- 1 The Securities and Exchange Commission (SEC) of the US approved 11 spot BTC ETFs on January 10, 2024. The listed funds started trading on January 11, 2024.

- 2 With this, markets experienced volatility in all the major cryptocurrencies, indices, and stocks of the companies involved in the stock market.

- 3 BlackRock Inc. (NYSE: BLK) gained traders’ and investors attention with its ETF launch.

BlackRock’s spot BTC ETF is live again on their official ETF website, iShares, Nasdaq, and across other 175,000 Aladin investor platforms.

It has announced to reduce the fee to 0.25% and waive a part of the fee for the first 12 months. Hence, the fee will be 0.12% of the NAV (net asset value) of the Trust’s assets worth $5 billion.

The crypto market turned its attention specifically to iShares Bitcoin Trust (NASDAQ: IBIT), issued by BlackRock Inc. It gained investors’ eyes as it had backing from one of the financial giants and largest global asset managers, BlackRock Inc. The asset manager has been actively investing in Bitcoin-related companies for the last few months.

Price Movement of IBIT on Day1 of Trading After Approval of BTC EFT

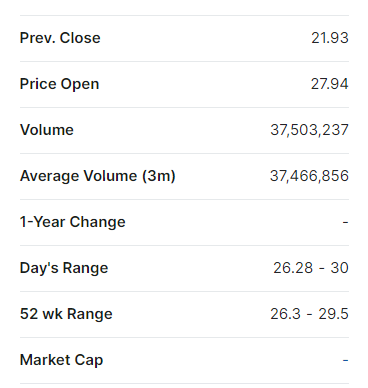

IBIT started rising in the pre-market hours itself and saw a gain of 23.35% from its previous close on April 26th.

On that day, the IBIT closed at 21.93 and before the rebeginning of trading in the pre-market hours, it reached 27.05 (an increase of $5.12, or 23.35%). The market opened at $28.05.

During the trading session, it marked a high of $30 and a low of $26.3. It also observed an increase in volume and users.

Surprisingly, BlackRock’s ETF hit its day high in the first 30 minutes of the trading window and then slowly declined to its daily low of $26.23 in the next two hours.

After that, the iShares Bitcoin Trust kept trading between $26.50 and $27.20.

Upcoming trends in BlackRock’s iShares

In the last two hours of the trading window, IBIT has formed a sustainable rising trend that is expected to continue for the next few days. Analysts expect the trend to continue and investors can earn secured returns but the amount might not be very large.

Considering the volatility and volume, iShares is anticipated to have a positive trading day ahead.

Most of the ETFs followed a similar pattern and are mostly correlated with the BTC prices in the spot market. Looking ahead, spot BTC ETF would have a positive correlation with BTC.

BTC also hit a high of $48,865 today and was trading within the range of $46,500 and $48,950.

Conclusion: Way Ahead

To go ahead, it is very crucial to understand the performance of ETFs for a few days to know their impact on Bitcoin investors. The crypto markets are excited about institutional investors’ capital deployment following the ETFs’ approval.

The entire world is hooked up with the recent developments in financial products and is still curious about the uncertain outcomes surrounding BTC ETF.

Disclaimer

The views and opinions stated by the author, or any people named in this article, are for informational purposes only. They do not establish financial, investment, or other advice. Investing in or trading crypto assets comes with a risk of financial loss.

Andrew is a blockchain developer who developed his interest in cryptocurrencies while pursuing his post-graduation major in blockchain development. He is a keen observer of details and shares his passion for writing, along with coding. His backend knowledge about blockchain helps him give a unique perspective to his writing skills, and a reliable craft at explaining the concepts such as blockchain programming, languages and token minting. He also frequently shares technical details and performance indicators of ICOs and IDOs.

Home

Home News

News