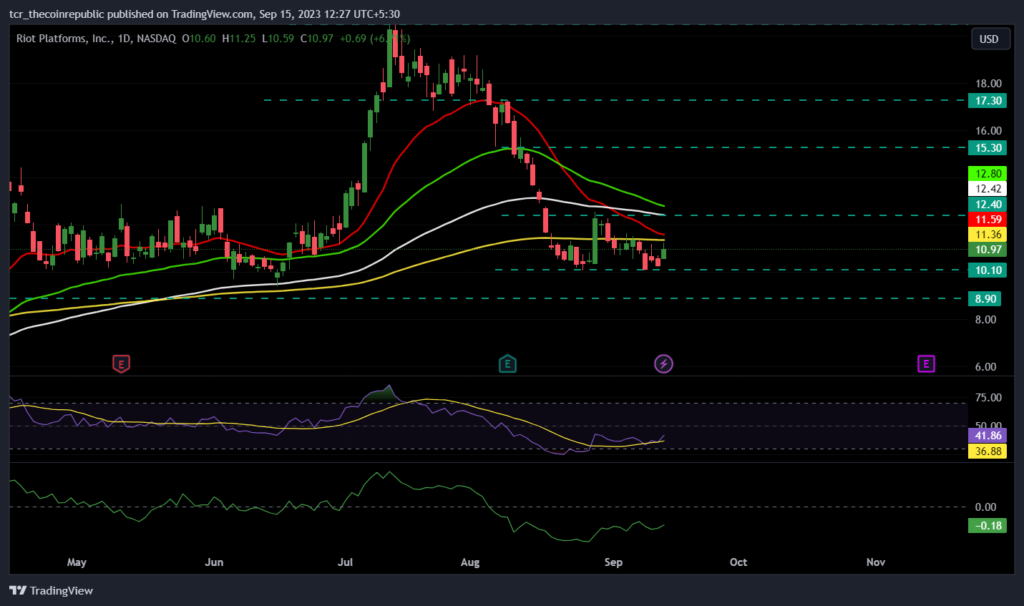

- 1 Riot Platforms’ stock price closed at $10.97 with a gain of 6.71% during the last intraday trading session.

- 2 Bitcoin, the world’s biggest cryptocurrency, is up by 1.5%, and crypto miner stocks like Riot Platforms gained almost 7%.

- 3 The year-to-date return of Riot stock is 214.33% while the monthly return is -24.71%.

The bullish rally for RIOT stock started during mid-June as BlackRock, an investment management firm, filed for Bitcoin Spot ETF. Bitcoin witnessed a strong surge so did the RIOT stock. The stock price jumped nearly 110% and created a yearly high of $20.65.

RIOT stock faced strong rejection above $20 and the BTC price also entered in a corrective phase which induced negative sentiment in the market. The stock price fell with a strong bearish momentum and recently formed support at $10.

After the formation of support, RIOT stock price entered a narrow consolidation zone ranging between $10.10 and $12.40. If bulls can push the price above $12.40, there is a possibility that the price might rise toward the next resistance level of $15.30.

On the other hand, if the stock price breaks the recent support of $10.10, it might melt down to the next key support level of $8.90.

Measuring Production of Riot Platforms

Riot Platforms operations have been consistent over the years. The crypto mining firm sits in third place in Bitcoin production for 2023 and finished 2022 ranked second.

The current hash rate of Riot is 10.7 exahashes per second (EH/s, a measure of computing power applied to mining cryptocurrencies), which is good enough to produce more than 4,300 Bitcoins in 2023 and add to its total reserve of roughly 7,300 BTC, worth around $188 Million.

The Bitcoin produced in August was around 333 BTC. Riot Platforms also anticipates achieving a total self-mining hash rate of 12.5 EH/s by the end of 2023 at its Rockdale facility.

The crypto mining company is also partnering with Micro BT, a China-based Bitcoin miner manufacturer, which includes an initial order of 7.6 EH/s of next-generation Bitcoin miners for its Corsicana Facility. Upon full deployment of this initial order by mid-2024, Riot’s total self-mining hash rate capacity is expected to reach 20.1 EH/s.

Will RIOT Stock Price Rise Above $12.40?

The stock price trades below all the major exponential moving averages, suggesting a confluence of bears over the price. Chaikin money flow score stands at -0.18, implying weakness in the market. The relative strength index (RSI) crossed above the 40 mark and stands at 41.86, suggesting a rise in the participation of bulls.

Conclusion

The operating cost of Riot Platforms is the lowest amongst all the Bitcoin miners, with an average cost per Bitcoin mined of $8,400. Marathon Digital has an operation cost of $19,000 per Bitcoin mined. Additionally, RIOT stock has zero long-term debt. Riot’s robust financial health and industry-leading efficiency put it head and shoulders above the competition.

Technical Levels

Major support: $10.10 and $8.90

Major resistance: $12.40 and $15.30

Disclaimer

The views and opinions stated by the author, or any people named in this article, are for informational purposes only. They do not establish financial, investment, or other advice. Investing in or trading crypto assets comes with a risk of financial loss.

Andrew is a blockchain developer who developed his interest in cryptocurrencies while pursuing his post-graduation major in blockchain development. He is a keen observer of details and shares his passion for writing, along with coding. His backend knowledge about blockchain helps him give a unique perspective to his writing skills, and a reliable craft at explaining the concepts such as blockchain programming, languages and token minting. He also frequently shares technical details and performance indicators of ICOs and IDOs.

Home

Home News

News