- 1 The second-biggest cryptocurrency holds a significant place in crypto investors’ portfolios as well.

- 2 It is important to know about the prospects of Ethereum before investing in it.

- 3 eToro is one of the most popular platforms that make ETH investment very easy.

Step-by-Step Guide For Buying Ethereum on eToro

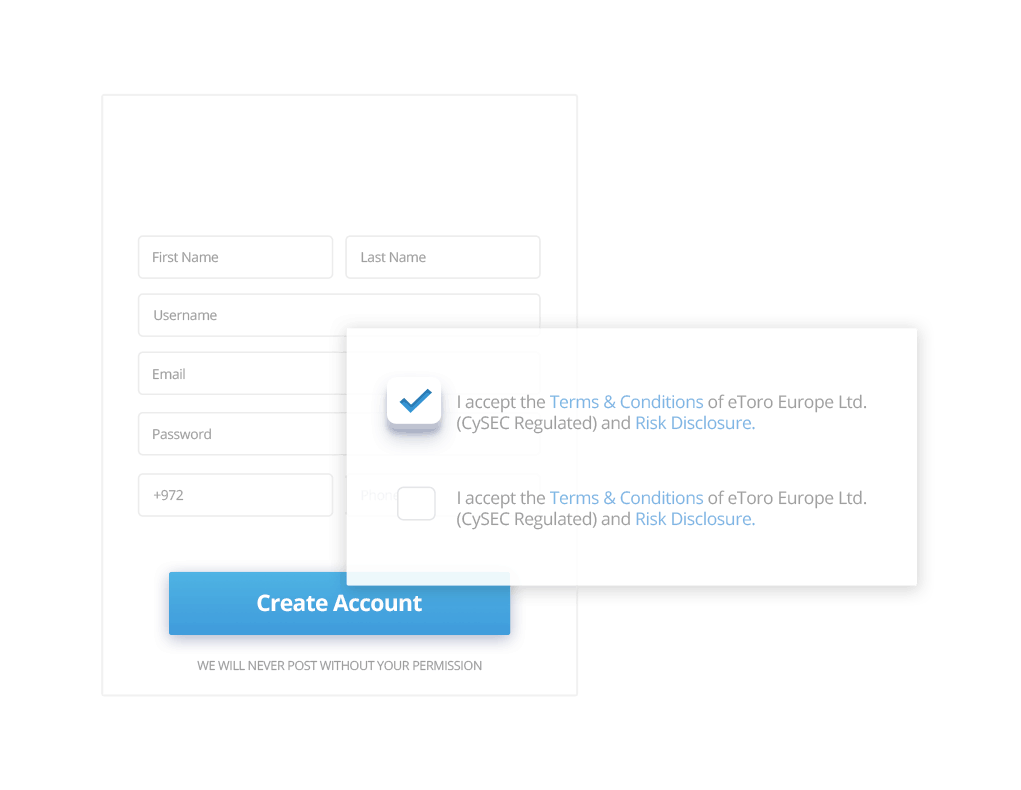

Step 1: Sign Up For eToro

To buy Ethereum on eToro, one needs to register with the platform first. Search for the website, open it, and start putting in the information. It verifies the identification of users with some licensed credentials.

