- 1 Onchain Iceberg Orders in the DeFi segment sizable trades into multiple smaller deals to maintain trader anonymity and minimize market disturbances.

- 2 The presence of centralized middlemen introduces risks to privacy and opens the door for potential front-running, compromising the secure processing of on-chain iceberg orders.

- 3 By leveraging encrypted private mempools, a secure, confidential, and decentralized handling of iceberg orders is achieved.

- 4 Elektrik integrates Fairblock’s SDK to bypass centralized go-betweens in iceberg orders, merging block identifiers with public keys to bolster transaction safety.

Blockchain technology has invented new ways of how financial operations can be performed and by changing the landscape permanently, it has also brought some new challenges. One such challenge in DeFi is the execution of on-chain iceberg orders. Elektrik, a next-gen DEX, offers a solution to this problem using advanced techniques and private mempools.

Understanding the Iceberg Order Phenomenon

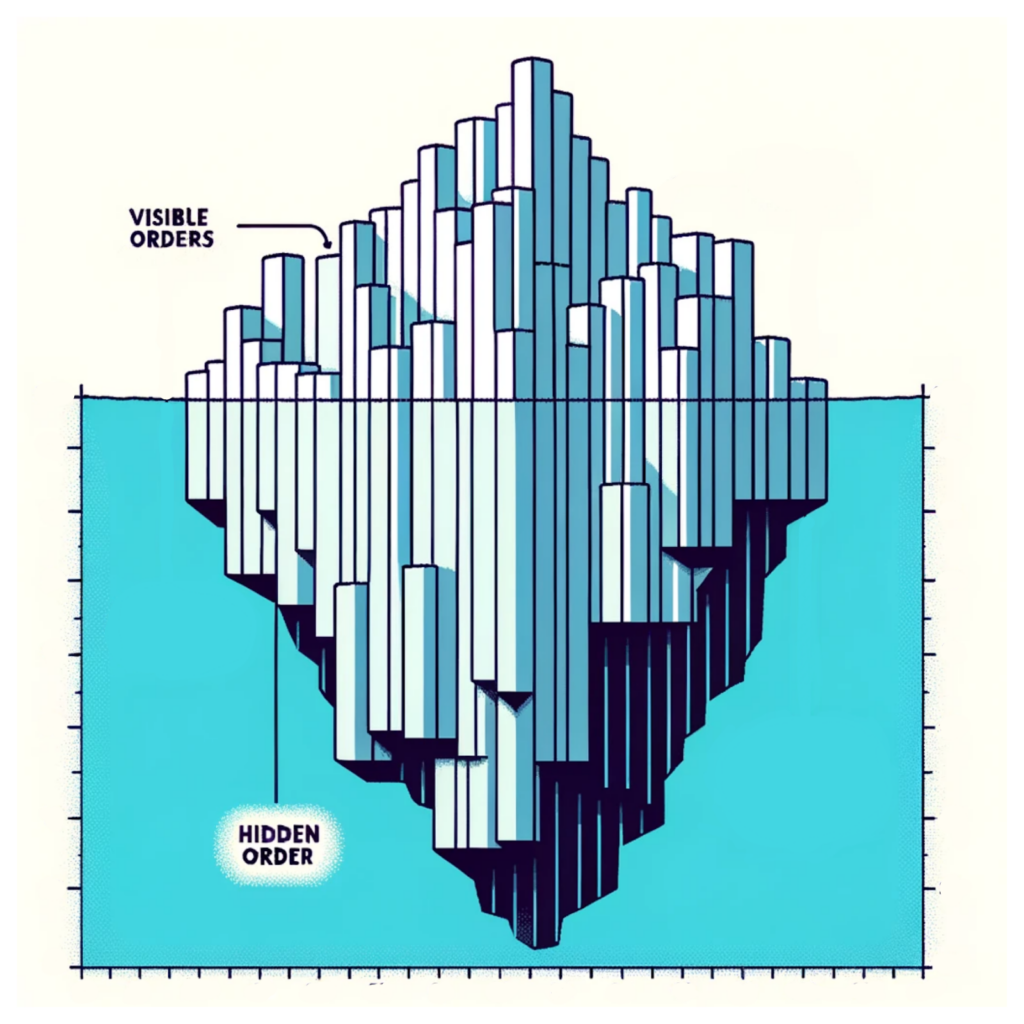

In traditional financial markets, iceberg orders are a strategy where large trades are divided into smaller transactions. It is done to mask the true size of the trade, ensuring minimal market impact and avoiding significant financial repercussions. The name “iceberg” is derived from the fact that only a small portion of the order (the tip) is visible, while the majority remains hidden.

When large trades are made public, they can influence market sentiment, potentially leading to price slippage and other unintended consequences. For instance, a massive sell order might indicate a lack of confidence in an asset, prompting other traders to follow suit. Therefore, by breaking down these trades, traders can navigate the market more discreetly.

The Centralization Dilemma

The current infrastructure for executing on-chain iceberg orders relies heavily on centralized intermediaries like brokers or centralized exchanges. These entities manage the trajectory of the iceberg order’s execution based on various parameters, such as price impact and total amount. However, this centralized approach poses risks. Centralized entities can potentially exploit the knowledge of upcoming trades for their benefit, leading to issues like front-running. It goes against the principles of decentralization and trust that blockchain technology champions.

