- 1 OPEN stock price accumulated investors’ interest amid strong growth this year.

- 2 After the release of Opendoor Technologies Inc’s recent quarterly report, its stock price entered a bullish trend.

- 3 The recent price surge in the stock might be a sigh of stability in the real estate market.

OPEN stock price once again showing its bullish trend as it previously showed earlier in February this year. With positive trading volume in February, the stock price rose to the trading price of nearly $3.00. However, this price growth was noted after the release of the company’s Q1 2023 report.

OPEN Stock Price Analysis

In this week, OPEN stock rose by more than 20% by adding $0.60 in its trading price. The stock price closed at $3.01 on June 16. This weekend, the opening price of stock was $2.99, while the high was $3.13, which is also its YTD high and low was $2.89. As the stock experienced massive upsurge with over 150% in its YTD price, the investor confidence is clearly up.

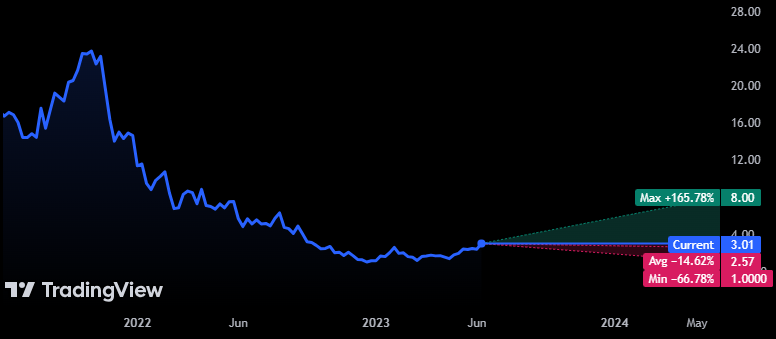

As the above price chart shows, the stock price surpassed its 200-day moving average this week. Amid bullish and bearish dominance, the stock price eventually reached its YTD high price. This further shows the rising graph of investors in the company.

The RSI surged amid bullish confidence in the stock which may take its price to the overbought zone.

Moving towards the analysts forecasts, they are offering their 1-year price target at $2.57 which shows a nearly 14% decline from the recent closing price of stock. Meanwhile, their maximum estimate is at $8.00 while minimum estimate is at $1.00.

The Fundamentals Highlights of Opendoor Technologies Inc

Opendoor Technologies Inc, the real estate company, has a market cap of nearly $1.95 Billion. Its revenue for the last year amounted to $15.57 Billion, while most of which around $15.57 Billion came from its highest performing source at the moment, Online Platform. Notably, the highest contribution to the revenue figure was made by the United States.

In its Q1 2023, the earnings or EPS are $-0.16 whereas the estimation was $-0.61 which accounts for 73.92% surprise. The revenue for the same period amounts to $3.12 Billion despite the estimated figure of $2.71 Billion. The estimated earnings for the next quarter are $-0.33, and revenue is expected to reach $1.82 Billion.

Disclaimer

The views and opinions stated by the author, or any people named in this article, are for informational ideas only and do not establish financial, investment, or other advice. Investing in or trading crypto or stock comes with a risk of financial loss.

Nancy J. Allen is a crypto enthusiast, with a major in macroeconomics and minor in business statistics. She believes that cryptocurrencies inspire people to be their own banks, and step aside from traditional monetary exchange systems. She is also intrigued by blockchain technology and its functioning. She frequently researches, and posts content on the top altcoins, their theoretical working principles and technical price predictions.

Home

Home News

News