- Crypto gaming hype goes hand in hand with speculations of Metaverse. A report from DappRadar recommends that it is going to witness more growth.

- In contrast to the figures of 2021, it suggests that this concept is heavily attracting investments from several investors.

- Crypto games offer rewards in digital assets through their game play. Prominent crypto games involve The Sandbox, Axie Infinity etc.

Growing Pile Of Investments For Crypto Games

A latest report offered by Blockchain Game Alliance and DappRadar recommends that 2022 is going to be a groundbreaking year for crypto games devs. Report unveils that $2.5 Billion in investments was jacked up during first quarter this year. Furthermore, it suggests that it can get inflated by 4x by the end of this year.

In contrast to previous years, these numbers also recommend the niche has become a core sector for investors. For instance, previous year, just $4 Billion were piled throughout the year. Investment trend is also backed by evolving interest from cryptocurrency enthusiasts.

Blockchain gaming lured 1.22 Million Unique Active Wallets previous month and at present, are responsible for 52% of blockchain sector’s activity. As per the report, blockchain gaming activity has escalated by an astounding 2,000% from Quarter 1 previous year.

Cooldown In Metaverse Speculations

There has also been a slight cooldown in metaverse speculation after a “hype cycle” sparked by retitling of Facebook to Meta previous year. Sales volume in Metaverse projects has since plunged 12% to $430 Million during first quarter in 2022.

Average price of digital land in TheSandbox and Decentraland – couple of greatest metaverse projects — plunged from 40% from Quarter 4 2021 to Q1 2022, while sales volume on every platform dropped 60% and 20% respectively.

Finally, report also analyzed the impact of Ronin Bridge collapse, a hack which depleted money from Ethereum sidechain treasury of of Axie Infinity and its creator Sky Mavis.

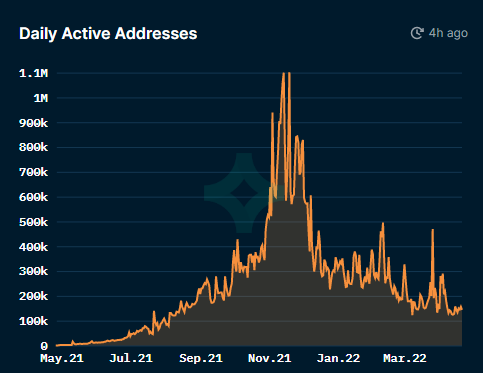

In spite of this attack, report recommends that blockchain of Axie Infinity remains declining since the start of this year.

Back in January, Axie Infinity had more than 55,000 UAW. This number diminished throughout February and bottomed out at 20,000 Unique Address Wallets just after mid-March. Meanwhile, Ronin Bridge attack was conducted on March 23, but devs got aware of the event after 6 days.

Usual plunge in activity and NFT sales volume on Axie Infinity is attributed to shifts to SLP token issuance created by Sky Mavis to make economy of Axie sustainable.

However, devs formerly stated that volume and activity were going down before changes were implemented and that they limited the in-game SLP supply to curb inflation of token.

Nevertheless, Axie Infinity is among the top cryptocurrency games based on daily utility, luring more than 1.5 Million daily active users.

As for reimbursement of funds that got hacked, a crypto exchange led a $150 Million fundraiser to reimburse attack victims of the Ronin Bridge collapse, and filled the vulnerabilities.

Steve Anderson is an Australian crypto enthusiast. He is a specialist in management and trading for over 5 years. Steve has worked as a crypto trader, he loves learning about decentralisation, understanding the true potential of the blockchain.

Home

Home News

News