Elektrik’s Decentralized Solution with Mempools

In blockchain networks, like Ethereum, when an order is placed, it’s temporarily stored in what’s known as a mempool prior to its execution. Mempools, essentially memory pools, serve as a staging area, allowing transactions to be collated and subsequently incorporated into a new block by a miner or validator. Think of these mempools as transactional lounges, ensuring each transaction is systematically processed and chronicled on the blockchain. However, a challenge arises with conventional mempools – they’re open to the public and they allow anyone to view the ongoing transactions.

The solution is the private mempools. These are emerging as a robust counter to the age-old dominance of centralized intermediaries, especially in the context of iceberg orders. True to their name, private mempools offer a secure, confidential space, while still retaining the essence of decentralization. The magic behind their privacy is advanced cryptographic methods, particularly multi-party computation techniques, which guarantee the utmost privacy and encryption for each transaction. In the context of iceberg orders, every segment of the order remains confidential within a private mempool until it’s time for execution, ensuring a trustless operation.

Leveraging these private mempools allows DEXes to ensure the sanctity and safety of user transactions, all while championing the fundamental principle of decentralization. A pivotal feature of this avant-garde method is the incorporation of local execution conditions. These conditions, essentially a set of rules, guide the order execution within the mempool, ensuring a methodical and strategic progression. It becomes crucial for iceberg orders, where each segment of the order is set for execution only after its preceding segment has been successfully executed. Hence, to adeptly manage iceberg orders, these local execution conditions are indispensable and must be integrated within the private mempool.

Harnessing Fairblock’s Expertise

Elektrik’s collaboration with Fairblock represents a significant stride in addressing the challenges associated with on-chain iceberg orders. Fairblock, a frontrunner in applied cryptography, has developed a unique infrastructure that prioritizes transactional privacy in blockchain applications. At the heart of Fairblock’s system is the innovative Secret Sharing Scheme (SSS). This method involves a consortium of validators working in tandem to generate a distributed public key. This key is not only distinct but also offers heightened security, forming the bedrock of Fairblock’s encrypted transaction framework.

Fairblock also integrates the concept of Identity Based Encryption (IBE) into their system. Unlike traditional methods that rely on generating and distributing public keys for every transaction, IBE uses block numbers as unique identifiers. It means that traders, such as those looking to place iceberg orders, can encrypt their transactions using a combination of the public key and the block number. This dual-layered approach binds each transaction to a specific block, adding an extra layer of cryptographic protection. The decryption of these transactions is then scheduled for specific block heights, where key shares are amalgamated to decrypt the transactions. The synergy of IBE with the foundational SSS ensures that the privacy and security of iceberg orders are maintained at all times. Through this partnership with Fairblock, Elektrik is leveraging the private mempool software development kit (SDK) and ensuring the privacy of iceberg orders.

The Execution Process Simplified

Here’s a brief overview of how an iceberg order is processed using Elektrik’s system:

- Initialization: A trader initiates an iceberg order on Elektrik.

- Fragmentation: This primary order is segmented into smaller limit orders. These divisions are determined by a random distribution to thwart potential statistical inference attacks. Each of these smaller orders denotes a specific price and a randomized amount. The cumulative total of these smaller orders equals the original trade’s volume.

- Execution Timing: A trader selects a duration for the entire order’s execution. By dividing the total number of orders by this duration, the execution time for each individual limit order is determined.

- Block Number Assignment: Using this formula, the block number for every limit order is deduced based on its designated execution time. It’s worth noting that block numbers can be manually assigned without affecting the overall execution process.

blockNumberi=currentBlock.timestamp +(inumber of seconds to wait n each limit order)block_mining_time(500ms in the case of Lightlink)

Note – blockNumber can be assigned manually to each limit order without affecting the execution.

- Encryption: Orders are encrypted using a designated public key and a block number which is assigned to identify each order.

- Mempool Submission: Encrypted transactions linked to a designated future block height are sent to the Fairblock mempool.

- Execution: Upon reaching the specified block height, Fairblock decrypts the transactions exclusive to that block. These decrypted transactions are then forwarded to a settlement contract where they undergo verification against certain preconditions, which might encompass price limits. Depending on the desired security level, these preconditions can be either stateless or stateful. Once verified, these transactions are primed for execution, preserving the integrity of the iceberg strategy.

Conclusion

Elektrik’s approach to on-chain iceberg orders exemplifies the potential of DeFi to match, if not surpass, TradFi mechanisms. By eliminating the need for centralized intermediaries and enhancing transaction privacy, Elektrik is paving the way for a more secure and efficient decentralized trading environment.

Disclaimer: Any information written in this press release or sponsored post does not constitute investment advice. Thecoinrepublic.com does not, and will not endorse any information on any company or individual on this page. Readers are encouraged to make their own research and make any actions based on their own findings and not from any content written in this press release or sponsored post. Thecoinrepublic.com is and will not be responsible for any damage or loss caused directly or indirectly by the use of any content, product, or service mentioned in this press release or sponsored post.

For publishing articles on our website get in touch with us over email or one of the accounts mentioned below.

Home

Home News

News