B2Broker, a well-established leader in Forex and cryptocurrency liquidity solutions, has made a major announcement regarding its product offerings. The company is now introducing Non-Deliverable Forwards (NDFs) as a new asset class, reinforcing its commitment to remain the preferred choice for premier liquidity solutions.

Besides introducing NDFs, B2Broker has significantly reduced margin requirements for ten additional cryptocurrency pairs and updated its Prime Of Prime liquidity offerings, ensuring that clients have access to enhanced trading capabilities and robust risk management tools across all major asset classes, such as: Energies, Commodities, Rolling Spot FX & Precious Metals, Equity indices, Crypto Derivatives/CFDs, Single Stocks, ETFs, and NDFs.

The Purpose of NDFs

NDFs, or Non-Deliverable Forwards, are financial contracts designed to protect against fluctuations in foreign exchange rates. They serve as a valuable tool for parties to minimize potential losses caused by changes in the value of two currencies.

With NDFs, the parties engaging in the contract can establish a predetermined exchange rate at the beginning of the agreement. As the contract progresses, any differences between the agreed-upon rate and the prevailing market rate are resolved. It’s important to note that NDFs are settled in cash, eliminating the need for actual currency conversion.

NDFs prove particularly useful in emerging markets where traditional local currency forwards may not be readily accessible or practical. By implementing NDFs as a risk management strategy, companies can effectively navigate fluctuations in international trade and protect themselves against potential losses, ensuring smooth operations and improved financial stability.

B2Broker’s NDF Currency List

Clients may hedge risk in various emerging economies with B2Broker’s NDF currency offerings. The supported NDF currency pairs are the following:

– USD/BRL

– USD/CLP

– USD/TWD

– USD/INR

– USD/COP

– USD/IDR

– USD/KRW

Why Choose B2Broker’s NDF Offer?

By structuring NDFs as CFDs, B2Broker can provide their customers with flexibility and convenience. While the standard settlement time for NDFs is 30 calendar days after the trade date (T+30), B2Broker’s CFD contracts allow clients to obtain payments as early as the next business day. This facilitates improved risk management and increased participation in short-term trading for clients.

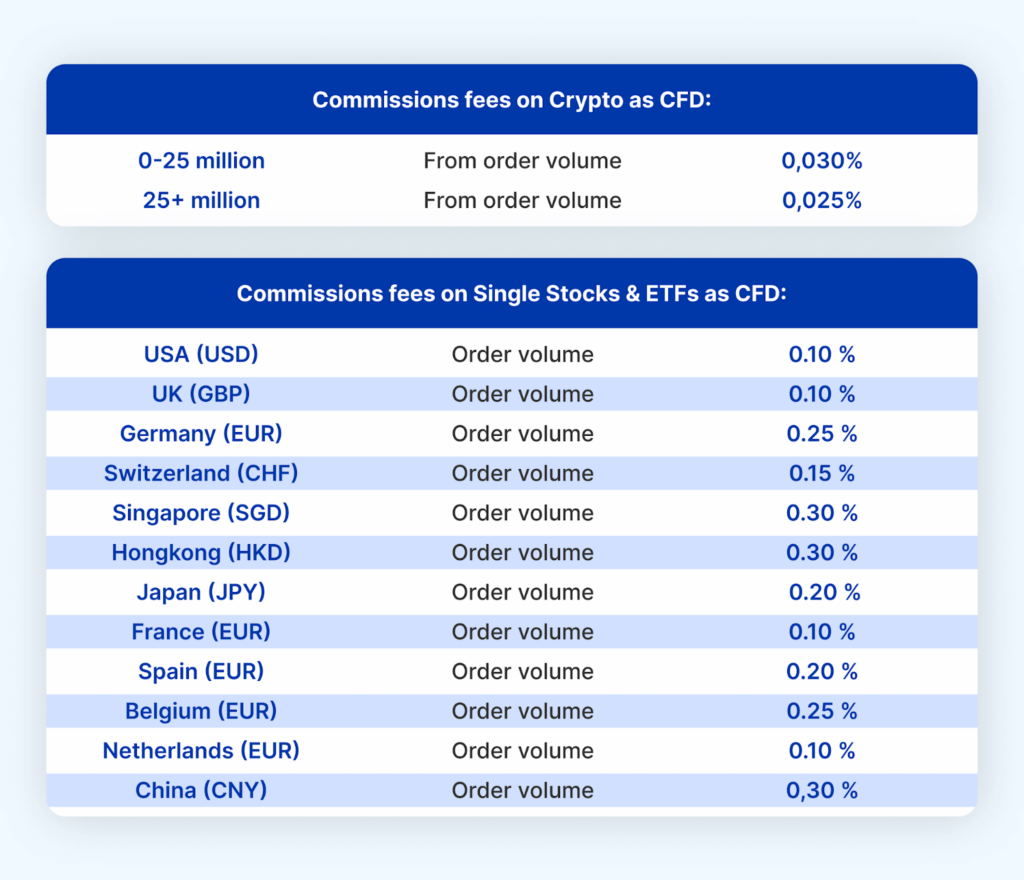

Additionally, B2Broker’s commission rates are among the lowest in the industry, making it an excellent choice for institutional and retail brokers that value efficiency and profitability.

Decreased Margin Requirements on 10 Crypto CFD Pairs

B2Broker’s latest update also reduces margin requirements for ten additional cryptocurrency pairs. Margin rates have been halved from 20% to 10% on the following CFD pairs:

– BNB/USD

– DSH/USD

– TRX/USD

– XMR/USD

– ZEC/USD

– SOL/USD

– DOT/USD

– LNK/USD

– AVA/USD

– ATM/USD

Updated Prime of Prime Institutional Liquidity Offer

B2Broker’s PoP institutional liquidity packages have added OneZero, PrimeXM, and Centroid connectivity points. Clients can benefit from STP/DMA (A-book) brokerage model for improved settling and transparent execution. Moreover, the company provides 24/7 technical support to guarantee the non-stop operation of your business.

A Prime Margin Account can be set up free of charge with the help of B2Broker. Clients can also benefit from minimal liquidity fees against traded volume.

The Bottom Line

B2Broker’s position as a leader in the Forex and cryptocurrency industries results from its distinctive technological solutions and comprehensive liquidity suite. The company offers businesses diverse trading instruments, enabling them to provide traders with access to numerous markets and exceptional trading opportunities.

Disclaimer: Any information written in this press release or sponsored post does not constitute investment advice. Thecoinrepublic.com does not, and will not endorse any information on any company or individual on this page. Readers are encouraged to make their own research and make any actions based on their own findings and not from any content written in this press release or sponsored post. Thecoinrepublic.com is and will not be responsible for any damage or loss caused directly or indirectly by the use of any content, product, or service mentioned in this press release or sponsored post.

For publishing articles on our website get in touch with us over email or one of the accounts mentioned below.

Home

Home News

News