Bitcoin ETF news is buzzing in the crypto market as 7RCC, a crypto firm, is all set to launch its environmentally conscious ETFs in the United States.

Crypto firm 7RCC again entered the Bitcoin ETF news and announced its latest launching of environmentally conscious ETFs in the United States. The New York Stock Exchange (NYSE) has informed the Securities Exchange Commission (SEC) of its recommendation to list and trade shares of the 7RCC spot Bitcoin and Carbon Futures ETF.

7RCC’s Bitcoin ETF News

Since the day the SEC approved Bitcoin ETFs, the Bitcoin ETF news has been sustained as a center of discussion in the crypto market.

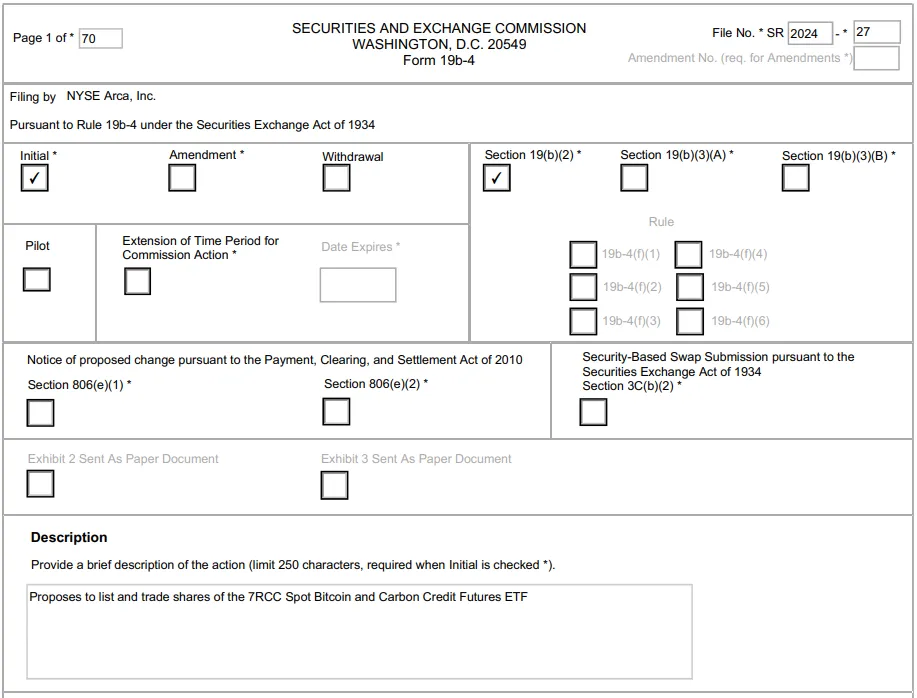

On March 13, the NYSE submitted a 19b-4 form to the SEC to list and trade shares of 7RCC spot Bitcoin (BTC) and Carbon Credit Futures ETF. The form is known as “proposed rule change” filing, which is essential when a stock exchange tries to list a new product.

7RCC Global, the crypto asset manager focused on ESG investing, is all prepared to launch its eco-friendly spot Bitcoin ETF in the US, adding one more option for Bitcoin ETF investors.

The company is completely focused on sustainable investment solutions and applied for the ETF in December 2023. 7RCC Global’s focus was on 80% investment in Bitcoin and 20% in the carbon credit futures.

The aim is to attract more and more investors interested in digital assets as well as environmental sustainability. 7RCC Global is on the way to aligning the Bitcoin ETF with the environmental, social, and governance (ESG) factors.

Another purpose is to track daily changes in the BTC price and the value of carbon credit futures contracts on the Vinter Bitcoin Carbon Credits Index.

“We want to target that group of institutional investors that need that ESG tick mark,” said Rali Perduhova, the co-founder and CEO of 7RCC at the time of the S-1 filing.

The approval of the ETFs is a catalyst and will enhance the adoption of digital assets in the US, she added. She also commented on BTC Halving, expecting around 9K to 10K BTC per day demand.

According to Perduhova, the supply of BTC will be cut from 900 BTC per day to over 450 BTC per day. The Bitcoin halving event is expected to take place in April 2024.

Moreover, the Gemini cryptocurrency exchange has been promoted as the custodian of the 7RCC BTC and Carbon Credit Futures ETF.

What Perduhova Predicted About the BTC Price

According to CoinMarketCap data, BTC is currently trading at $73,643.09 after an upsurge of 1.27% in one day. The coin’s market cap is around $1,447,563,091,684, and the 24-hour volume is $47,945,432,894.

BTC’s all-time high was recorded at $73,641.04 on March 14, 2024, whereas the all-time low was documented at $0.04865 on July 15, 2010. Bitcoin ETF news is supposed to boost the price of BTC in the near future.

Furthermore, Perduhova predicted that the BTC price would reach over $200,000 by the end of 2024.

Anurag is working as a fundamental writer for The Coin Republic since 2021. He likes to exercise his curious muscles and research deep into a topic. Though he covers various aspects of the crypto industry, he is quite passionate about the Web3, NFTs, Gaming, and Metaverse, and envisions them as the future of the (digital) economy. A reader & writer at heart, he calls himself an “average guitar player” and a fun footballer.

Home

Home News

News