SUI has a TVL of $625 million and is currently trading near the value of $1.32, with a slight drop in intraday session

SUI is a layer 1 platform designed to support the needs and demands for scaling any project. It has a solid technical foundation and uses MOVE language to improve the inefficiencies in the blockchain protocol. The security of MOVE increases productivity and fosters an era of experimentation. It has a similar throughput and latency as compared to Web 2 platforms.

The SUI protocol can scale horizontally, unlike any other protocol. The transactions conducted on the network are pretty similar to market conditions. Various ecommerce brands and others are participating in the network.

The Decline in SUI Network Activity

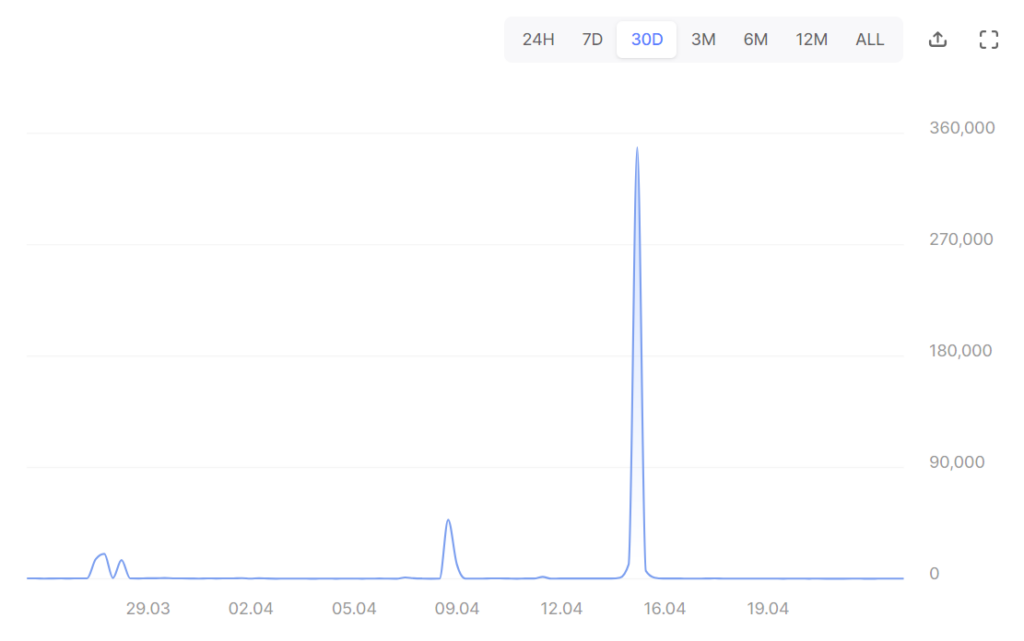

SUI has a market dominance of approximately 0.07% with a total supply of 10,000,000,000, of which only 12.96% is circulating in the market. All SUI tokens staked or delegated to validators are around $11,052,640,318, with 106 validators in the validator node. The protocol has a TPS of 71, which is a drop of 43% in the intraday session. The average gas fee for the network is 0.005233 SUI, and it has 10,103,751 accounts.

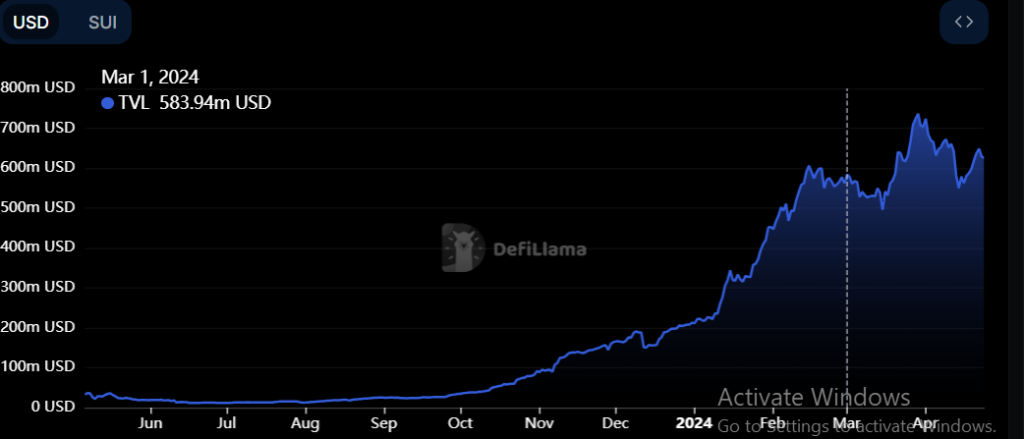

The SUI protocol has observed a rise of 300% in its TVL from the start of JAN 2024 and has reached $625 Million. Meanwhile, the number of core developers in the protocol has been constant and is at 59. The overall derivative volume of the protocol has taken a plunge from the highs of $158 Million to $77 Million in the last few months. The protocol has observed a surge of 300% in the minting of new NFTs in the previous 30 days.

Is SUI Token Price Looking For A Revival?

Is SUI Token Price Looking For A Revival? by Ritika_TCR on TradingView.com

SUI has a market cap of $1.71 Billion and is ranked 61st in the CMC. The current volume-to-market cap ratio for the asset price suggests a consolidation in the trend. It is currently trading near the value of $1.33, with a drop of 2.45% in the intraday session.

The asset price has recently given a breakdown below the upside parallel channel. If this trend continues, then the next support price for the asset can be observed to be near the value of $1.02. Meanwhile, the resistance for the asset price can be near $1.6.

SUI token price is trading below the 50 and 100 EMA with a negative crossover in the past. They can also act as resistance in case of an uptrend.

The RSI of the asset price is at 43, with no slope in it, hinting towards a bearish trend in the price. Meanwhile, the MACD suggests a weak bullish momentum in the near future.

Conclusion

SUI protocol has been seeing a strong surge in its TVL, but there has been a decline in the total transactions over the past three months. The overall NFT mint on the network has been seeing a surge. SUI token price is currently observing a consolidated trend but can see a new high in the future.

Disclaimer

The views and opinions stated by the author or any other person in this article are for informational purposes only and do not constitute financial, investment, or other advice.

Adarsh Singh is a true connoisseur of Defi and Blockchain technologies, who left his job at a “Big 4” multinational finance firm to pursue crypto and NFT trading full-time. He has a strong background in finance, with MBA from a prestigious B-school. He delves deep into these innovative fields, unraveling their intricacies. Uncovering hidden gems, be it coins, tokens or NFTs, is his expertise. NFTs drive deep interest for him, and his creative analysis of NFTs opens up engaging narratives. He strives to bring decentralized digital assets accessible to the masses.

Home

Home News

News