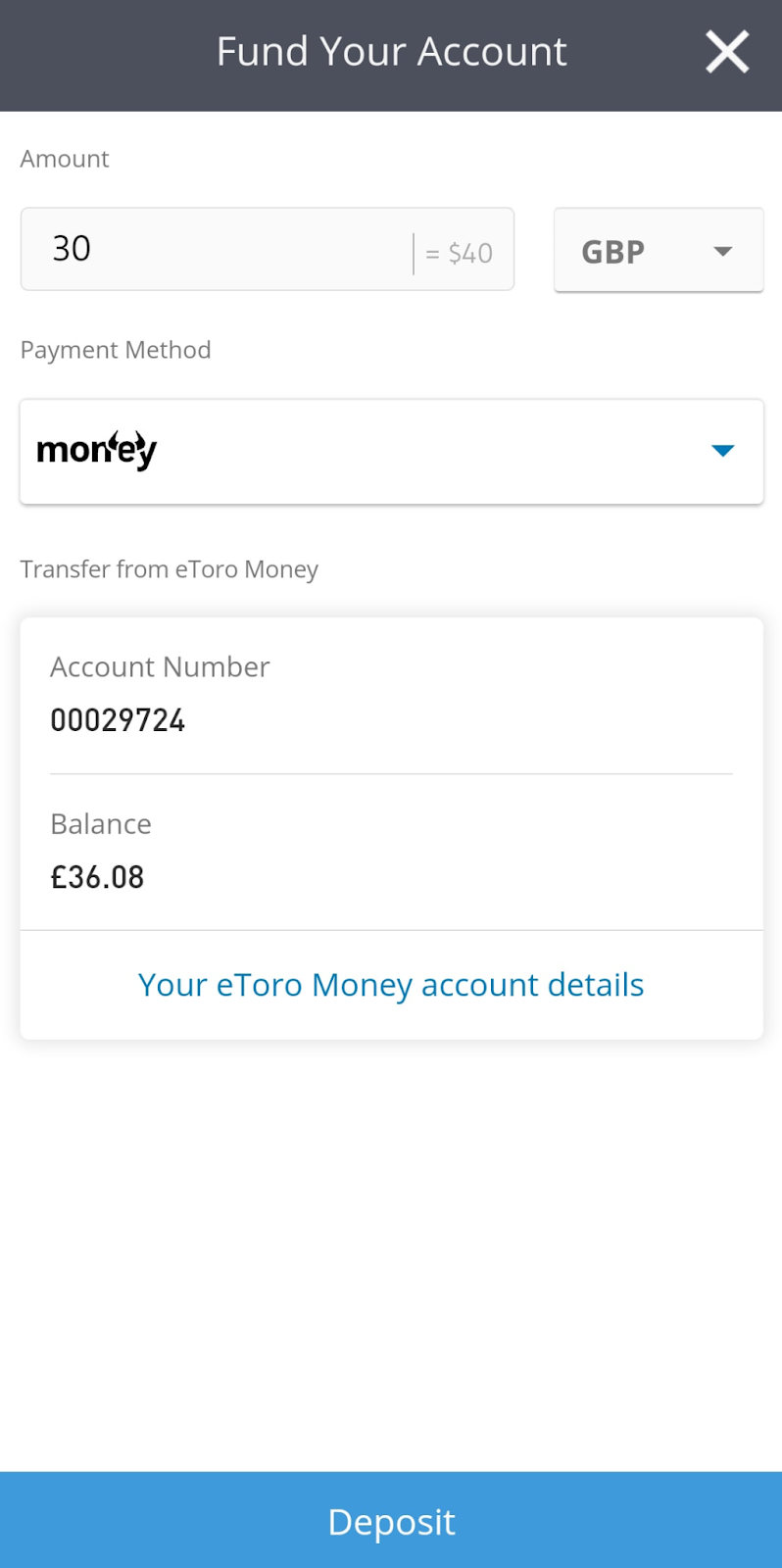

Step 2: Make the Deposit

Once the verification is done, the users need to enable the account to make purchases. So, they need to deposit fiat currency into the newly-formed account.

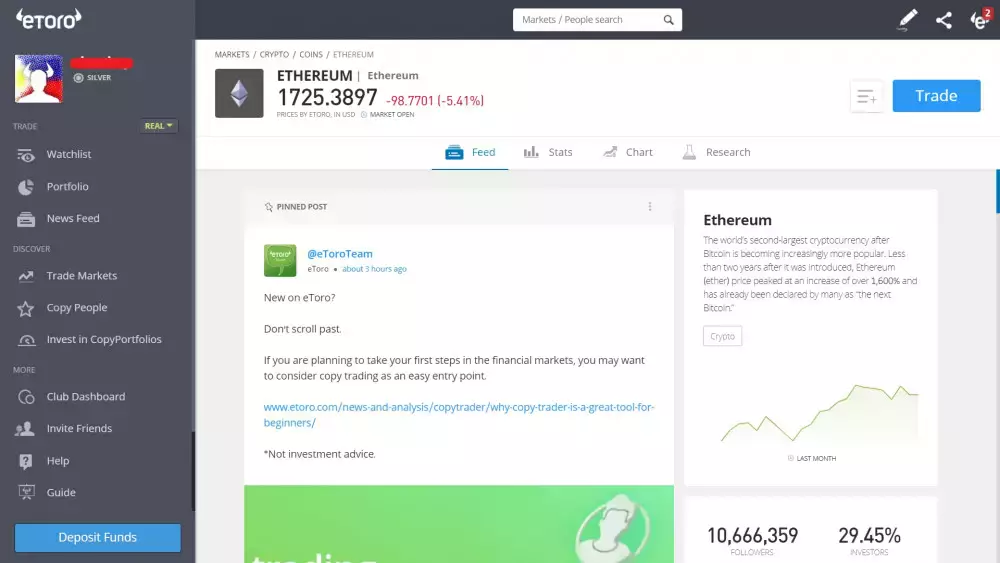

Step 3: Choose Ethereum

Click on the search bar on the trading platform and type Ethereum. Choose the number of ETHs, and the type of order, and place the order. There are two types of orders on eToro: trade and order. Trade is the current market price and order is the price set by the user.

Step 4: Review and Proceed

Before placing the order, go through all the details once. When 100% sure, place the order and check the portfolio.

