- 1 Bitcoin bounced back above $62.5K after traders’ Shorts were liquidated and now have turned back to Longs.

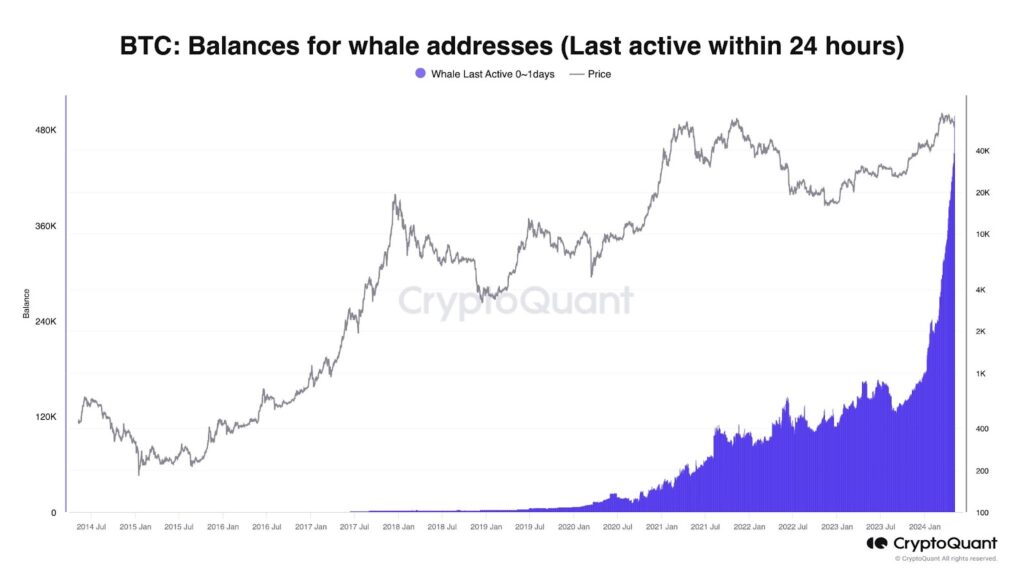

- 2 Bitcoin whales purchased 47,500 BTC valued at almost $2.8 Billion in 24 hours, showing increased confidence among investors.

The recent downturn in the cryptocurrency market is shifting direction, with significant Bitcoin accumulation by whales at lower prices. The market saw a rebound, particularly on Friday, with Bitcoin leading the charge and climbing nearly 5%.

The Bitcoin price surged over $62,000 during morning trading in the U.S. session. This uptick came after the release of the U.S. April jobs report, which was more subdued than anticipated, alleviating fears of imminent interest rate hikes. This surge in Bitcoin’s price has positively influenced investor sentiment.

Let’s look into a more detailed way of how the trajectory of BTC may change following the recent change in market sentiments.

BTC Shorts Have Liquidated & Have Turned To Longs!

On Friday, Bitcoin experienced a significant rebound, with its market capitalization increasing by 5.4%. According to sentiment analysis data, traders on Binance have drastically changed their positions, shifting from being predominantly in short positions to taking long positions following the price increase.

📈 #Bitcoin has bounced on a #bullish Friday with its market cap rising +5.4% in 24 hours. The crowd has completely #flipflopped on their #Binance trades, going from liquidated #shorts to #longs after this bounce. For the rally to continue, we don't want to see #FOMO rising too… pic.twitter.com/fY3lEX3REb

— Santiment (@santimentfeed) May 3, 2024

To maintain the momentum of this rally, it’s important to avoid an excessive rise in fear of missing out (FOMO) beyond its current level.

Whales Are Bullish On BTC

As per the data obtained from CryptoQuant, whales have snapped up over 47,500 Bitcoins within 24 hours. These significant players secured their holdings at an average price of $59,000 per Bitcoin, strategically capitalizing on the market’s downturn with an investment totaling $2.8 Billion.

Source: cryptoquant.com

Keeping tabs on these whales is a savvy strategy, as they’re usually in sync with the market’s most influential traders. A key metric is the average Bitcoin volume per transaction heading into derivative exchanges.

Moreover, with the market experiencing a minor slump, the average Bitcoin volume moving into these exchanges is currently 3.8 BTC.

Whales are known for their early moves, opting to go long in anticipation of a price surge, in contrast to retail investors who often enter the fray at the zenith, typically with smaller Bitcoin volumes.

Conclusion

The broader crypto market is rebounding after whales accumulated 47,500 Bitcoins at an average of $59,000 each, totaling $2.8 Billion, signaling a strategic “buy the dip” move.

This accumulation led to a market surge, with Bitcoin’s price jumping nearly 5% to over $62,000. Traders on Binance shifted from short to long positions, reflecting a change in sentiment.

The market’s recovery, particularly on Friday, suggests a positive shift in investor confidence and a potential trend reversal after the recent downturn.

Technical levels:

- Support Levels: $58,500 and $56,557

- Resistance Levels: $64,630 and $67,250

Disclaimer

The views and opinions stated by the author, or any people named in this article, are for informational purposes only and do not establish financial, investment, or other advice. Investing in or trading crypto or stock comes with a risk of financial loss.

Adarsh Singh is a true connoisseur of Defi and Blockchain technologies, who left his job at a “Big 4” multinational finance firm to pursue crypto and NFT trading full-time. He has a strong background in finance, with MBA from a prestigious B-school. He delves deep into these innovative fields, unraveling their intricacies. Uncovering hidden gems, be it coins, tokens or NFTs, is his expertise. NFTs drive deep interest for him, and his creative analysis of NFTs opens up engaging narratives. He strives to bring decentralized digital assets accessible to the masses.

Home

Home News

News