Founded in December 2004 and headquartered in Seattle, Washington, US, Zillow Group (NASDAQ: ZG) provides real-estate and home-related information marketplaces on the web and mobile. They operate through segments like Internet, Media and Technology (IMT), Homes and Mortgages.

Zillow Group (ZG) – The Number Game

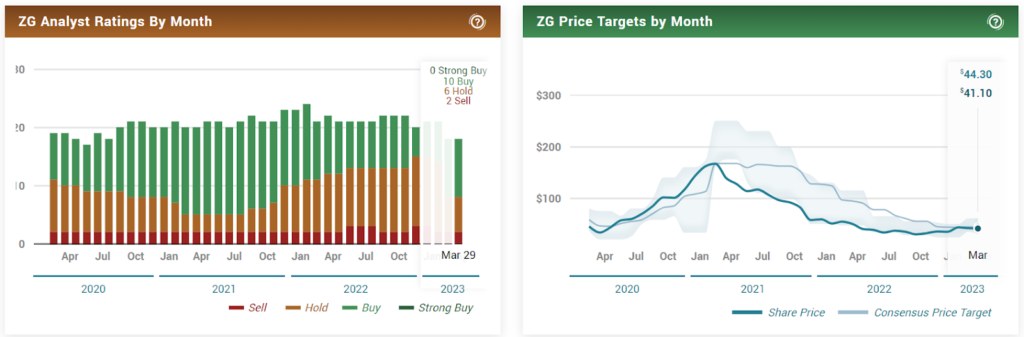

When writing, Zillow Group (NASDAQ: ZG) was trading at $41.63, with a drop of 0.64% when the previous close and opening were at $41.90 and $41.58, respectively. The market cap for the real estate domain company was $9.903 billion, with an average volume of 462,956 shares. Analysts have placed the price target at $44.30 with an upside of 6.4%.

With a 2.44 analyst rating for HOLD and a healthy short interest of 2.94%, floats sold short; the 52-week change comes with a drop of 18.66%. Concerning data for December 2022, the revenue dropped by 18.69% from $435.00 million, while revenue per share was $8.09, and there was a fall of 18.70% in the quarterly revenue growth.

Operating expenses grew 5.81% from $419.00 million, and Net income was negative $72.00 million and gained 72.41%; in comparison, the net profit margin jumped by 66.07% from negative $16.55. Earnings per Share massively gained 147.78% from $0.20. The EBITDA ratings were hiked by 175.68% from negative $56.00 million.

The last earnings were reported on February 15, 2023, where estimated revenue was $414.516 million, while it was reported to be $435 million (a gain of $20.484 million or 4.94%). The next earnings are scheduled on May 4, 2023, with an estimated revenue of $425.731 million.

Zillow Group (ZG) – Candle Exploration

A bullish trend, denoted by an upward-sloping trend line, is stopped by a sideways-moving average line. The current price point for Zillow Group is close to the trend line, moving towards immediate support (I_S) at $38.71, and could cross to enter the demand zone.

If the Fed rates are revised (lowered or maintained), real estate market sentiments are reversed, or a piece of good news appears, the price may increase to the immediate resistance (I_R) present at $44.44. However, if the price could move across R1 toward R2, it would depend on many variables.

Disclaimer:

The views and opinions stated by the author, or any people named in this article, are for informational purposes only and do not establish financial, investment, or other advice. Investing in or trading crypto assets comes with a risk of financial loss.

Nancy J. Allen is a crypto enthusiast, with a major in macroeconomics and minor in business statistics. She believes that cryptocurrencies inspire people to be their own banks, and step aside from traditional monetary exchange systems. She is also intrigued by blockchain technology and its functioning. She frequently researches, and posts content on the top altcoins, their theoretical working principles and technical price predictions.

Home

Home News

News