- 1 Bitcoin Funding rate has observed a decline, while the number of Active address is also seeing a downtrend

- 2 Bitcoin Price is currently trading near the value of $29200 with a strong consolidation on the daily chart.

What Is Bitcoin?

One of the Age Old questions among various investors is What is BTC or, to be more precise, Why Bitcoin? Bitcoin is one of the biggest cryptocurrency, with a market cap of $528 Billion.

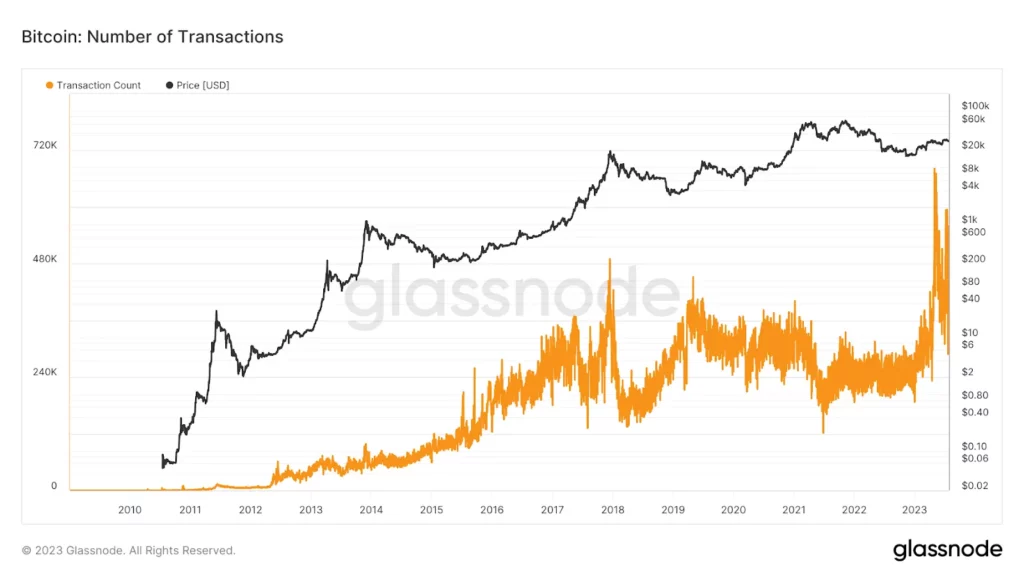

The adoption of Bitcoin can be seen from the number of transactions that have happened since its beginning. In April 2012, the average transactions on the network was around 20,000.

In a span of a decade, the number of transactions on the network has surged more than 10X. The number of addresses with more than 1 BTC has observed a surge from 50,000 to 1,005,901 surging more than 20x.

The Price of Bitcoin has also observed a strong surge from a low of $50 to a high of $65000 within a decade. It gave various investors a great return in comparison to other assets.

Bitcoin Mining (Go Far And Go Together)

Bitcoin Mining was once considered a great way of income for cryptocurrency enthusiasts. With the increasing difficulty and higher machinery many are looking to just invest instead of mining. Looking at the above chart, it can be seen that whenever the BTC price has hit a new high, the number of blocks created on that day has seen a surge.

