- 1 The technology may help central banks to respond quickly amid fast-changing markets.

- 2 The Bahamas, Nigeria, Jamaica, and more have included CBDCs for retail use cases

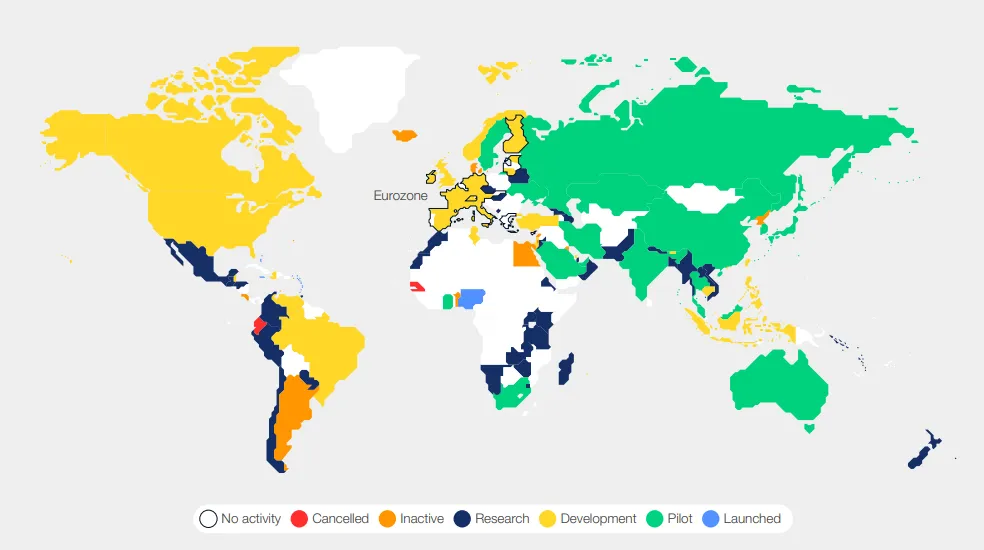

The digitization of payment systems has made it easier for people to transfer money. Now, several nations are testing central bank digital currencies (CBDCs) to simplify payments across the globe. However, only a few nations have successfully deployed CBDCs into their financial ecosystem. A new report by an intergovernmental and lobbying body, World Economic Forum (WEF), looks into prospects to achieve interoperability in CBDCs.

CBDC Could Simplify Cross-Border Remittances

The report dubbed ‘Central Bank Digital Currency Global Interoperability Principles’ considers several regions globally. It highlighted that there is no universal case for CBDCs as no one economy is the same. The Latin American and Caribbean (LAC) region is a major recipient of remittances with $127 Billion in cross-border payments last year. CBDCs can aid in cost reduction and enhance the efficiency of international payments across LAC.

CBDC could improve financial inclusion in Sub-Saharan Africa. However, the lack of digital infrastructure and connectivity could prove to be major hurdles in implementing the technology. Middle East and North Africa (MENA) regions’ diverse regulatory framework could use a CBDC infrastructure to meet compliance in the location.

Asia Pacific (APAC) region is a thriving location for digital economy and e-commerce, WEF notes. Moreover, APAC holds a robust interconnectivity and trade relations globally. Additionally, a significant number of migrants bring in large sums in remittances in the region. Central bank digital currency could assist all these areas by simplifying payment transfers.

The document highlights, “The decision-making process for issuing a CBDC varies among central banks, reflecting their distinct priorities and circumstances. Nevertheless, despite these differences, there are areas of alignment across jurisdictions that lay the groundwork for both domestic and cross-border interoperability. It is crucial for central banks to prioritize interoperability considerations early in the design process by adhering to a set of guiding principles.”

Only a Few Nations Are Using CBDCs

A majority of nations have either launched a pilot program or developed one. A few nations including The Bahamas, Nigeria, Jamaica and more have included CBDCs for retail use cases according to a think tank Atlantic Council. The United States is studying potential CBDC utility, however, a few have opposed the technology’s inclusion in the nation’s financial system.

WEF believes the technology may help central banks gain real time insights. It would help them respond faster during highly volatile market periods. Additionally, CBDCs could reduce nations’ reliance on foreign reserves. Currently, the US dollar dominates international systems.

To ensure interoperability, WEF suggests separate authorities to govern CBDCs in a country. Moreover, central banks could provide common standards for cross-border interoperability. Compatibility with a range of digital wallets and applications may enhance this global interface.

Anurag is working as a fundamental writer for The Coin Republic since 2021. He likes to exercise his curious muscles and research deep into a topic. Though he covers various aspects of the crypto industry, he is quite passionate about the Web3, NFTs, Gaming, and Metaverse, and envisions them as the future of the (digital) economy. A reader & writer at heart, he calls himself an “average guitar player” and a fun footballer.

Home

Home News

News