- 1 Loopring price currently trades at $0.1821 while witnessing a gain of 0.22% during the intraday trading session.

- 2 LRC price is trading below 20, 50, 100 and 200-day exponential moving averages.

- 3 The year-to-date return of Loopring is -3.09%.

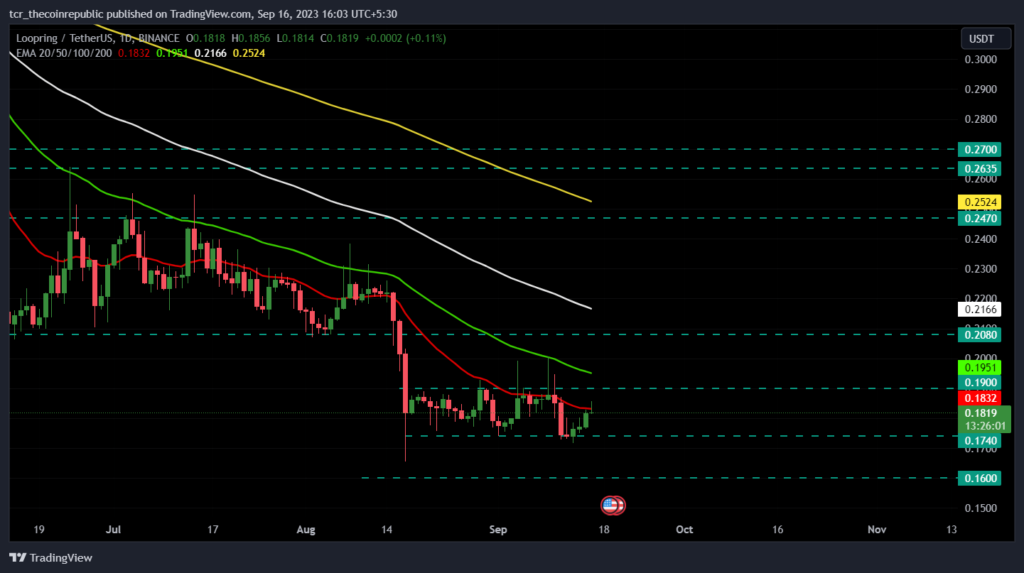

Loopring (LRC) price has been in a downtrend, forming lower lows, since the end of April, falling from the high of $0.41. The cryptocurrency price broke the significant support level of $0.27 in June. Since then, LRC price has been performing zone-to-zone breakout.

After the meltdown, the asset price was stuck in a narrow consolidation zone between $0.2080 and $0.2470. The price consolidated for more than two months, and during mid-August, the price finally had a breakout in a downward direction.

The breakout pushed the price into another consolidation zone between $0.1740 and $0.1900. The price has been consolidating since mid-August. The previous candle closed as a strong bullish candle, and the current candle has broken the high of the previous candle but has turned bearish.

Possibilities For Loopring Price

LRC price has attempted several times to break the consolidation in an upward direction but was unsuccessful. If bulls push the price above the resistance level of $0.19, the price might rise toward the support-turned-resistance of $0.2080.

On the other hand, if the loopring price breaks below the $0.174 support level, the price might fill the lower wick of the 17 August candle and meltdown toward $0.16.

The market capitalization of Loopring has increased by 1.93% to $242,087,012 at the time of writing. The 24-hour trading volume has also increased by 12.17%. LRC price is down 95.24% from an all-time high of $3.83 and up 816.93% from the all-time low of $0.019.

Will LRC Price Break the Consolidation Zone?

The cryptocurrency price has plunged below the 20, 50, 100, and 200-day exponential moving averages, indicating a solid confluence of bears over the price. The 20-day EMA has been acting as a resistance to the price.

The current candle also touched 20-day EMA, which has turned bearish. The Chaikin money flow score still hovers below the 0 mark and trades at -0.17, suggesting weakness and capital outflow in the market.

However, the relative strength index has surged from 33 points to the current level of 44.68, implying a rise in the participation of bulls in the market. The Bollinger bands have also contracted, indicating low volatility in the market.

The long/short ratio is 0.85, with 46.22% longs and 53.78% shorts, suggesting higher positions from the selling side in the last 24 hours.

Conclusion

The market structure and price action of Loopring are slowly turning bullish and need to breakout from the consolidation zone in an upward direction for some decent gains.

Technical Levels

Major support: $0.174 and $0.16

Major resistance: $0.19 and $0.2080

Disclaimer

The views and opinions stated by the author, or any people named in this article, are for informational purposes only. They do not establish financial, investment, or other advice. Investing in or trading crypto assets comes with a risk of financial loss.

Nancy J. Allen is a crypto enthusiast, with a major in macroeconomics and minor in business statistics. She believes that cryptocurrencies inspire people to be their own banks, and step aside from traditional monetary exchange systems. She is also intrigued by blockchain technology and its functioning. She frequently researches, and posts content on the top altcoins, their theoretical working principles and technical price predictions.

Home

Home News

News