- 1 Microsoft Corp, MSFT Stock has rallied noticeably in 2023 so far.

- 2 The tech giant is trying to ride on the AI mania .

Microsoft Corp. (MSFT stock) rallied around 40% YTD, and EMA, too, is gaining a northbound trajectory. Will AI mania help the price surge? In May 2023, MSFT announced the expansion of access to its Microsoft 365 Copilot preview; the feature was introduced earlier this year and is a powerful generative AI technology integrator into the company’s popular apps.

Microsoft Corp (MSFT Stock) – Financial Analysis

Q1 2023 has been good for Microsoft as its revenue gained 7.1% Year-over-Year (YoY) to $52.86 Billion while trailing twelve-month (TM) revenue is reported to be $207.59 Billion. Operating income increased by 9.8% to $22.35 Billion, and operating expenses jumped 7.44% to $14.38 Billion. Also, the operating margin gained 41.41% to

The last earnings were reported on April 25, 2023, with reported revenue of $52.853 Billion, estimated to be $51.019 Billion. Bringing in a surprise of $1.838 Billion and a hike of 3.60%, MSFT’s share price surged 6.4% the next day. Earnings per share rose by 10.36% to $2.45, while basic EPS is reported to be $9.26.

Net income gained 9.36% to $18.30 Billion, net profit margin gained 2.15% to 34.62%, and the profit margin increased by 33.25%. Also, its comprehensive income jumped 38.3% from last year to $19.11 Billion.

The return on assets and equity surged by 14.83% and 38.60%, respectively, while gross profit (ttm) was reported to be $135.62 Billion. Total cash in hand at the end of the more recent quarter is $104.42 Billion, while debt in the same time frame is $79.31 Billion.

Experts estimated that MSFT’s revenue for Q4 2023 would surge by 6.9% (YoY) to $55.42 Billion, while EPS in the same lapse of time should increase 14.7% to $2.56. Also, the EPS value has surpassed the estimates for the last three quarters, an impressive feat indeed.

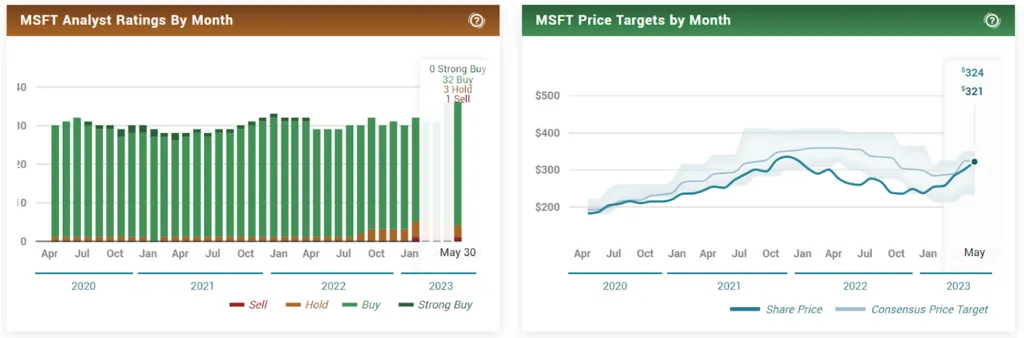

Analysts also provided a 2.83 rating for moderate buy, placing the price target at $323.69 with a downside of 2.8%. At press time, MSFT is trading at $332.89 with a noticeable gain of 2.14%. Previous close and open were at $325.92 and $324.02, respectively. With an average volume of 30.75 million shares, the market cap is $2.475 Trillion.

Microsoft Corporation (MSFT Stock) – Candle Exploration

MSFT share price could create a new yearly high if it enters the supply zone. The distance from EMA and the RSI value of 67.18 indicates its strength. Even though factors point to a northbound hike, upcoming Fed hike rates and other factors could disrupt the rally.

If the price drops, it would fill the gap created post-earning after breaking immediate resistance. However, it shall go up to S1, present at $275.59. Moreover, if the price is inside this range, the possibility of a bounceback is strong. Considering the AI momentum in the market, price action might go haywire.

Disclaimer:

The views and opinions stated by the author, or any people named in this article about Microsoft Corp, are for informational purposes only and do not establish financial, investment, or other advice. Investing in or trading crypto assets comes with a risk of financial loss.

Nancy J. Allen is a crypto enthusiast, with a major in macroeconomics and minor in business statistics. She believes that cryptocurrencies inspire people to be their own banks, and step aside from traditional monetary exchange systems. She is also intrigued by blockchain technology and its functioning. She frequently researches, and posts content on the top altcoins, their theoretical working principles and technical price predictions.

Home

Home News

News