- 1 Roku recently released a positive earnings report for Q1 2023.

- 2 The streaming giant is trying to leverage this prowess to rally.

Roku Inc. ‘s (NASDAQ: ROKU) share price hiked by almost 46% YTD. Can it leverage its streaming prowess to fuel the rally? Per the latest financial results, the streaming giant posted a revenue of $741 Million in Q1 2023, surpassing expectations. Net loss in a similar time frame was $194 Million, an improvement from Q4 2022.

Roku Inc. is its Leveraging Streaming Prowess – Financial Analysis

As of March 31, 2023, Roku has around 71.6 Million active accounts, which is 17% higher than last year. Streaming hours in Q1 2023 stood at 25.1 Billion which is a 20% hike compared to Q1 2022. Company management feels that net revenue for Q2 2023 would be $770 Million, higher than the figure for Q2 2022.

Customarily a positive quarterly report garners investors’ interest, but a birds-eye view of the situation clears the picture even more. Roku is currently riding the trend of streaming entertainment. People are increasingly shifting from traditional cable TV to these platforms. The company could leverage the situation based on its streaming prowess.

HighTower Advisors LLC increased its stake in Roku by 569.5% in Q4 2022. The Chicago-based wealth management company currently owns 88,472 shares worth $3.6 Million. Even though this accounts for only 0.06% of Roku, it still highlights HighTower’s confidence in the streaming company.

At press time, ROKU stock is trading at $56.62, with a hike of 7.62% in the last 24 hours. Previous close and open were at $52.61 and $52.53, respectively. The 52-week change comes with a drop of 28.47%. With an average volume of 8.16 Million shares, the market cap stays strong at $7.971 Billion.

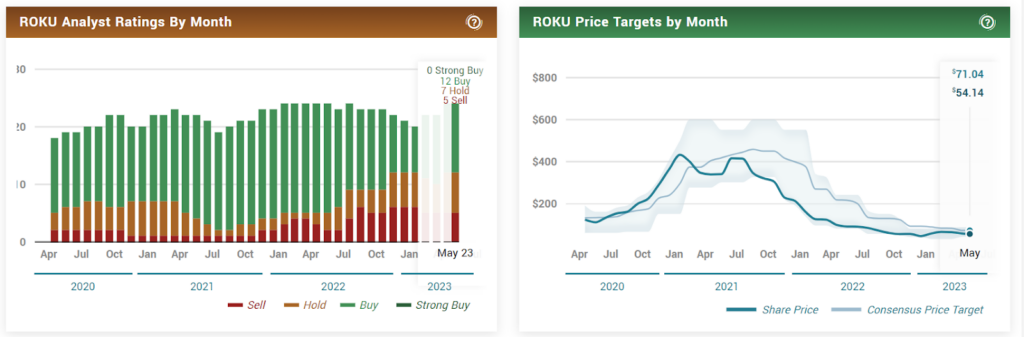

Analysts gave a 2.25 rating for HOLD while keeping the price target at $71.04 with a 25.5% upside.

The trailing twelve months (ttm) Revenue was reported to be $3.13 Billion, revenue per share was $22.57, and the quarterly revenue growth was 1.00%. Comparing Q1 2022 and 2023, operating expenses grew by 33.61% to $518.79 Million; net income dropped by 635.97% to minus $193.60 Million. EBITDA corrected by 457.96% to negative $116.15 Million, while ttm was minus $359.34 Million.

Roku Inc. (NASDAQ: ROKU) – Candle Exploration

A downward-sloping trendline and a similar moving EMA give a slight bearish indication. But the price is breaking the trendline, and moving towards the immediate resistance at $60.22 offers positive signals.

If it breaks the immediate resistance, ROKU stock could go into the supply zone, but if it bounces back, the story would be different. The share price may drop below immediate support; if so, the price could be closer to solid support at $38.02.

However, the likelihood of price consolidating for some time is high rather than showing movement in either direction.

Disclaimer:

The views and opinions stated by the author, or any people named in this article, are for informational purposes only and do not establish financial, investment, or other advice. Investing in or trading crypto assets comes with a risk of financial loss.

Andrew is a blockchain developer who developed his interest in cryptocurrencies while pursuing his post-graduation major in blockchain development. He is a keen observer of details and shares his passion for writing, along with coding. His backend knowledge about blockchain helps him give a unique perspective to his writing skills, and a reliable craft at explaining the concepts such as blockchain programming, languages and token minting. He also frequently shares technical details and performance indicators of ICOs and IDOs.

Home

Home News

News