- For the second time running in 2020, Bitcoin has eclipsed all other securities.

- On Tuesday, the Bitcoin price increased by $1,268.19 reaching a six-month zenith of $11,203.90

A report was published by a top research and analytical firm which portrayed Bitcoin (BTC) as the top-performing asset class of 2020 so far. Just like every other mainstream asset class, Bitcoin’s prices too fell sharply during the Covid-19 pandemic. However, it seems to have recovered and has reached an all-time high level of $11,000 on Tuesday. The rise of Bitcoin shows the increased stability of the infrastructure of digital currency.

What is meant by Asset Class?

An asset class can be defined as an array of investments that showcase similar characteristics—for example, Equities, fixed incomes, cash, and cash equivalents, etc. In a layman’s term, it is a grouping of comparable financial securities.

Bitcoin’s outstanding performance in Numeric Terms

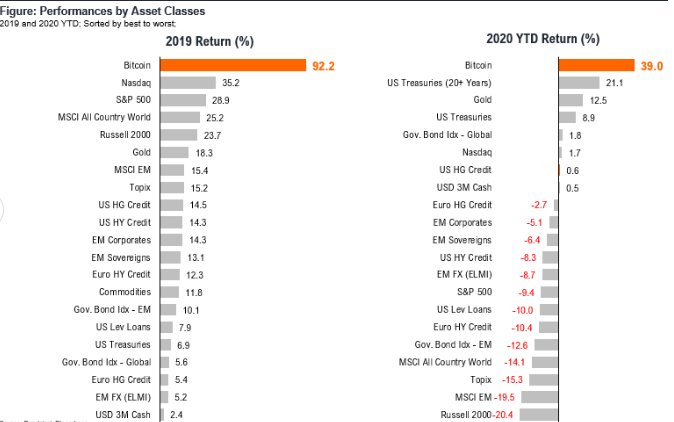

So, for the second time running in 2020, Bitcoin has eclipsed all other securities. In numerical terms, Bitcoin’s YDT return is the highest at 39%, followed by US treasuries at 21.1%, Gold at 12.5%, Gov. Bond Index at 1.6%, and Nasdaq at 1.5%.

Bitcoin has consistently topped the charts in 2019 & 2017, respectively, as the best performing asset class. In 2019, Bitcoin had topped the chart with a 92.2 return percentage followed by Nasdaq and S&P 500 at 35.2 percent and 28.9 percent, respectively. Experts believe that Bitcoin’s intrinsic value is more than any other asset class.

Why Bitcoin is the Best Compared to Others

On an overall spectrum, Bitcoin appears to be rising rapidly due to its increased demand and high volatility. i.e., it’s the ability to adjust to overcome challenging situations. The government-backed stimulus packages, which will be paid for via borrowing and creation of more fiat currency, should also be given major credit for the upswing of Bitcoin.

On Tuesday, the Bitcoin price increased by $1,268.19, reaching a six-month zenith of $11,203.90. These figures show a one-day growth of 12.73%. Seeing such a bullish nature, many financial institutions hoarding onto the cryptocurrency. By doing so, the companies are trying to gain the confidence of investors in the securities and assets.

Home

Home News

News