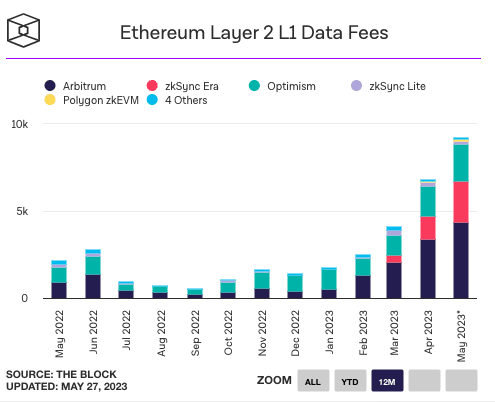

- 1 Layer 2 data fees ATH transaction fees because of their high demand and usage

- 2 Arbitrum contributes majorly with more than 45% of transactions for the month of May.

- 3 Optimistic rollups beat ZK rollups in both TVL and transactions.

The layer 2 solutions of the Ethereum Blockchain have gained some exposure since they can address the blockchain network’s sustainability and high transaction fees. As a result of the traction L2 data fees on the Ethereum blockchain have hit an ATH. the data was revealed by The Block recently.

Increase in Layer-2 Fees on Ethereum

Layer-2 data is basically the data fees related to the cost of transferring and executing data on L2 networks built on the Ethereum L1 mainnet. Due to the high usage of L2 solutions because of their benefits, demand for off-chain transactions has surged, which indirectly resulted in increased usage and demand for such solutions.

The above chart shows that Optimisim and ZK rollups have contributed to the high transaction fees milestone. However, if a closer look at the chart would reveal that Arbitrum and Optimism, which fall under the same optimistic rollup, have contributed more than ZK.

Arbitrum contributed a whopping 47.3% in the month of May while Optimism trailed with 23.04% of the spoils for the same month. While ZK rollups couldn’t beat the Optimistic roll-up numbers, zkSync stole the second spot ahead of Optimism with 25.38% of the total $16.2 million registered.

One of the major things the chart and the data fees indicates is that the adoption and use of these networks have been huge. It can be connected to the spike in Ethereum Mainnet’s transaction fees.

One of the most noteworthy observations from the publishing record is Polygon (MATIC) zkEVM. Despite the hype surrounding its launch even during the Beta phase, the project has cooled off significantly with only 1.03% of the total fees.

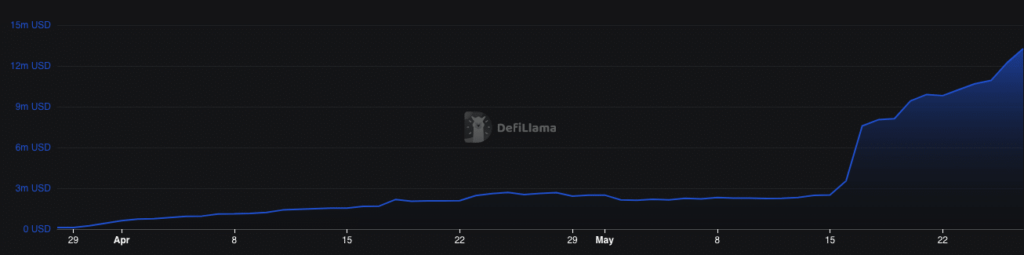

Decrease in TVL

Due to the cool-off it, impacted its Total Value Locked performance. Despite DefiLlama data showing the metric increasing, one should note that it is way below its major competitors at $13.27 million.

Total value locked is majorly used for liquidity pool purposes for smart contract lending and staking in that respective blockchain. An increase in TVL indicates excellent health of the protocol and a decrease in TVL indicates threat and drying up of liquidity.

zkSync with its total value locked at $127.63 million, is way ahead of Polygon zkEVM. The landscape in Optimism is however very different. Optimism has maintained its TVL stability at $889.36 million. Arbiturm has gained the first spot here as well with a TVL of $2.34 billion.

Essentially, Optimistic rollups have captured the majority of the investors and the market shares as well. To beat Optimistic, ZK has to do a lot to impress investors.

With a background in journalism, Ritika Sharma has worked with many reputed media firms focusing on general news such as politics and crime. She joined The Coin Republic as a reporter for crypto, and found a great passion for cryptocurrency, Web3, NFTs and other digital assets. She spends a lot of time researching and delving deeper into these concepts around the clock, and is a strong advocate for women in STEM.

Home

Home News

News