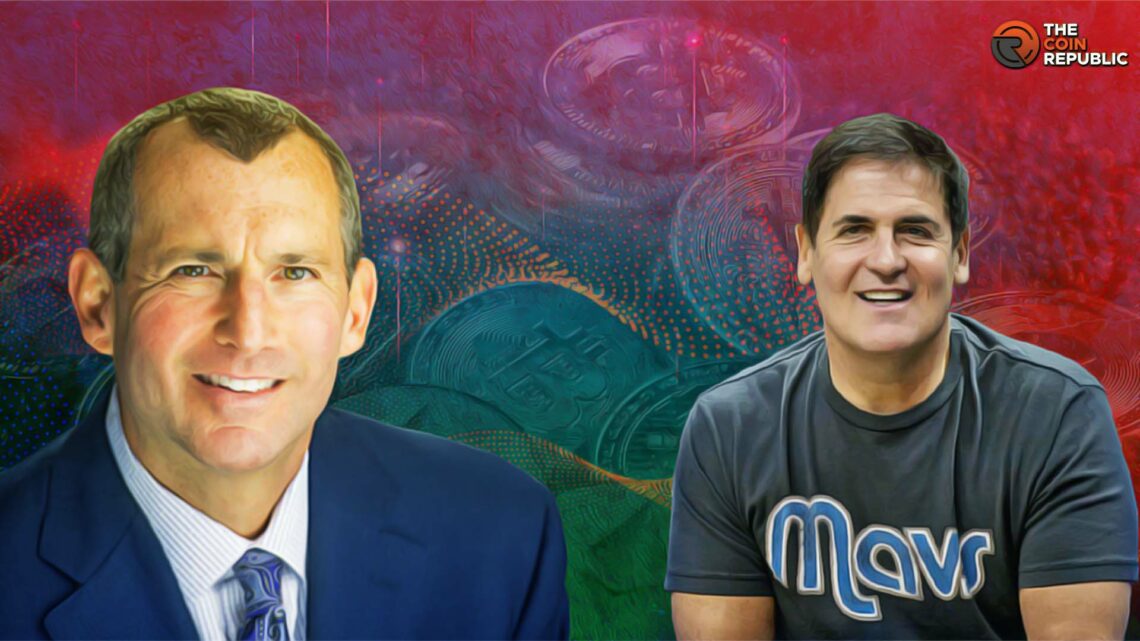

- 1 Billionaire Mark Cuban and former SEC Official John Reed Stark had a Twitter feud regarding crypto regulations.

- 2 The prominent personalities have starkly different views on the topic.

Billionaire Mark Cuban and ex-SEC official John Reed Stark had a Twitter feud on how to address crypto regulations. The former Securities and Exchange Commission (SEC) official shared his concerns and urged the public to be cautious about cryptocurrencies. At the same time, Cuban argued about the need for more transparent laws.

Mark Cuban & John Reed Stark; Thoughts on Crypto Regulations

The two prominent personalities have unique views about the infamous FTX-saga. Cuban argues that the financial watchdog of the United States, the SEC, took a wrong turn somewhere en route to crypto regulations. He further cited that the FTX users in Japan suffered fewer losses than their U.S. counterparts.

Billionaire Mark Cuban thinks that had the SEC implemented regulations similar to Japan; things would have turned out differently in the U.S. In regulating crypto, Japan separates the clients’ and businesses’ funds. The country also implements more wallet requirements.

The land of the rising sun would soon introduce stricter Anti-Money Laundering (AML) Laws, strengthening crypto regulations.

The billionaire then stated that “The SEC is not infallible. It makes mistakes. In this case, it chose the wrong course. It was arrogant in thinking that its framework covered every possible situation.” On the other side of the world, Japan was clear from the get-go that FTX-saga was not a crypto issue but a fraud issue.

While referring to a Wall Street Journal article, SEC Official John Reed Stark hinted towards the extent of Japanese regulations. Crypto exchanges and entities are required to register with the authorities. They are mandated to keep consumer funds separate from their accounts. Also, 95% of the customers can hold their assets in cold wallets.

Stark feels the United States Securities rules must have a greater protection sphere than Japan. He also disagrees with Cuban on the requirement for a regulatory framework for cryptocurrencies. Stark states, “I do not want to integrate crypto’s systemic risk into the U.S. Financial marketplace, especially not with U.S. banks.”

Reed then pointed out that the SEC proposed changes to several regulations—for instance, Rule 3b-16 of the Securities Exchange Act, Regulation ATS, and Regulation SCI. After implementation, they shall provide more clarity for the crypto entities.

Reed manages a consultancy business in Washington, DC. He has expressed his concerns regarding the Central Bank Digital Currencies (CBDC) and cryptocurrencies. He also said that many digital assets are risky and unnecessary financial ideas.

The former SEC official thinks that crypto companies fail to provide insurance, do not have government oversight, lack in safeguarding consumers, and do not have mandated cybersecurity standards.

While defending the SEC, Stark said that traditional financial institutions like banks still play a significant role. He also argued that blaming the SEC for scenarios like FTX-saga, BlockFi, Voyager, Terra, etc, is a stretch.

The crypto industry is already criticizing the agency for its regulatory crackdown on the industry. The number of enforcement actions jumped 183% since the FTX incident, and the recent lawsuits against the world’s biggest crypto exchange and Coinbase worsened their image.

Cuban then argues the dire need for a clear crypto regulatory framework in the United States. He previously stated that the current regulations make it hard to distinguish securities. At a time when the SEC is trying to rebrand almost every other token as a security, this is big.

Andrew is a blockchain developer who developed his interest in cryptocurrencies while pursuing his post-graduation major in blockchain development. He is a keen observer of details and shares his passion for writing, along with coding. His backend knowledge about blockchain helps him give a unique perspective to his writing skills, and a reliable craft at explaining the concepts such as blockchain programming, languages and token minting. He also frequently shares technical details and performance indicators of ICOs and IDOs.

Home

Home News

News