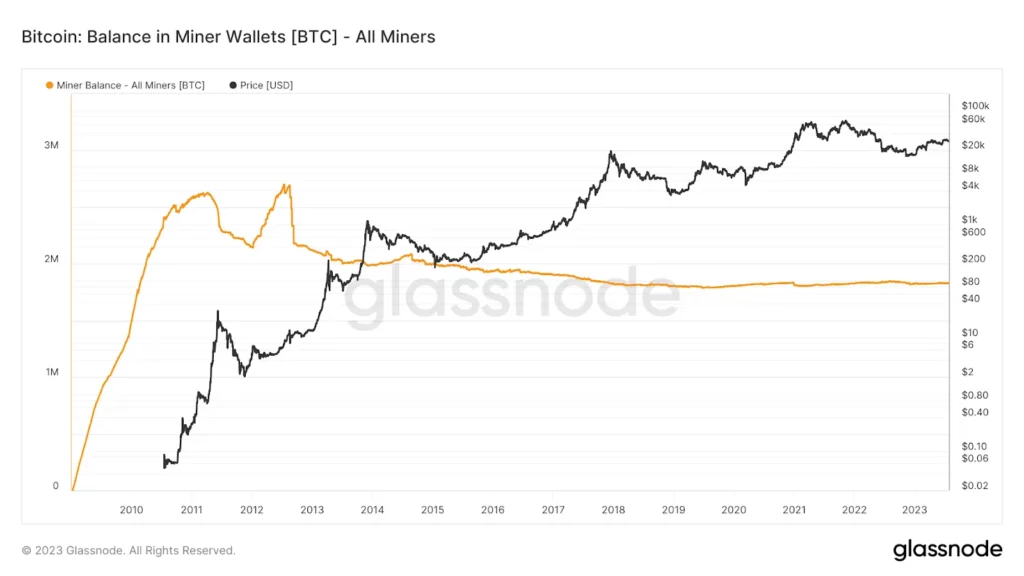

Bitcoin Miners are considered one of the most giant whales in the crypto-verse. If we look at the number of BTC held by miners, it can be seen that there is no effective change in the overall supply.

Bitcoin Miner’s revenue has also remained stagnant, as per GlassNode.From Jan 2023 to July 2023, the daily average revenue of the top miners, including Antpool, Ark pool, and various others, has remained at 850BTC. Meanwhile, the fees revenue of the miners has remained stagnant between 3% to 5% in the past few months.

Catching BTC Whales With Derivatives

Various analysts consider the behavior of whales on the exchanges as a sign of a Bullish or bearish rally. Looking at the past few month’s data, the overall exchange balance of BTC has observed a strong decline. It hints that Bitcoin price may see a strong pullback in the near future. Meanwhile, the number of whales holding more than 1000 BTC has seen a decline of 250 in the past three months.

Bitcoin derivatives data and Open interest can also be a great way to Forecast the BTC Price.

The current funding rate of Bitcoin has observed a slight decline and is near 0.0002%. Meanwhile, the number of Future Open Interest is around $12 Billion, which has declined with the consolidation in the market.

The Put/Call ratio of Bitcoin across various exchanges is near 0.445. It suggests that the number of Call for BTC has been observing a rise in the past few months.

Meanwhile looking towards the Inflation rate of the asset it has seen a strong decline hinting toward a bullish momentum

Is BTC Price Ready To Hit A High Of $5000?

The price of Bitcoin today is near the value of $29300, with a slight decline. The technical BTC chart it is seeing a strong consolidation over the past few weeks. BTC’s price can face resistance near the value of $32000 in the upside trend. If the price observes a decline then a bounceback near the value of $28000 can be observed in the future. BTC chart can show a bullish crossover in the near future among the 50 and 200 Daily Moving Averages.

The RSI of Bitcoin price today is near the value of 43, hinting its presence in the neutral zone. The overall sentiment of the BTC is consolidating in nature as per RSI.

Are Institutions Aiming For Bitcoin?

Bitcoin ETF has remained one of the most talked about subjects among crypto enthusiasts. In recent Bitcoin news today, Grayscale has urged the SEC to approve all Bitcoin ETFs. This will open a door for every big player to make more money, as an ETF will open a money Dam for them. Satoshi Nakamoto made Bitcoin with the aim to increase decentralization and was one of the most innovative people of the decade, whether a congressman approved it or not. Bitcoin is currently on sale for everyone. It depends on the investors whether to hand it to big banks or be free from their paws.

Adarsh Singh is a true connoisseur of Defi and Blockchain technologies, who left his job at a “Big 4” multinational finance firm to pursue crypto and NFT trading full-time. He has a strong background in finance, with MBA from a prestigious B-school. He delves deep into these innovative fields, unraveling their intricacies. Uncovering hidden gems, be it coins, tokens or NFTs, is his expertise. NFTs drive deep interest for him, and his creative analysis of NFTs opens up engaging narratives. He strives to bring decentralized digital assets accessible to the masses.

Home

Home News

News