- 1 Now-defunct crypto exchange staked 5.5 Million SOL coins.

- 2 SOL is trading at $22.69 at the press time.

Solana (SOL) network recently received $122 Million worth of its native coin in their staking pool from FTX estate. The now-bankrupt exchange still holds over a billion dollars in SOL. The company is an early investor in the cryptocurrency and is bound to get a significant volume in unlocked SOL as per the vesting schedule.

Solana Gets a Staking Push

The transaction was first reported by WhaleTracker, a blockchain tracker, as an unknown wallet, on X (formerly Twitter). Ashpool, an on-chain investigator, later verified the wallet’s identity. Sam Bankman-Fried, former FTX CEO, is on trial in court over accusations of financial fraud.

FTX estate is staking 5.5M SOLhttps://t.co/ajRgBHFNt9 https://t.co/UGorSGMtwC

— ashpool (@solanobahn) October 14, 2023

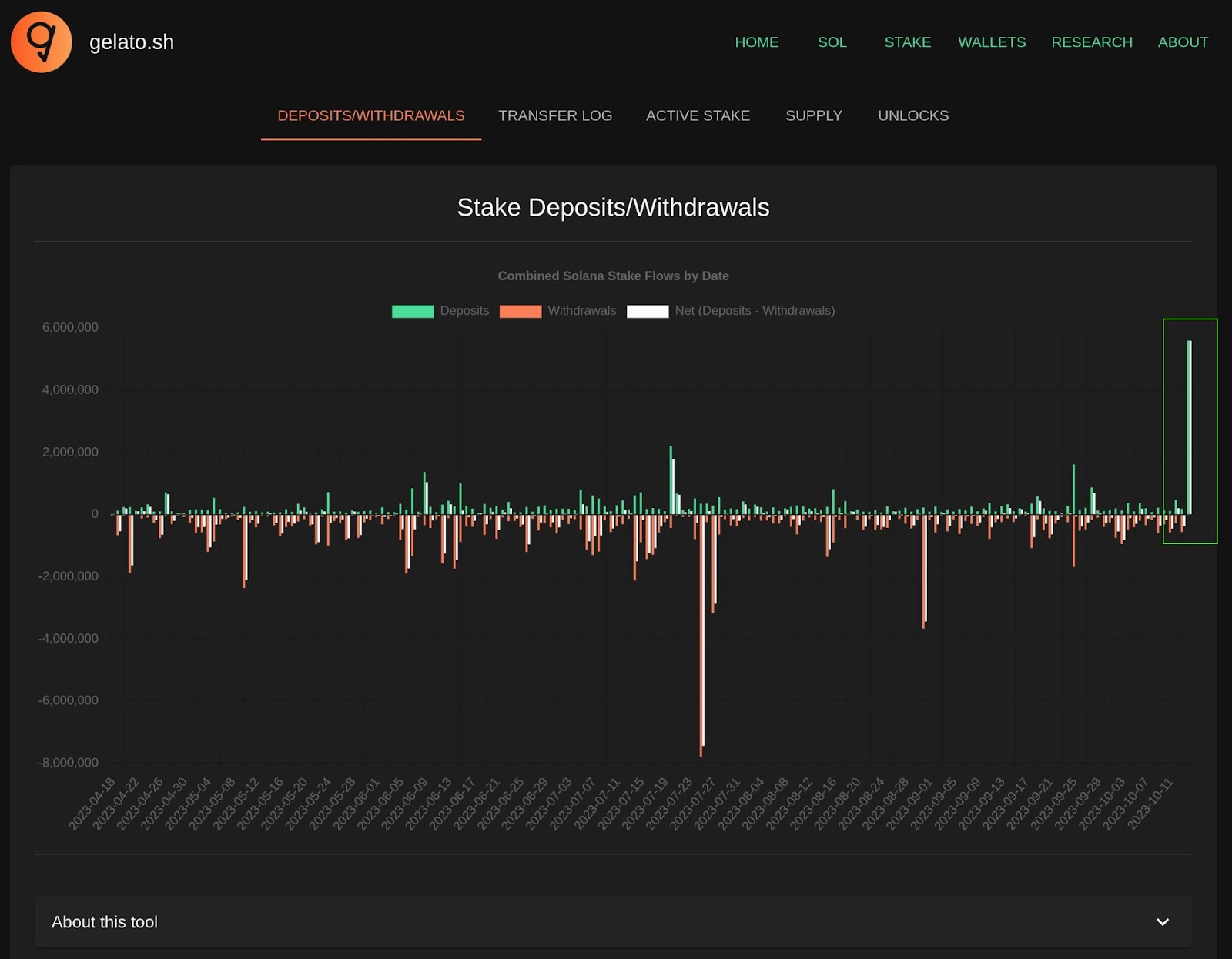

Ashpool cited information from the real-time exchange wallet tracker, Gelato. The significant activity is visible in the chart below. Currently, 71 percent of total SOL coins are staked. Furthermore, data aggregator DefiLlama highlights that Solana holds $316 Million in total value locked (TVL).

The network has been experiencing progressive staking for a month now with Marinade Finance having a lion’s share. Moreover, Jito Finance on Solana witnessed over 60 percent surge during the period.

Increased staking has benefited SOL price with over 30 percent gain during the last week of September 2023. Currently, the cryptocurrency is changing hands at a market value of $22.69 at the press time.

A Threat Lurks Around

FTX’s pursuit for regulatory approval to liquidate its $3.4 Billion worth of digital asset portfolio is a matter of concern in the market. Specifically for Solana, as its native token makes up nearly one-third of the portfolio. News agency Reuters reported the company hired Galaxy Digital, a financial services firm, in August 2023 to manage its assets.

If the asset manager decides to liquidate SOL holdings, it can easily trigger a market bust for the Solana network. It is not that it will happen overnight, but it should not be ruled out as the investors have witnessed a similar happening during the FTX drama. Large withdrawals were among the causes that turned what once was a crypto-trading powerhouse into ashes.

On the contrary, the Solana network has been sustaining some positivity lately. Last week, the ecosystem saw $24 Million in weekly inflows. CoinShares, an asset manager, speculated SOL “becoming the altcoin of choice.” Furthermore, crypto exchange OKX recently launched the coin’s trading pairs with stablecoins USDT and USDC.

The past 24 hours appear to have been constructive for Solana as SOL rose by over 4 percent. The altcoin is likely following Bitcoin (BTC) and Ethereum (ETH), the market movers. As of now, both currencies sit atop a combined market capitalization of nearly $750 Million, representing around 70 percent of the sector.

Anurag is working as a fundamental writer for The Coin Republic since 2021. He likes to exercise his curious muscles and research deep into a topic. Though he covers various aspects of the crypto industry, he is quite passionate about the Web3, NFTs, Gaming, and Metaverse, and envisions them as the future of the (digital) economy. A reader & writer at heart, he calls himself an “average guitar player” and a fun footballer.

Home

Home News

News