Why Should Investors Think of Investing in Ethereum in the First Place?

ETH has held the position of second biggest cryptocurrency since its launch. The PoS-based blockchain has focused on being more feasible for industry adoption. Here are some use cases that show its penetration in different domains.

Growing Dominance in DeFi

Ethereum’s influence in the growing DeFi industry is highly noticeable. Several platforms in this niche are using ETH blockchain for their operations. Reportedly, the protocol makes yield farming, automated loans, and token swapping easier than ever.

Furthermore, this network removes many barriers, promotes accessibility, and offers low fees as well. For all obvious reasons, the adoption of Ethereum is increasing rapidly in this sector.

Tokenization of Assets

In essence, tokenization means representing a real-world asset through a tradable token. The best example of it is a non-fungible token (NFT) that represents digital artwork. This form of asset is very fruitful for artists as it prevents plagiarism and unauthorized sales.

As a result, tokenization is increasing and Ethereum has become a go-to option for many. It supports the cost-effective creation of tokens along with security and speed.

Supply Chain Management

In the past years, the adoption of decentralization in logistical operations has grown extensively.

Most projects have used the Ethereum blockchain to manage transactions. They have noticed enhanced productivity and lesser cost of operations. The progress of the existing projects indicates that more companies will open up to ETH-powered supply chain operations.

Blockchain Gaming

The gaming industry is another big proponent of blockchain technology. Ethereum has seen a fair share of use cases in this sector as well. Many platforms offer NFTs that are created on the ETH network. They also use the blockchain to secure and boost the efficacy of their in-game transactions.

Digital Identities

With the rise of decentralization, the concept of digital identity also gained popularity. Like the assets, blockchain also safeguards individuals’ identities efficiently. Not only does it secure their profile but it also makes its sharing highly convenient.

Factors That Determine the Price of Ethereum

Ethereum’s price takes a hit or jump due to the following factors.

Crypto Market Sentiment– The overall crypto market sentiment plays a significant role in the rise and fall of every coin.

dApp Developer Activity– The ongoing dApp developer activity determines the future course of the network to a large extent.

Regulatory Conditions– The regulatory circumstances of any crypto ascertain how well it can expand and operate.

Other Blockchains– If rival networks like Solana achieve a significant feat and get ahead of ETH, it’d impact the latter’s price.

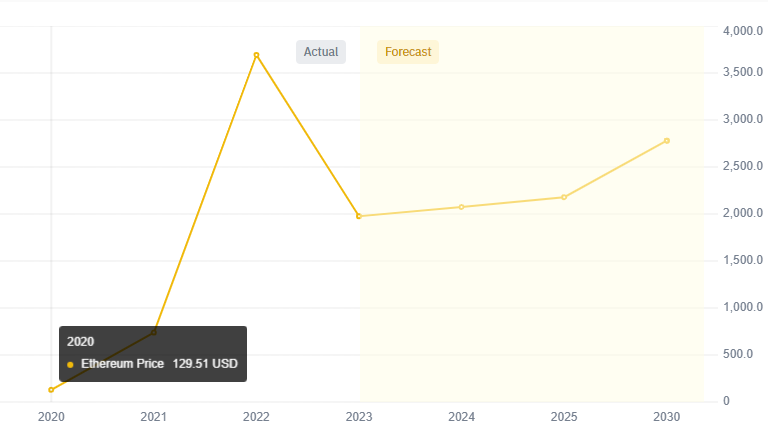

Forecast on Ethereum in Forthcoming Years

The price strength may not be a strong suit of Ethereum. However, it boasts a market cap of $233,494,320,374 at the time of writing. The live price is $1,941.69 with a slump of 1.14% in the last 24 hours. Experts believe that it will continue to maintain its rank in the future as well. However, there are factors at play that will determine its price and growth.

In 2024, every crypto enthusiast will closely watch the SEC’s stand on crypto. They’ll see if the regulator introduces a crypto-friendly framework or not. If things pan out in favor of crypto, Ethereum can see more institutional investment. As a result, the ETH value can touch the $3600 threshold.

In 2025 and years after, Ethereum’s utility quotient is likely to play a big role. Experts suggest that if the network continues its scalability endeavors, it could get some mainstream attention as well.

Judging by the current circumstances, many crypto investors are hopeful about ETH’s price surge. Still, only time will tell if it yields profits or losses to them.

Amanda Shinoy is one of the few women in the space invested knee-deep in crypto. An advocate for increasing the presence of women in crypto, she is known for her accurate technical analysis and price prediction of cryptocurrencies. Readers are often waiting for her opinion about the next rally. She is a finance expert with an MBA in finance. Quitting a corporate job at a leading financial institution, she now engages herself full-time into financial education for the general public.

Home

Home News

News